Tista | Aug 30, 2021 |

Cancellation and Revocation of Cancellation of GST Registration

Cancellation of Registration under GST means that the registered person will no more be registered under GST. The provisions regarding cancellation of registration is stated under section 29 of CGST Act, 2017.

The proper officer may, either on his own motion, or on an application filed by the registered person, or by his legal heirs (in case of death of such person), cancel the registration, in such manner and within such period as may be prescribed, cancel the registration, in such manner and within such period as may be prescribed.

As per Rule 20 of CGST Rules, 2017, a registered person other than:-

Seeking cancellation of his registration shall electronically submit an application in Form GST REG-16, including therein,:-

may furnish, along with the application, relevant documents in support thereof, at the common portal, within a period of 30 days of the occurrence of event warranting the cancellation, either directly or through a Facilitation Center notified by the commissioner.

Rule 22 of the CGST Act, 2017 lays down the procedure to be followed by the proper officer for cancellation of registration. According, the procedure has been described as follows:-

1. Show cause notice (SCN) for cancellation of registration: Where the proper officer has reasons to believe that the registration of a person is liable to be canceled, he shall issue a notice to such person in Form GST REG-17, requiring him to show cause, within a period of 7 working days from the date of service of such notice, as to why his registration shall not be canceled.

2. Reply to SCN: The reply to the show-cause notice shall be furnished in Form GST REG-18 within 7 working days from the date of service of notice.

3. Order for cancellation of Registration: Where registration of a person is liable to be canceled, the proper officer shall issue the order of cancellation of registration within 30 days from the date of reply to SCN, in Form GST REG-19.

4. Effective date of cancellation: The cancellation of registration shall be effective from a date to be determined by the proper officer and mentioned in the cancellation order.

He will direct the taxable person to pay arrears of any tax, interest, or penalty including the amount liable to be paid under section 29(5).

5. Dropping of proceedings for cancellation of Registration: If the reply to SCN is satisfactory, the proper officer shall drop the proceedings and pass an order in Form GST REG-20. However, where the person instead of replying to the SCN served for failure to furnish returns for a continuous period of 6 months (3 months in case of composition scheme supplier)furnishes all the pending returns and makes full payment of the tax dues along with applicable interest and late fee, the proper officer shall drop the proceedings and pass an order.

A taxable person whose GST registration is canceled or surrendered has to file a final return in the form of GSTR-10, within three months from the date of cancellation or date of cancellation order whichever is later, for the purpose of providing details of ITC involved in closing stock (including inputs and capital goods) to be reversed/ paid by the taxpayer.

A registered person whose registration is canceled will have to debit the electronic credit or cash ledger by an amount equivalent to:-

whichever is higher, calculated in such manner as may be prescribed.

However, in case of capital goods or plant and machinery, the taxable person shall pay an amount equal to the input tax credit taken on the said capital goods or plant and machinery, reduced by such percentage points as may be prescribed or the tax on the transaction value of such capital goods or plant and machinery under section 15, whichever is higher.

The manner of determination of amount of credit to be reversed is prescribed under rule 44 of the CGST Rules, 2017.

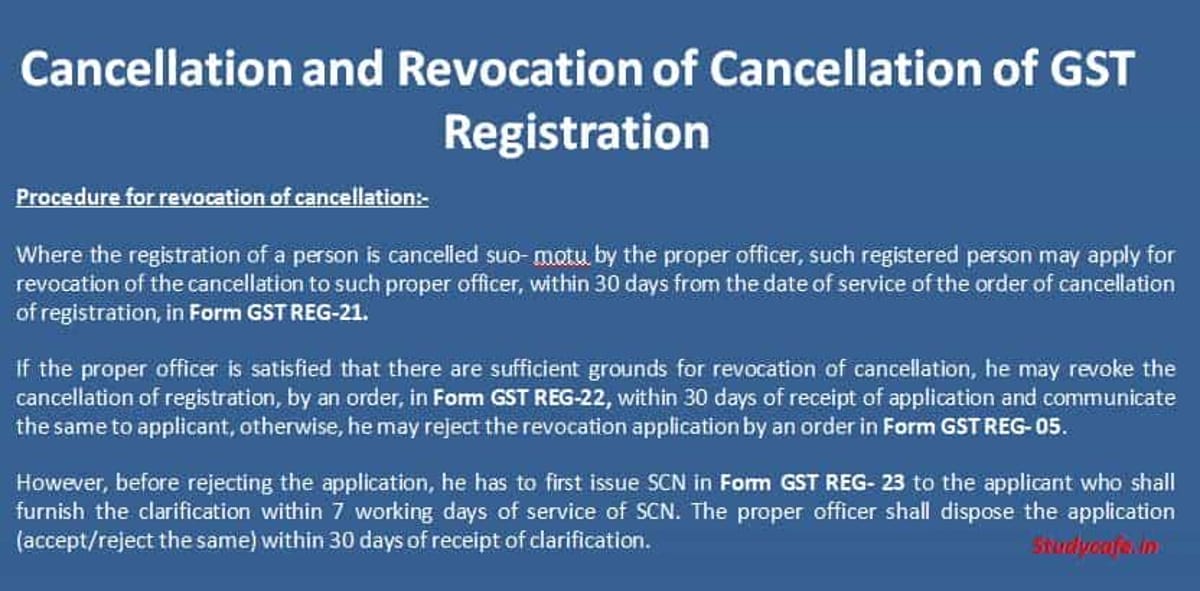

Revocation of cancellation of registration under GST simply means the restoration of GST registration. The following procedures has been laid down in this regard:-

Where registration was cancelled for failure of registered person to furnish returns, before applying for revocation, the person has to make good the defaults, i.e. the person needs to file such returns.

However, the registration may have been cancelled by the proper officer either from the date of order of cancellation of registration or from a retrospective date.

The common portal does not allow furnishing of returns after the effective date of cancellation, but returns for the earlier period (i.e. for the period before date of cancellation mentioned in the cancellation order) can be furnished after cancellation.

Where the registration is cancelled with effect from the date of order of cancellation of registration, person applying for revocation of cancellation has to furnish all returns due till the date of such cancellation before the application for revocation can be filed and has to pay any amount due as tax, in terms of such returns along with any amount payable towards interest, penalties or late fee payable in respect of the said returns.

However, since the portal does not allow to furnish returns after the date of cancellation of registration, all returns due for the period from the date of order of cancellation till the date of order of revocation of cancellation of registration have to be furnished within a period of 30 days from the date of the order of revocation.

Where the registration has been canceled with retrospective effect, it is not possible to furnish the returns before filing the application for revocation of cancellation of registration. In that case, the application for revocation of cancellation of registration is allowed to be filed, subject to the condition that all returns relating to the period from the effective date of cancellation of registration till the date of order of revocation of cancellation of registration shall be filed within a period of 30 days from the date of order of such revocation of cancellation of registration.

In case of any Doubt regarding Membership you can mail us at contact@studycafe.in

Join Studycafe's WhatsApp Group or Telegram Channel for Latest Updates on Government Job, Sarkari Naukri, Private Jobs, Income Tax, GST, Companies Act, Judgements and CA, CS, ICWA, and MUCH MORE!"