CA Pratibha Goyal | Jan 5, 2020 |

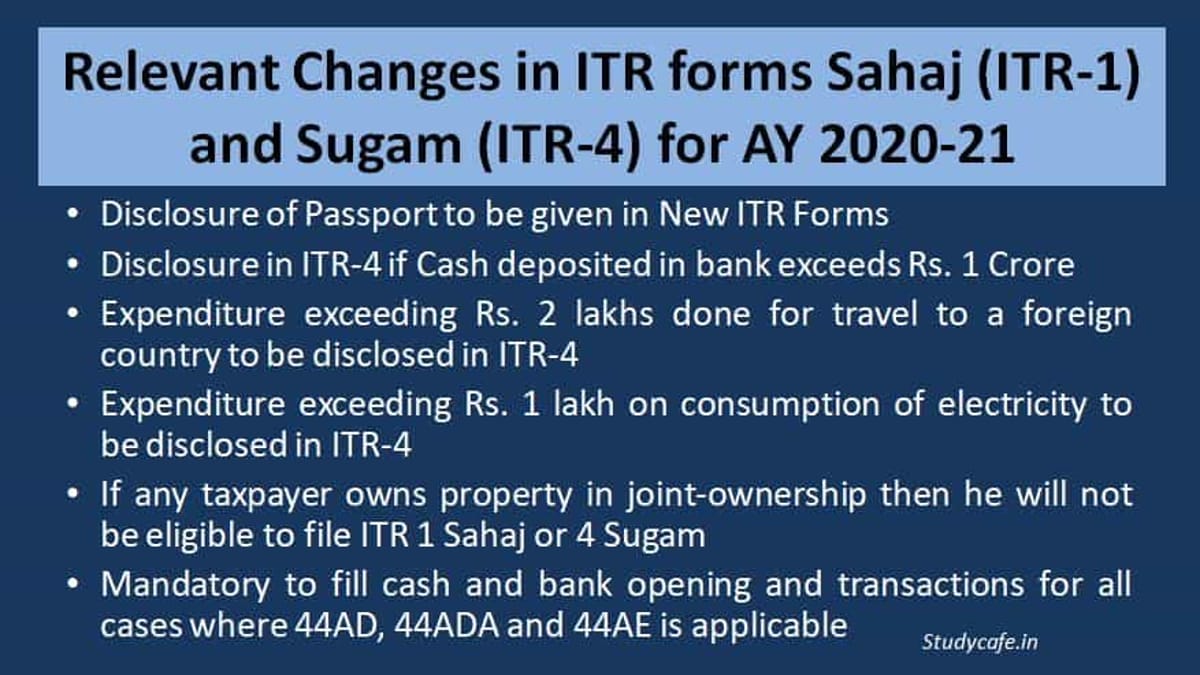

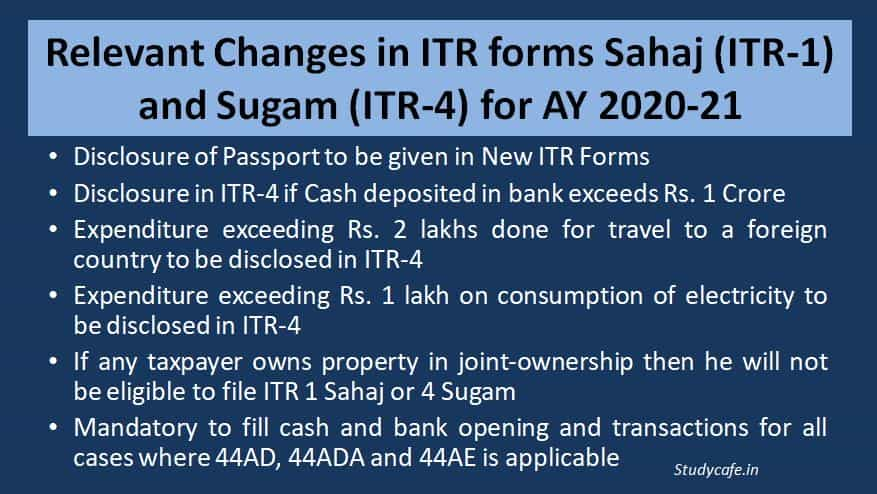

Relevant Changes in ITR forms Sahaj (ITR-1) and Sugam (ITR-4) for AY 2020-21

This is a Good update that Income Tax ITR forms for AY 2020-21 Sahaj (ITR-1) and Sugam (ITR-4) for AY 2020-21 have been released by CBDT.

