CBIC has issued Clarification to deal with difference in ITC availed in FORM GSTR-3B as compared to that in FORM GSTR-2A for period 01.04.2019 to 31.12.2021.

Reetu | Jul 17, 2023 |

CBIC Clarifications w.r.t difference in ITC availed in FORM GSTR-3B as compared to FORM GSTR-2A for the period 01.04.2019 to 31.12.2021

The Central Board of Indirect Taxes and Customs(CBIC) has issued Clarification to deal with difference in Input Tax Credit (ITC) availed in FORM GSTR-3B as compared to that detailed in FORM GSTR-2A for the period 01.04.2019 to 31.12.2021.

Attention is invited to Circular No. 183/15/2022-GST dated 27th December, 2022, vide which clarification was issued for dealing with the difference in Input Tax Credit (ITC) availed in FORM GSTR-3B as compared to that detailed in FORM GSTR-2A for FY 2017-18 and 2018-19, subject to certain terms and conditions.

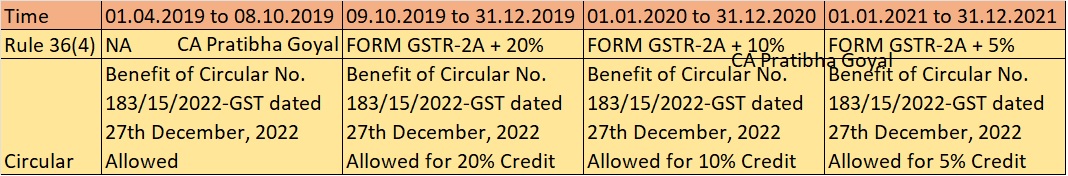

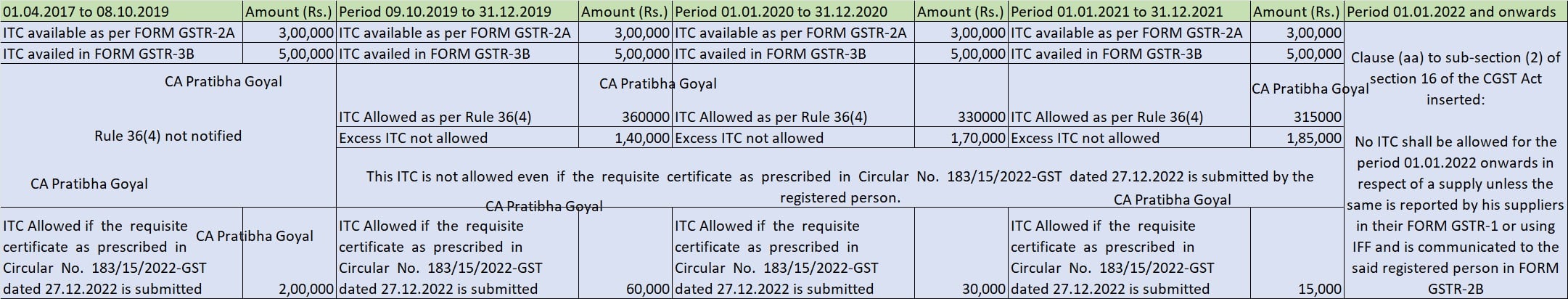

Even though the availability of ITC was subjected to restrictions and conditions specified in Section 16 of Central Goods and Services Tax Act, 2017 (hereinafter referred to as “CGST Act”) from 1st July, 2017 itself, restrictions regarding availment of ITC by the registered persons up to certain specified limit beyond the ITC available as per FORM GSTR-2A were provided under rule 36(4) of Central Goods and Services Tax Rules, 2017 (hereinafter referred to as “CGST Rules”) only with effect from 9th October 2019. w.e.f. 09.10.2019, the said rule allowed availment of Input tax credit by a registered person in respect of invoices or debit notes, the details of which have not been furnished by the suppliers under sub-section (1) of section 37, in FORM GSTR-1 or using the invoice furnishing facility (IFF), to the extent not exceeding 20 per cent. of the eligible credit available in respect of invoices or debit notes the details of which have been furnished by the suppliers under sub-section (1) of section 37 of CGST Act in FORM GSTR-1 or using the IFF.

The said limit was brought down to 10% w.e.f. 01.01.2020 and further reduced to 5% w.e.f. 01.01.2021. The said rule was intended to allow availment of due credit in cases where the suppliers may have delayed in furnishing the details of outward supplies. Further, w.e.f. 01.01.2022, consequent to insertion of clause (aa) to sub-section (2) of section 16 of the CGST Act, ITC can be availed only up to the extent communicated in FORM GSTR-2B.

As discussed above, rule 36(4) of CGST Rules allowed additional credit to the tune of 20%, 10% and 5%, as the case may be, during the period from 09.10.2019 to 31.12.2019, 01.2020 to 31.12.2020 and 01.01.2021 to 31.12.2021 respectively, subject to certain terms and conditions, in respect of invoices/supplies that were not reported by the concerned suppliers in their FORM GSTR-1 or IFF, leading to discrepancies between the amount of ITC availed by the registered persons in their returns in FORM GSTR-3B and the amount as available in their FORM GSTR-2A.

It may, however, be noted that such availment of input tax credit was subject to the provisions of clause (c) of sub-section (2) of section 16 of the CGST Act which provides that ITC cannot be availed unless tax on the said supply has been paid by the supplier. In this context, it is mentioned that rule 36(4) of CGST Rules was a facilitative measure and availment of ITC in accordance with rule 36(4) was subject to fulfilment of conditions of section 16 of CGST Act including those of clause (c) of sub-section (2) thereof regarding payment of tax by the supplier on the said supply.

