Deepak Gupta | Apr 23, 2019 |

CBIC Clarifies various issues on GST Input Tax Credit Set off Rules

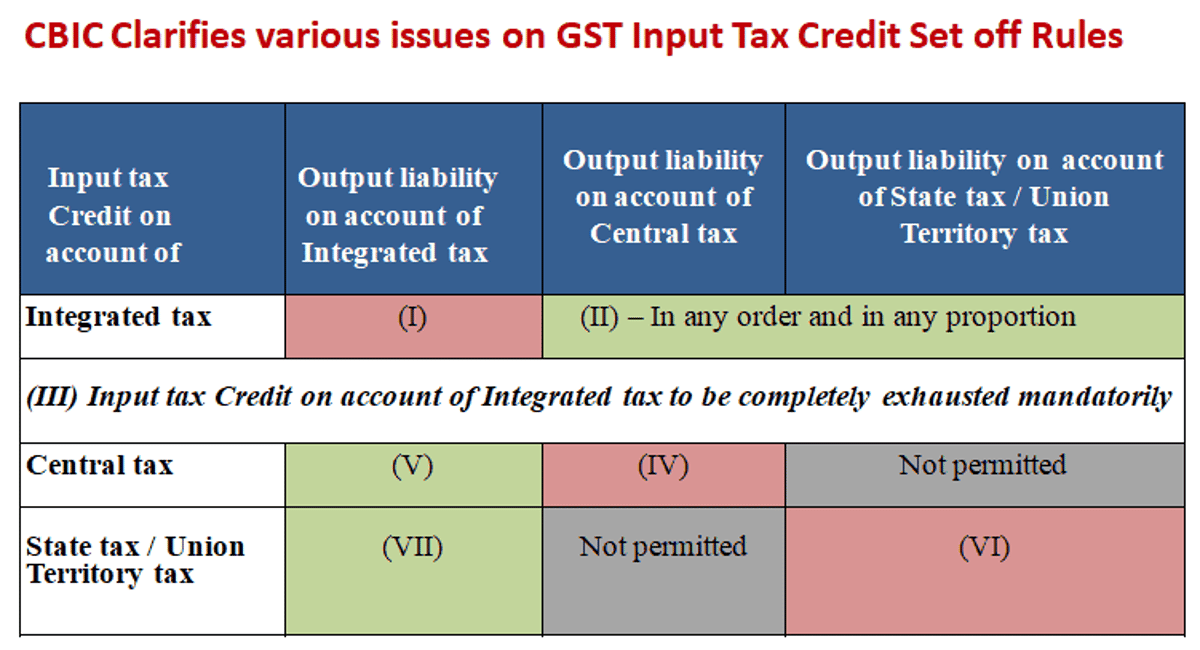

CBIC has recently clarified various issues on GST Input Tax Credit Set off Rules vide Circular No. 98/17/2019-GST. The Circular has clarified that IGST Credit will be first used to offset IGST Liability and thereafter it can be used to offset CGST and SGST/UGST liability in and order and in any proportion.

The Circular has also clarified that presently, the common portal supports the order of utilization of input tax credit in accordance with the old provisions. Therefore, till the new order of utilization as per new rules is implemented on the common portal, taxpayers may continue to utilize their input tax credit as per the functionality available on the common portal.

Circular No. 98/17/2019-GST

F. No. CBEC 20/16/04/2018 GST

Government of India

Ministry of Finance

Department of Revenue

Central Board of Indirect Taxes and Customs

GST Policy Wing

New Delhi, Dated the 23rd April 2019

To,

The Principal Chief Commissioners / Chief Commissioners / Principal Commissioners / Commissioners of Central Tax (All)

The Principal Director Generals / Director Generals (All)

Madam/Sir,

Subject: Clarification in respect of utilization of input tax credit under GST Reg.

Section 49 was amended and Section 49A and Section 49B were inserted vide Central Goods and Services Tax (Amendment) Act, 2018 [hereinafter referred to as the CGST (Amendment) Act]. The amended provisions came into effect from 1st February 2019.