Income earned in Financial Year 2019-20 has to be assessed in Year 2020-21. Last year, many taxpayers represented that, ITR forms should be released well in advance, so that they can be studied in advance and ITR can be filed in time.

This is for the first time, when government has released the ITR forms before the completion of Financial year. Usually, ITR Forms came in first week of April , but this time ITR forms for AY 2020-21 Sahaj (ITR-1) and Sugam (ITR-4) have been released in First week of Jan 2020.

Readers should note that Only Forms have been released, But Utility will be released only after March 2020.

This Article will Discuss Major Changes in ITR forms Sahaj (ITR-1) and Sugam (ITR-4) for AY 2020-21.

Relevant Changes in ITR forms Sahaj (ITR-1) and Sugam (ITR-4) for AY 2020-21

Disclosure of Passport to be given in New ITR Forms:

Disclosure of Passport to be given in New ITR -1 (Sahaj)

Both the newly released ITR Forms Sahaj & Sugam require Disclosure of Passport in case you have one

Disclosure of Passport to be given in New ITR -4 (Sugam)

Disclosure in ITR-4 if Cash deposited in bank exceeds Rs. 1 Crore

The newly released ITR Form Sugam requires Disclosure in case deposit amount or aggregate of amounts exceeds Rs. 1 Crore in one or more current account during the previous year.

Again this maybe because government wants to discourage cash transactions and wants to track the cash deposits.

Expenditure exceeding Rs. 2 lakhs done for travel to a foreign country to be disclosed in ITR-4

Also you have to give disclosure in case you have incurred expenditure of an amount or aggregate of amount exceeding Rs. 2 lakhs for travel to a foreign country for yourself or for any other person.

Expenditure exceeding Rs. 1 lakh on consumption of electricity to be disclosed in ITR-4

Also you have to give disclosure in case you have incurred expenditure of amount or aggregate of amount exceeding Rs. 1 lakh on consumption of electricity during the previous year.

If any taxpayer owns property in joint-ownership then he will not be eligible to file ITR 1 Sahaj or ITR 4 Sugam

Rule 12 of Income Tax Rules have been amended by Income Tax Notification G.S. R. 9(E) dated 3rd January 2020 whereby it has been provided that, in case taxpayer, owns a house property in joint-ownership with two or more, then he cannot file ITR 1 Sahaj or 4 Sugam.

Mandatory to fill cash and bank opening and transactions for all cases where 44AD, 44ADA and 44AE is applicable or books of account not required to be maintained

In case of 44AD or 44ADA or 44AE now the Taxpayer will be required to give opening balance of cash in hand and opening balance of bank accounts and also will be required to give total amount received in cash during the year total Amount deposited in bank during the year, total amount of cash outflow out of cash balance during the year, total amount of withdrawal from Bank during the year and closing balance of cash in hand and closing balance of banks.

Things removed from ITR-4 : Now there will be no need to provide figures of unsecured loans, sundry debtors, sundry creditors, amount of closing stock, etc. as was required in earlier years

ITR Form 1 is used by an individual who is a resident other than not ordinarily resident, whose total income for the assessment year 2020-21 does not exceed Rs. 50 lakh and who has income under the following heads:-

(a) Income from Salary/ Pension; or

(b) Income from One House Property; or

(c) Income from Other Sources.

ITR 4 for AY 2020-21 is to be used by an individual or HUF, who is resident other than not ordinarily resident, or a Firm (other than LLP) which is a resident, whose total income for the assessment year 2020-21 does not exceed Rs.50 lakh and who has income under the following heads:-

(a) Income from business where such income is computed on presumptive basis under Section 44AD (i.e. Gross Turnover upto Rs. 2 crore) or Section 44AE (income from goods carriage upto ten vehicles); or

(b) Income from Profession where such income is computed on presumptive basis under Section 44ADA (i.e. Gross receipt upto Rs. 50 lakh); or

(c) Income from Salary/ Pension; or

(d) Income from One House Property; or

(e) Income from Other Sources.

Due Date of Filing ITR for assessment year 2020-21 is 31st July 2020 unless extended by the government.

For Regular Updates Join : https://t.me/Studycafe

In case of any Doubt regarding Membership you can mail us at contact@studycafe.in

Join Studycafe's WhatsApp Group or Telegram Channel for Latest Updates on Government Job, Sarkari Naukri, Private Jobs, Income Tax, GST, Companies Act, Judgements and CA, CS, ICWA, and MUCH MORE!"