Calculation of Interest on EPF or GPF -Income Tax (Amendment ) Rules, 2021

FCS DEEPAK P. SINGH | Feb 28, 2022 |

Calculation of Interest on EPF or GPF -Income Tax (Amendment ) Rules, 2021

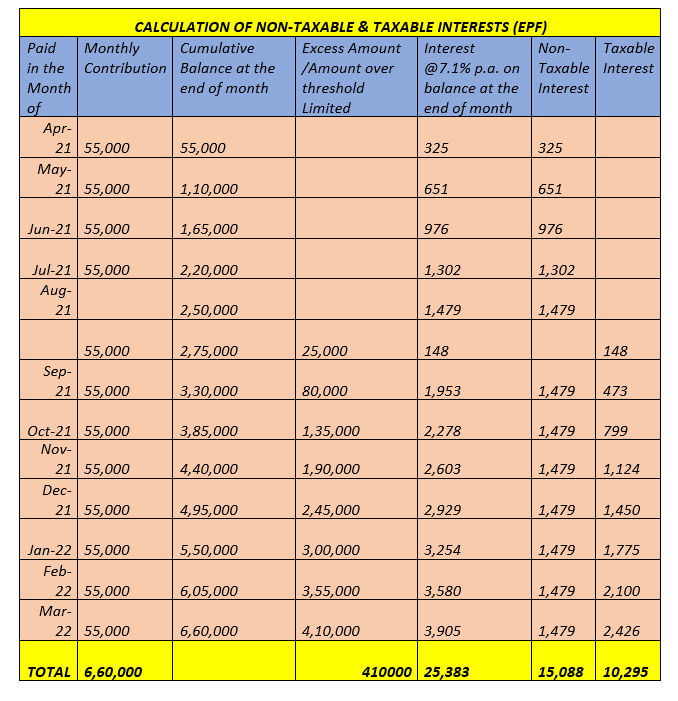

The Government has changed the rules for calculation of interest on EPF/GPF/RPF Accounts and has set threshold limit for contribution in EPF Rs. 2.50 Lakhs and GPF Rs. 5.00 Lakhs on which interest received will not be taxable. Any interest on contribution made during the FY 2021-22 in excess of amount of Rs. 2.50 Lakhs (EPF) and Rs. 5.00 Lakhs (GPF) will be taxable as “Income from Other Sources “in the hand of employee or person contributing to those funds.

CBDT Notification No. 95/2021, dated 31-08-2021, has notified the method of calculation of interest and maintenance of two separate accounts in the EPF /GPF as Taxable Account and Non-Taxable Account.

The Finance Act, 2021 has amended Section 10(11) and Section 10(12) to provide that exemption shall not be available for the interest income accrued during the previous year on the recognized and statutory provident fund in the account of the person to the extent it relates to the contribution made by the employees in excess of Rs. 2,50,000 in the previous year.

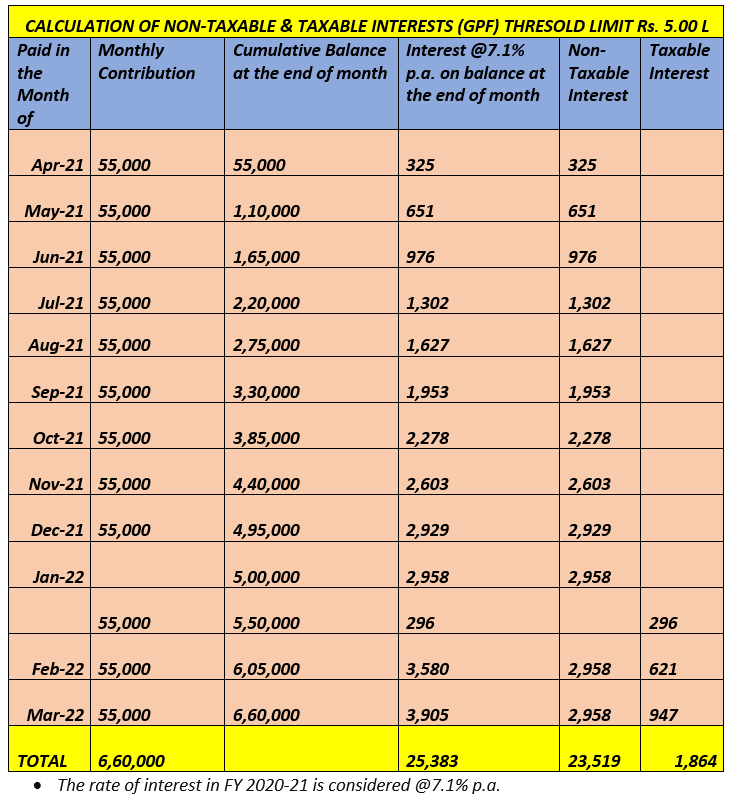

However, if such person has contributed to a fund in which there is no contribution by the employer, a limit of Rs. 2,50,000 shall be increased to Rs. 5,00,000 (GPF). The amount of such interest income shall be computed as per the prescribed rules.

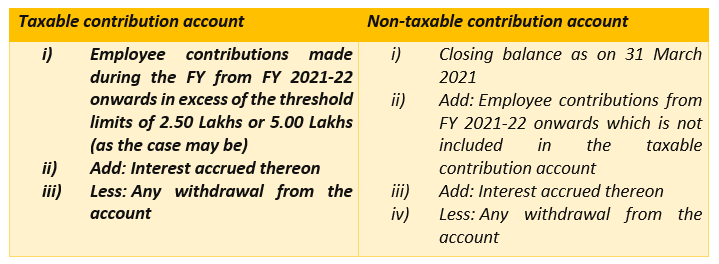

The CBDT has notified Rule 9D to calculate the taxable portion of interest pertaining to the contribution made to a statutory or a recognized provident fund in excess of the threshold limit of Rs. 2.5 lakh or 5.0 lakhs as the case may be. It provides that separate accounts within the provident fund account shall be maintained during the previous year 2021-22 and onwards for the taxable and non-taxable contribution made by the person.

As per Rule 9D, for the purpose of tax calculation, separate accounts shall be maintained within the Provident Fund account from FY 2021-22 and onwards for the taxable and non-taxable contribution by an individual employee.

The same is tabulated below:

Please note that: Only the interest accrued in Taxable contribution account would be taxable in the hands of the employee under the income head ‘Income from Other Sources’. The interest accrued in Non-taxable contribution account shall continue to be tax exempt.

Let’s Understand with an Examples; Mr. Aman is contributing Rs. 55,000/- per month in his GPF Account.

The Calculation of Non-Taxable and Taxable Interest are as follows;

DISCLAIMER: the above writeup is only for information and knowledge of readers. In case of necessity do consult with tax consultants.

In case of any Doubt regarding Membership you can mail us at [email protected]

Join Studycafe's WhatsApp Group or Telegram Channel for Latest Updates on Government Job, Sarkari Naukri, Private Jobs, Income Tax, GST, Companies Act, Judgements and CA, CS, ICWA, and MUCH MORE!"