Studycafe | Apr 5, 2020 |

Cancellation/Surrendering of TAN | Tax Deduction and Collection Account Number | How can I cancel my TAN Number | The Article also contain draft letter surrender tan and Steps for Cancellation of TAN

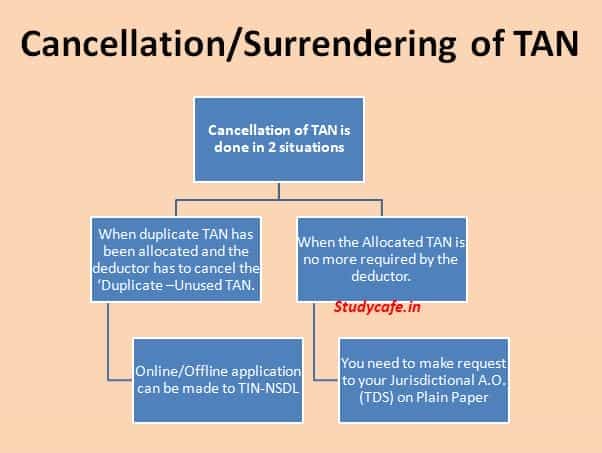

Cancellation of TAN can be done in 2 situations:

When duplicate TAN has been allocated and the deductor has to cancel the ‘Duplicate –Unused TAN

You May Also Like: Who is liable to deduct Tax at Source (TDS) | Who is liable to deduct TDS

Duplicate TAN is a TAN which has been inadvertently obtained by a person who is responsible for deducting/collecting tax and who already has a TAN allotted to him. It is illegal to possess or use more than one TAN. Different branches/divisions of an entity may, however, have separate TANs.

In case duplicate TAN has been allotted, which TAN should be used

In case duplicate TANs have been allotted, the TAN which has been used regularly should be continued to be used. The other TAN/s should be surrendered for cancellation using ‘Form for Changes or Correction in TAN’ which can be downloaded from NSDL-TIN website or may be procured from TIN-FCs or other vendors.

Note: Please submit the proof of TAN, details of which being changed and proof of TAN/s to be surrendered/cancelled. Applicant may submit the TAN aallotment letter received from Income Tax Department as a proof of TAN. In case the applicant does not have TAN allotment letter, he can submit a printout of TAN details using TAN search facility provided at www.incometaxindia.gov.in or www.tin-nsdl.com

What should I do if I have been allotted a duplicate TAN by oversight

Fill the Form Apply for Changes or Correction in TAN.

For Cancellation of Duplicate TAN, this form can be download from website of TIN-NSDL.

For Cancellation of TAN, fill all mandatory fields in the Form, enter TAN to be cancelled in Item No.6 of the Form and select the check box on left margin.

TAN to be cancelled should not be same as TAN (the one currently used) mentioned at the top of the Form.

This application can be made physically and online as well.

When the Allocated TAN is no more required by the deductor

How can I cancel my TAN Number

An application, requesting for cancellation of TAN and state reasons for such a request. Usually we surrender TAN only in case of closure of Business:

Format of request letter for TAN Surrender is given below for reference:

The Assessing officer (TDS),

TDS Ward

Dear Sir,

Re: Application for Surrender of TAN ——–

We , (Name of the Organization), were engaged into the business of (details of business activity). We have obtained the TAN registration because_____________. Accordingly the TAN was allotted and above mentioned (TAN No…………) was issued.

We have been regularly filing TDS returns and paying TDS in respect of the (above mentioned payments). However, we have decided to discontinue operations in the state of ____ due to (Reason to discontinue).

Screen shot of TRACES along with copy of last income tax returns are enclosed as a proof of no dues pending.

We hereby further undertake that if any Government dues are found to be recoverable against us in future and demanded raised by the Income Tax Department, We shall deposit the same immediately along with Interest.

In view of the above we request you to please cancel our TAN registration with immediate effect.

Authorised Signatory

Place:

Date:

In case of any Doubt regarding Membership you can mail us at [email protected]

Join Studycafe's WhatsApp Group or Telegram Channel for Latest Updates on Government Job, Sarkari Naukri, Private Jobs, Income Tax, GST, Companies Act, Judgements and CA, CS, ICWA, and MUCH MORE!"