Central Board of Direct Taxes has issued a clarification on Linking of PAN with Aadhaar for persons who are having difficulty linking the same on its Official twitter handle.

Reetu | Jul 1, 2023 |

CBDT issued Clarification on Linking of PAN with Aadhaar; Deadline may extend

The Central Board of Direct Taxes(CBDT) has issued a clarification on Linking of PAN with Aadhaar for persons who are having difficulty linking the same on its Official twitter handle.

The clarification comes only hours before the deadline for connecting PAN to Aadhaar expires. The deadline for linking PAN to Aadhaar was June 30, 2023.

According to the income tax department’s tweet, persons who have paid their penalty for linking their PAN with Aadhaar and consent has been obtained but the process of linking is not completed by June 30, 2023, would be reviewed by the income tax department before deeming the PAN inoperative. It should be noted that if PAN is not linked to Aadhaar by June 30, 2023, it would become inoperative. This means that an individual will not have a valid PAN when citing it is required.

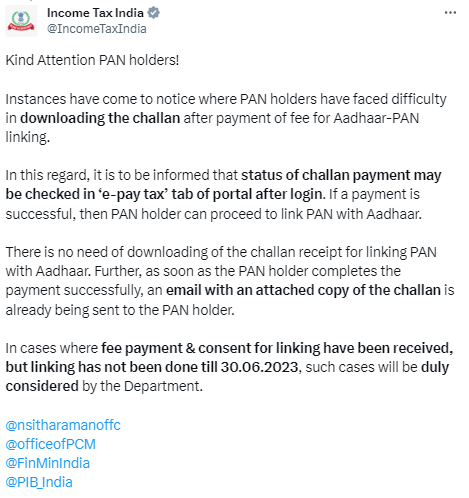

The Official tweet is goes like, “Kind Attention PAN holders!

Instances have come to notice where PAN holders have faced difficulty in downloading the challan after payment of fee for Aadhaar-PAN linking.

In this regard, it is to be informed that status of challan payment may be checked in ‘e-pay tax’ tab of portal after login. If a payment is successful, then PAN holder can proceed to link PAN with Aadhaar.

There is no need of downloading of the challan receipt for linking PAN with Aadhaar. Further, as soon as the PAN holder completes the payment successfully, an email with an attached copy of the challan is already being sent to the PAN holder.

In cases where fee payment & consent for linking have been received, but linking has not been done till 30.06.2023, such cases will be duly considered by the Department.”

Some industry experts also anticipating that government may decide to extend the deadline for Linking of PAN with Aadhaar. The deadline for submitting Income Tax Returns (ITR) is July 31, although it is expected that individuals would get these deadlines mixed up, resulting in non-compliance.

Experts, on the other hand, are encouraging the government to extend the deadline in order to minimise misunderstanding and to synchronise the date with the IT reporting deadline.

Previously, the deadline for linking PAN to Aadhaar was March 31, 2023. The income tax authority, however, extended the deadline by three months to June 30, 2023. The income tax department has yet to declare whether or not this deadline will be extended again.

It should be noted that if the PAN is not linked to Aadhaar by June 30, 2023, it would become inoperative. When the PAN becomes inactive, the following repercussions will occur: non-processing of income tax refunds, greater TDS and TCS on income and expenditures, inability to invest in bank FDs, mutual fund schemes, and so on.

In case of any Doubt regarding Membership you can mail us at [email protected]

Join Studycafe's WhatsApp Group or Telegram Channel for Latest Updates on Government Job, Sarkari Naukri, Private Jobs, Income Tax, GST, Companies Act, Judgements and CA, CS, ICWA, and MUCH MORE!"