Change in TAR notified for MSME 45 Days Payment Rule: Is it a hint for Non-deferment?

CA Pratibha Goyal | Mar 6, 2024 |

Change in TAR notified for MSME 45 Days Payment Rule: Is it a hint for Non-deferment?

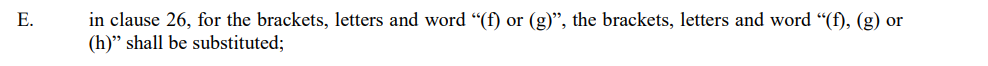

Recently, the Central Board of Direct Taxes (CBDT) has notified changes in the Income Tax Audit Report Form 3CD. [Read Notfication]

The changes have been made by notifying the Income-tax (Fourth Amendment) Rules, 2024. The changes shall come into force on the date of their publication in the Official Gazette.

In Form 3CD, changes include the addition of clauses related to Section 115BAE tax regime, presumptive taxation u/s 44ADA and 44AD, Adjustment made to the written down value etc.

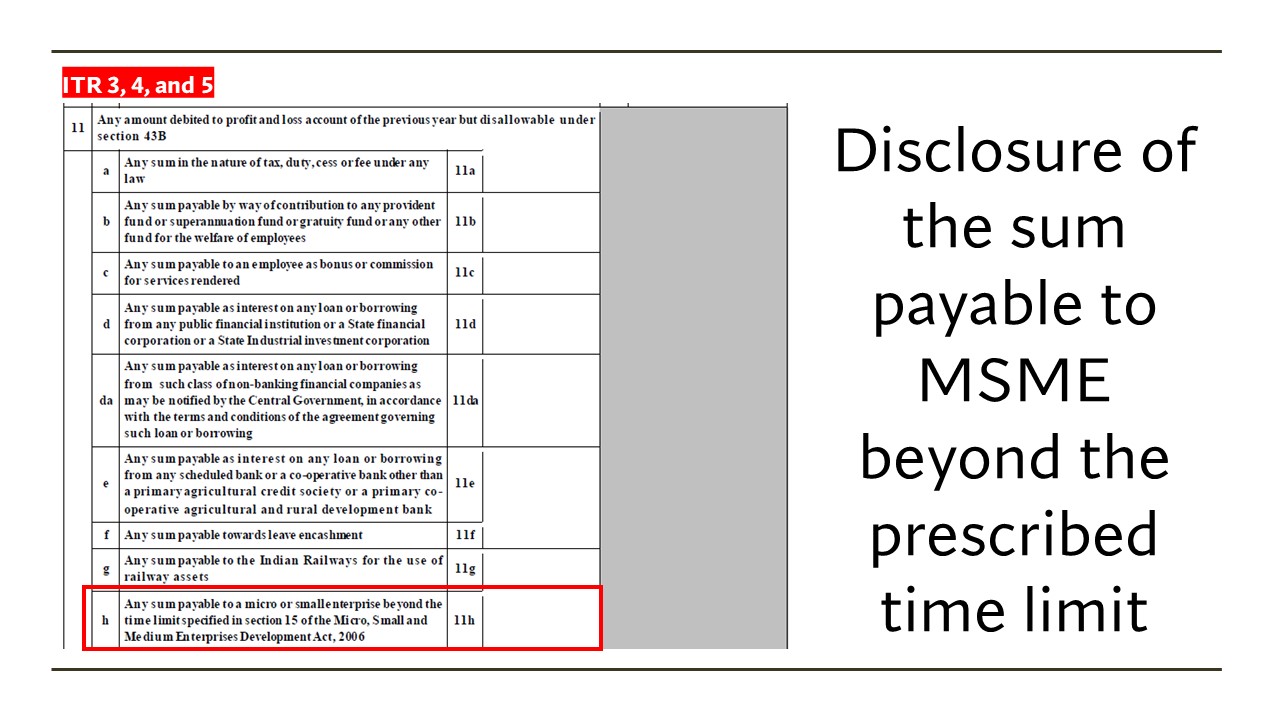

The most anticipated change on Section 43B(h) related to MSME 45 Days Payment Rule has also been notified in the Tax Audit Report Form.

This change has been notified in the Income Tax Return (ITR) Forms for Assessment Year 2024-25 as well.

As per recent news update, Government is planning for deferment of MSME 45 Days Payment Rule for one year. However, there is no official announcement for the same.

In case of any Doubt regarding Membership you can mail us at contact@studycafe.in

Join Studycafe's WhatsApp Group or Telegram Channel for Latest Updates on Government Job, Sarkari Naukri, Private Jobs, Income Tax, GST, Companies Act, Judgements and CA, CS, ICWA, and MUCH MORE!"