TDS on Partnership Firm u/s 194T is applicable from 1st April 2025. Firms are required to apply for TAN for That for due compliance.

CA Pratibha Goyal | Mar 17, 2025 |

TDS on Partnership Firm u/s 194T: Firms should apply TAN before 1st April

The Finance (No. 2) Act, 2024, has brought a major income tax change for partnership firms, including Limited Liability Partnerships (LLPs), from April 1, 2025. The change is the introduction of Section 194T, which requires Tax Deducted at Source (TDS) on payments made to partners.

One of the most important changes that are taking place from April 1, 2025, is the mandatory deduction of TDS on payments to partners under Section 194T. Section 194T is applied to all partnership firms and LLPs, irrespective of their turnover. Under this Section, TDS will be deducted if the total payments to a partner are above Rs. 20,000 in a financial year. If the limit exceeds Rs. 20,000, a 10% TDS will apply to the total payment amount and not just the portion exceeding Rs. 20,000.

|

Payment Type |

TDS Applicable? |

| Salary/Remuneration | Yes |

| Commission | Yes |

| Bonus | Yes |

| Interest on Capital/Loan | Yes |

| Drawings or Capital Repayment | No |

If a partner receives a salary of Rs. 5,00,000, the entire amount will be deducted at 10% TDS, i.e., Rs. 50,000 will be deducted as TDS.

As TDS is deducted at the source under section 194T, the partners will have the credit against their final income tax liability at the time of ITR filing. If the TDS deducted is more than what the partner owes, the extra deducted amount will be refunded after the ITR is processed. The TDS deducted under this section can also be used to cover the partner’s Advance Tax payments. This helps the partner plan better throughout the year so they don’t end up with huge tax burdens.

The TDS must be deducted while crediting the amount in the partner’s account or at the time of payment- whichever is earlier.

If a firm fails to deduct TDS, it could result in financial and legal consequences, such as:

1) 30% disallowance of the expenses, including salary, remuneration, commission, bonus, and interest on capital.

2) Interest penalty:

The annual or monthly deduction depends on the type of payment. If the partnership agreement mentions that partners receive a monthly salary, then the TDS should be deducted monthly when the salary is credited. The interest on capital is often calculated annually. Therefore, TDS on interest should be deducted at the end of the financial year. To avoid penalties, firms need to carefully check their payment schedule and ensure they are deducting TDS at the right time for each type of payment.

Under Section 194T, partners cannot use Form 15G or 15H to claim an exemption from TDS on payments they receive from the partnership firm. Also, there’s no option to get a lower TDS rate under Section 197 at the moment. This means that the firm must deduct the full 10% TDS on payments, with no exceptions or reductions.

How to Apply for TAN Registration

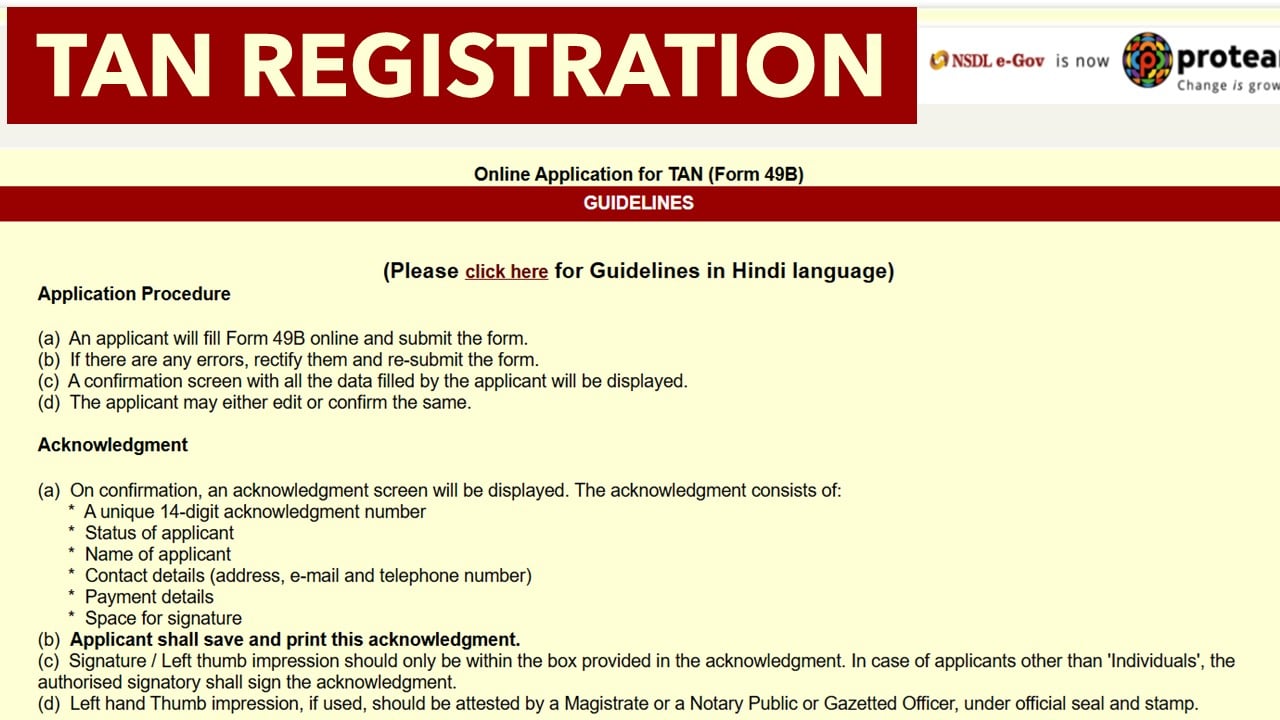

You can apply for TAN through both offline and online mode. In offline mode you have fill the form manually and have to attached the required documents and then have to send your form to the official departments whereas in online mode you have to visit the official website that is https://tin.tin.nsdl.com/tan/form49B.html then you have to fill the form online and have to submit the form. Here is online procedure in stepwise-

In case of any Doubt regarding Membership you can mail us at contact@studycafe.in

Join Studycafe's WhatsApp Group or Telegram Channel for Latest Updates on Government Job, Sarkari Naukri, Private Jobs, Income Tax, GST, Companies Act, Judgements and CA, CS, ICWA, and MUCH MORE!"