CBDT Notifies Form and Manner for filing Updated Returns u/s 139(8A)

Reetu | Apr 30, 2022 |

CBDT Notifies Form and Manner for filing Updated Returns u/s 139(8A)

The Central Board of Direct Taxes (CBDT) vide Notification No. 48/2022 Dated 29th April 2022 notifies Form and Manner for filing Updated Returns u/s 139(8A).

Updated return can be filed from the Financial Year 2019-20 [Assessment Year 2020-21] onwards. The return shall be filed in form no ITR-U

The Notification is Given Below:

G.S.R. 325(E).—In exercise of the powers conferred by sub-section (8A) of section 139 read with section 295 of the Income-tax Act, 1961 (43 of 1961), the Central Board of Direct Taxes hereby makes the following rules further to amend Income-tax Rules, 1962, namely:-

1. Short title and commencement.—(1) These rules may be called the Income-tax (Eleventh Amendment) Rules, 2022.

(2) They shall come into force from the date of their publication in the Official Gazette.

2. In the Income-tax Rules, 1962 (hereinafter referred to as the principal rules), after rule 12AB, the following rule shall be inserted, namely,––

“12AC. Updated return of income.- (1) The return of income to be furnished by any person, eligible to file such return under the sub-section (8A) of section 139, relating to the assessment year commencing on the 1st day of April, 2020 and subsequent assessment years, shall be in the Form ITR-U and be verified in the manner indicated therein.

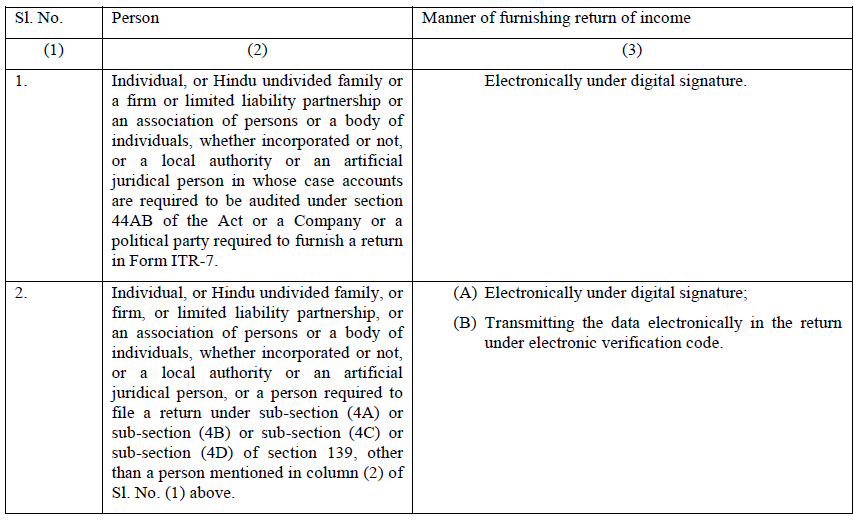

(2) The return of income referred to in sub-rule (1) shall be furnished by a person, mentioned in column (2) of the Table below in the manner specified in column (3) thereof:––

Explanation.–– For the purposes of this sub-rule, “electronic verification code” means a code generated for the purpose of electronic verification of the person furnishing the return of income as per the data structure and standards specified by Principal Director General of Income-tax (Systems) or Director General of Income-tax (Systems).

(3) The Principal Director-General of Income-tax (Systems) or Director-General of Income-tax (Systems) shall specify the procedures, formats and standards for ensuring secure capture and transmission of data and shall also be responsible for evolving and implementing appropriate security, archival and retrieval policies in relation to furnishing the return in the manners specified in column (3) of the Table.’.

Download PDF Given Below:

In case of any Doubt regarding Membership you can mail us at [email protected]

Join Studycafe's WhatsApp Group or Telegram Channel for Latest Updates on Government Job, Sarkari Naukri, Private Jobs, Income Tax, GST, Companies Act, Judgements and CA, CS, ICWA, and MUCH MORE!"