Though the matter of dealing with difference in Input Tax Credit (ITC) availed in FORM GSTR-3B as compared to that detailed in FORM GSTR-2A has been clarified for FY 2017-18 and 2018-19 vide Circular No. 183/15/2022-GST dated 27th December, 2022, various representations have been received seeking clarification regarding the manner of dealing with such discrepancies between the amount of ITC availed by the registered persons in their FORM GSTR-3B and the amount as available in their FORM GSTR-2A during the period from 01.04.2019 to 31.12.2021

(i) Since rule 36(4) came into effect from 09.10.2019 only, the guidelines provided by Circular No. 183/15/2022-GST dated 27th December, 2022 shall be applicable, in toto, for the period from 01.04.2019 to 08.10.2019.

(ii) In respect of period from 09.10.2019 to 31.12.2019, rule 36(4) of CGST Rules permitted availment of Input tax credit by a registered person in respect of invoices or debit notes, the details of which have not been furnished by the suppliers under sub-section (1) of section 37, in FORM GSTR-1 or using IFF to the extent not exceeding 20 per cent. of the eligible credit available in respect of invoices or debit notes, the details of which have been furnished by the suppliers under sub-section (1) of section 37 in FORM GSTR-1 or using IFF. Accordingly, the guidelines provided by Circular No. 183/15/2022-GST dated 27th December, 2022 shall be applicable for verification of the condition of clause (c) of sub-section (2) of Section 16 of CGST Act for the said period, subject to the condition that availment of Input tax credit by the registered person in respect of invoices or debit notes, the details of which have not been furnished by the suppliers under sub-section (1) of section 37, in FORM GSTR-1 or using IFF shall not exceed 20 per cent. of the eligible credit available in respect of invoices or debit notes the details of which have been furnished by the suppliers under sub-section (1) of section 37 in FORM GSTR-1 or using IFF.

(iii) Similarly, for the period from 01.01.2020 to 31.12.2020, when rule 36(4) of CGST Rules allowed additional credit to the tune of 10% in excess of the that reported by the suppliers in their FORM GSTR-1 or IFF, the guidelines provided by Circular No. 183/15/2022-GST dated 27th December, 2022 shall be applicable, for verification of the condition of clause (c) of sub-section (2) of Section 16 of CGST Act for the said period, subject to the condition that availment of Input tax credit by the registered person in respect of invoices or debit notes, the details of which have not been furnished by the suppliers under sub-section (1) of section 37, in FORM GSTR-1 or using the IFF shall not exceed 10 per cent. of the eligible credit available in respect of invoices or debit notes the details of which have been furnished by the suppliers under sub-section (1) of section 37 in FORM GSTR-1 or using the IFF.

(iv) Further, for the period from 01.01.2021 to 31.12.2021, when rule 36(4) of CGST Rules allowed additional credit to the tune of 5% in excess of that reported by the suppliers in their FORM GSTR-1 or IFF, the guidelines provided by Circular No. 183/15/2022-GST dated 27thDecember, 2022 shall be applicable, for verification of the condition of clause (c) of sub-section (2) of Section 16 of CGST Act for the said period, subject to the condition that availment of Input tax credit by the registered person in respect of invoices or debit notes, the details of which have not been furnished by the suppliers under sub-section (1) of section 37, in FORM GSTR-1 or using the IFF shall not exceed 5 per cent. of the eligible credit available in respect of invoices or debit notes the details of which have been furnished by the suppliers under sub-section (1) of section 37 in FORM GSTR-1 or using the IFF.

It is further clarified that consequent to insertion of clause (aa) to sub-section (2) of section 16 of the CGST Act and amendment of rule 36(4) of CGST Rules w.e.f. 01.01.2022, no ITC shall be allowed for the period 01.01.2022 onwards in respect of a supply unless the same is reported by his suppliers in their FORM GSTR-1 or using IFF and is communicated to the said registered person in FORM GSTR-2B.

Further, it may be noted that proviso to rule 36(4) of CGST Rules was inserted vide Notification No. 30/2020-CT dated 03.04.2020 to provide that the condition of rule 36(4) shall be applicable cumulatively for the period February to August, 2020 and ITC shall be adjusted on cumulative basis for the said months in the return for the tax period of September 2020. Similarly, second proviso to rule 36(4) of CGST Rules was substituted vide Notification No. 27/2021-CT dated 01.06.2021 to provide that the condition of rule 36(4) shall be applicable Page 4 of 4cumulatively for the period April to June, 2021 and ITC shall be adjusted on cumulative basis for the said months in the return for the tax period of June 2021. The same may be taken into consideration while determining the amount of ITC eligibility for the said tax periods.

It may also be noted that these guidelines are clarificatory in nature and may be applied as per the actual facts and circumstances of each case and shall not be used in the interpretation of the provisions of law.

These instructions will apply only to the ongoing proceedings in scrutiny/ audit/ investigation, etc. for the period 01.04.2019 to 31.12.2021 and not to the completed proceedings. However, these instructions will apply in those cases during the period 01.04.2019 to 31.12.2021 where any adjudication or appeal proceedings are still pending.

For Official Circular Download PDF Given Below:

In case of any Doubt regarding Membership you can mail us at contact@studycafe.in

Join Studycafe's WhatsApp Group or Telegram Channel for Latest Updates on Government Job, Sarkari Naukri, Private Jobs, Income Tax, GST, Companies Act, Judgements and CA, CS, ICWA, and MUCH MORE!"