Reetu | May 27, 2023 |

CBIC issued SOP for Scrutiny of GST Returns for FY 2019-20 Onwards

The Central Board of Indirect Taxes and Custom(CBIC) has issued Standard Operating Procedure for Scrutiny of GST Returns for FY 2019-20 onwards via issuing Instructions.

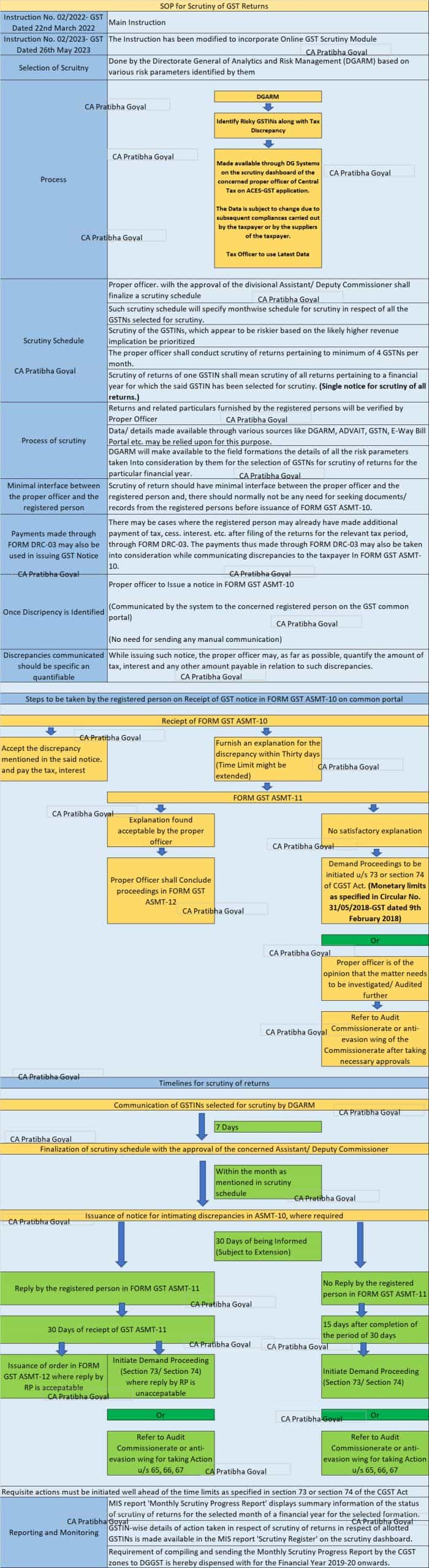

Attention is invited to the Instruction No. 02/2022-GST dated 22nd March, 2022, wherein a Standard Operating Procedure (SOP) was provided for scrutiny of returns under section 61 of Central Goods and Services Tax Act, 2017 (hereinafter referred to as “the CGST Act) read with rule 99 of Central Goods and Service Tax Rules, 2017 (hereinafter referred to as “the CGST Rules”) for FY 2017-18 and 2018-19. It was mentioned in the said instruction that the said SOP was issued as an interim measure till the time a Scrutiny Module for online scrutiny of returns is made available on the ACES-GST application.

In this regard, it is to inform that DG Systems has developed functionality “Scrutiny of Returns”, containing the online workflow for scrutiny of returns in the CBIC ACES-GST application. Advisory No. 22/2023-Returns dated 16.05.2023 has also been issued by DG Systems in this regard, along with a User Manual providing for the detailed workflow of the said functionality. The GSTINs selected for scrutiny for the Financial Year 2019-20 have also been made available on the scrutiny dashboard of the proper officers on ACES-GST application.

The functionality provides for the detailed workflow for communication of discrepancies noticed, in relation to the details furnished in the returns, by the proper officer in FORM GST ASMT-10to the registered person, receipt of reply from the registered person in FORM GST ASMT-11, issuance of order in FORM GST ASMT-12or taking further action for issuance of show cause notice under Section 73 or 74 of CGST Act, 2017 or for referring the matter for Audit or investigation, as the case may be.

In view of this, the SOP for scrutiny of returns provided in the Instruction No. 02/2022-GST dated 22ndMarch 2022 stands modified to the following extent in respect of scrutiny of returns for financial years 2019-20 onwards:

Selection of returns for scrutiny will be done by the Directorate General of Analytics and Risk Management (DGARM) based on various risk parameters identified by them. DGARM will select the GSTINs registered with the Central Tax authorities, whose returns are to be scrutinized for a financial year, based on identified risk parameters. The details of GSTINs selected for scrutiny for a financial year will be made available by DGARM through DG Systems on the scrutiny dashboard of the concerned proper officer of Central Tax on ACES-GST application.