2. Various representations have been received from the trade and industry regarding challenges being faced by taxpayers due to bringing into force of section 49A of the Central Goods and Services Tax Act, 2017 (hereinafter referred to as the CGST Act). The issue has arisen on account of order of utilization of input tax credit of integrated tax in a particular order, resulting in accumulation of input tax credit for one kind of tax (say State tax) in electronic credit ledger and discharge of liability for the other kind of tax (say Central tax) through electronic cash ledger in certain scenarios. Accordingly, rule 88A was inserted in the Central Goods and Services Tax Rules, 2017 (hereinafter referred to as the CGST Rules) in exercise of the powers under Section 49B of the CGST Act vide notification No. 16/2019- Central Tax, dated 29th March, 2019. In order to ensure uniformity in the implementation of the provisions of the law, the Board, in exercise of its powers conferred by section 168 (1) of the CGST Act, hereby clarifies the issues raised as below.

3. The newly inserted Section 49A of the CGST Act provides that the input tax credit of Integrated tax has to be utilized completely before input tax credit of Central tax / State tax can be utilized for discharge of any tax liability. Further, as per the provisions of section 49 of the CGST Act, credit of Integrated tax has to be utilized first for payment of Integrated tax, then Central tax and then State tax in that order mandatorily. This led to a situation, in certain cases, where a taxpayer has to discharge his tax liability on account of one type of tax (say State tax) through electronic cash ledger, while the input tax credit on account of other type of tax (say Central tax) remains un-utilized in electronic credit ledger.

4. The newly inserted rule 88A in the CGST Rules allows utilization of input tax credit of Integrated tax towards the payment of Central tax and State tax, or as the case may be, Union territory tax, in any order subject to the condition that the entire input tax credit on account of Integrated tax is completely exhausted first before the input tax credit on account of Central tax or State / Union territory tax can be utilized. It is clarified that after the insertion of the said rule, the order of utilization of input tax credit will be as per the order (of numerals) given below:

Input tax Credit on account of | Output liability on account of Integrated tax | Output liability on account of Central tax | Output liability on account of State tax / Union Territory tax |

Integrated tax | (I) | (II) In any order and in any proportion | |

(III) Input tax Credit on account of Integrated tax to be completely exhausted mandatorily | |||

Central tax | (V) | (IV) | Not permitted |

State tax / Union Territory tax | (VII) | Not permitted | (VI) |

5. The following illustration would further amplify the impact of newly inserted rule 88A of the CGST Rules:

Illustration:

Amount of Input tax Credit available and output liability under different tax heads

Head | Output Liability | Input tax Credit |

Integrated tax | 1000 | 1300 |

Central tax | 300 | 200 |

State tax / Union Territory tax | 300 | 200 |

Total | 1600 | 1700 |

Option 1:

Input tax Credit on account of | Discharge of output liability on account of Integrated tax | Discharge of output liability on account of Central tax | Discharge of output liability on account of State tax / Union Territory tax | Balance of Input Tax Credit |

Integrated tax | 1000 | 200 | 100 | 0 |

Input tax Credit on account of Integrated tax has been completely exhausted | ||||

Central tax | 0 | 100 | – | 100 |

State tax / Union territory tax | 0 | – | 200 | 0 |

Total | 1000 | 300 | 300 | 100 |

Input tax Credit on account of | Discharge of output liability on account of Integrated tax | Discharge of output liability on account of Central tax | Discharge of output liability on account of State tax / Union Territory tax | Balance of Input Tax Credit |

Integrated tax | 1000 | 100 | 200 | 0 |

Input tax Credit on account of Integrated tax has been completely exhausted | ||||

Central tax | 0 | 200 | – | 0 |

State tax / Union territory tax | 0 | – | 100 | 100 |

Total | 1000 | 300 | 300 | 100 |

6. Presently, the common portal supports the order of utilization of input tax credit in accordance with the provisions before implementation of the provisions of the CGST (Amendment) Act i.e. pre-insertion of Section 49A and Section 49B of the CGST Act. Therefore, till the new order of utilization as per newly inserted Rule 88A of the CGST Rules is implemented on the common portal, taxpayers may continue to utilize their input tax credit as per the functionality available on the common portal.

7. It is requested that suitable trade notices may be issued to publicize the contents of this circular.

8. Difficulty, if any, in the implementation of this Circular may be brought to the notice of the Board. Hindi version would follow.

(Upender Gupta)

Principal Commissioner (GST)

Tags : set off rules in gst, gst set off rules chart, gst set off notification, gst set off new rules, gst set off rules amendment, gst set off chart, gst set off example

In case of any Doubt regarding Membership you can mail us at [email protected]

Join Studycafe's WhatsApp Group or Telegram Channel for Latest Updates on Government Job, Sarkari Naukri, Private Jobs, Income Tax, GST, Companies Act, Judgements and CA, CS, ICWA, and MUCH MORE!"