The CBIC has recently issued a circular, where it has clarified which officers are assigned under sections 74A, 75(2), and 122 of the Central Goods and Services Tax Act (CGST Act) and related rules.

Nidhi | Oct 30, 2025 |

CBDT Issues Circular Regarding Assignment of Proper Officers Under Sections 74A, 75(2), and 122 of CGST Act

The Central Board of Indirect Taxes and Customs (CBIC) has recently issued a circular (No. 254/11/2025-GST), where it has clarified which officers are assigned under sections 74A, 75(2), and 122 of the Central Goods and Services Tax Act (CGST Act) and related rules.

The key sections mentioned in the circular are as follows:

The circular assigns specific officers to handle these tasks. The designated officers are as follows:

These officers are required to function under Sub-sections (1), (2), (3), (6), (7), (8), (9) and (10) of Section 74A, Section 122, and Rule 142(1A) of the CGST Rules, 2017.

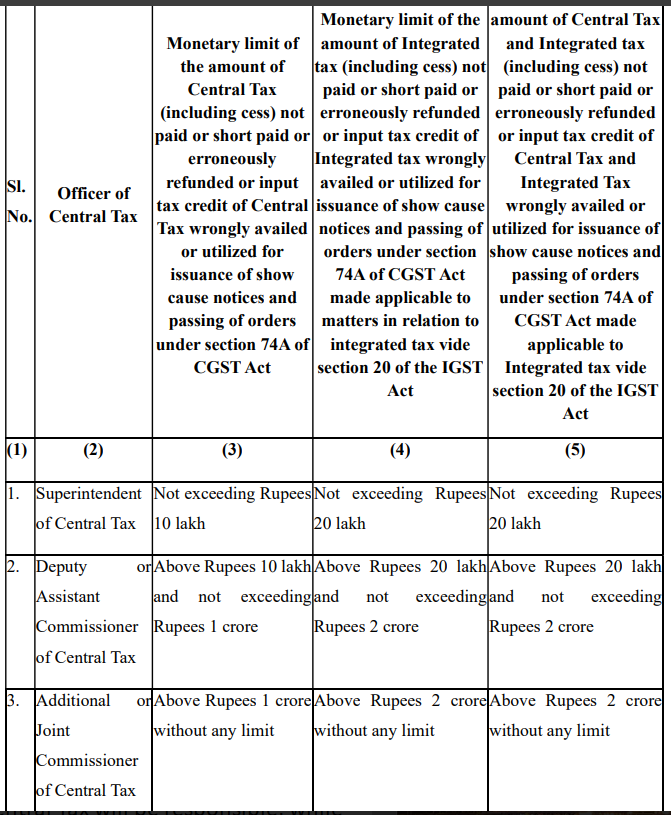

The circular also outlines the monetary limit for the issuance of the show cause notices and passing order under section 74A of the CGST Act.

If a show cause notice issued under section (1) of section 73 or 74A of the CGST Act, 2017, involves both Central Tax and Integrated Tax, the combined tax amount is used to determine which proper officer will handle the case.

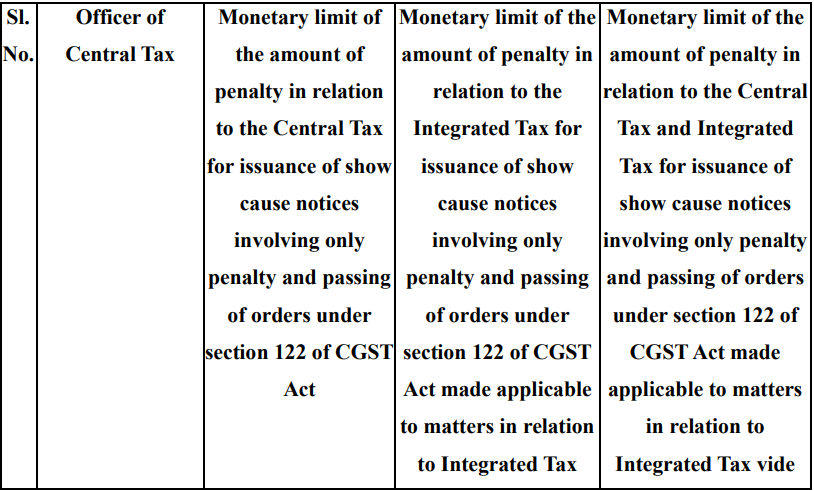

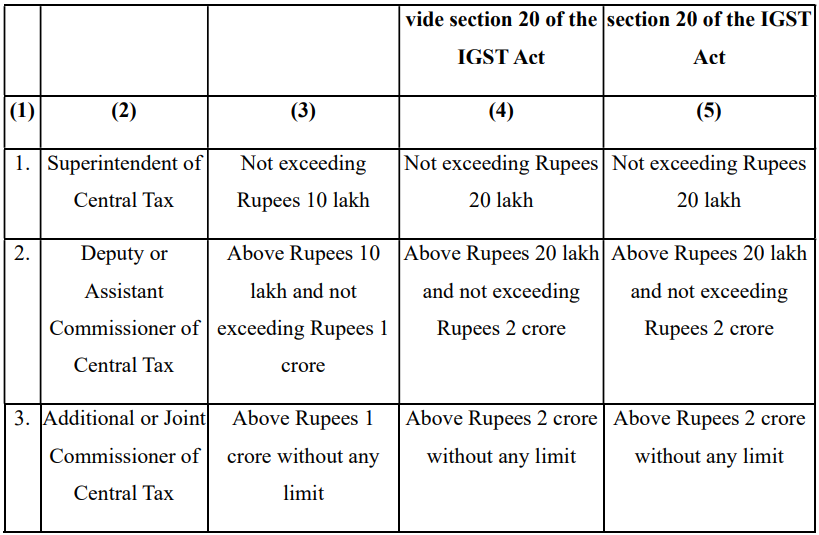

Here is the monetary limit for issuing the show cause notices and passing orders under section 122 of the CGST Act.

Refer to the Official Notification for More Information

In case of any Doubt regarding Membership you can mail us at [email protected]

Join Studycafe's WhatsApp Group or Telegram Channel for Latest Updates on Government Job, Sarkari Naukri, Private Jobs, Income Tax, GST, Companies Act, Judgements and CA, CS, ICWA, and MUCH MORE!"