The details of the risk parameters, in respect of which risk has been identified for a particular GSTIN, and the amount of tax/ discrepancy involved in respect of the concerned risk parameters (i.e. likely revenue implication), will also be shown on the scrutiny dashboard of the proper officer for their convenience. It is re-emphasized that as the data made available on the dashboard has been generated at a particular point of time for calculation of risk parameters, this data may undergo change at the time of scrutiny of returns, due to subsequent compliances carried out by the taxpayer or by the suppliers of the taxpayer. The proper officer shall, therefore, rely upon the latest available data.

Once the details of GSTINs selected for scrutiny for a financial year are made available on the scrutiny dashboard of the concerned proper officer of Central Tax on ACES-GST application, the proper officer, with the approval of the divisional Assistant/ Deputy Commissioner, shall finalize a scrutiny schedule in the format specified in Annexure A of Instruction 02/2022-GST dated 22nd March 2022.Such scrutiny schedule will specify month-wise schedule for scrutiny in respect of all the GSTINs selected for scrutiny. While preparing the scrutiny schedule, the scrutiny of the GSTINs, which appear to be riskier based on the likely higher revenue implication indicated on the dashboard, may be prioritized. The Principal Commissioner/ Commissioner of the concerned Commissionerate will monitor and ensure that the schedule identified in Scrutiny Schedule is adhered to by the officers under his jurisdiction.

The proper officer shall conduct scrutiny of returns pertaining to minimum of 4 GSTINs per month. Scrutiny of returns of one GSTIN shall mean scrutiny of all returns pertaining to a financial year for which the said GSTIN has been selected for scrutiny.

The Proper Officer shall scrutinize the returns and related particulars furnished by the registered persons to verify the correctness of the returns. Information available with the proper officer on the system in the form of various returns and statements furnished by the registered person and the data/ details made available through various sources like DGARM, ADVAIT, GSTN, E-Way Bill Portal etc. may be relied upon for this purpose.

As mentioned in Para 3.2 above, for the convenience of proper officers, details of the risk parameters involving risk/ discrepancies in respect of the GSTIN, along with the amount of tax/ discrepancy involved in respect of the concerned risk parameters (i.e. likely revenue implication), will be made available in the scrutiny dashboard of the proper officer. Besides, DGARM will also make available to the field formations the details of all the risk parameters taken into consideration by them for the selection of GSTINs for scrutiny of returns for the particular financial year. In addition to these parameters, proper officer may also consider any other relevant parameter, as he may deem fit, for the purpose of scrutiny.

It may be noted that at this stage, the proper officer is expected to rely upon the information available with him on records. As far as possible, scrutiny of return should have minimal interface between the proper officer and the registered person and, there should normally not be any need for seeking documents/ records from the registered persons before issuance of FORM GST ASMT-10.

The proper officer shall issue a notice to the registered person in FORM GST ASMT-10through the scrutiny functionality on ACES-GST application, informing him of the discrepancies noticed and seeking his explanation thereto. There may be cases where the registered person may already have made additional payment of tax, cess, interest, etc. after filing of the returns for the relevant tax period, through FORM DRC-03. The payments thus made through FORM DRC-03may also be taken into consideration while communicating discrepancies to the taxpayer in FORM GST ASMT-10.The notice in FORM GST ASMT-10, issued by the proper officer through scrutiny functionality on ACES-GST application, shall be communicated by the system to the concerned registered person on the common portal and therefore, there will be no need for sending any manual communication of notice in FORM GST ASMT-10by the proper officer to the registered person separately. While issuing such notice, the proper officer may, as far as possible, quantify the amount of tax, interest and any other amount payable in relation to such discrepancies. It may also be ensured that the discrepancies so communicated should, as far as possible, be specific in nature and not vague or general. In this regard, the user manual issued by DG Systems may be referred to regarding the detailed procedure for issuance of FORM GST ASMT-10on scrutiny functionality on ACES-GST application. The proper officer shall mention the parameter-wise details of the discrepancies noticed by him in FORM GST ASMT-10and shall also upload the worksheets and supporting document(s)/ annexures, if any.

To Read More Download PDF Given Below:

In case of any Doubt regarding Membership you can mail us at [email protected]

Join Studycafe's WhatsApp Group or Telegram Channel for Latest Updates on Government Job, Sarkari Naukri, Private Jobs, Income Tax, GST, Companies Act, Judgements and CA, CS, ICWA, and MUCH MORE!"