Studycafe | Jan 2, 2020 |

Clarificatory Notification w.r.t. RCM applicability on Renting of Motor Vehicle:

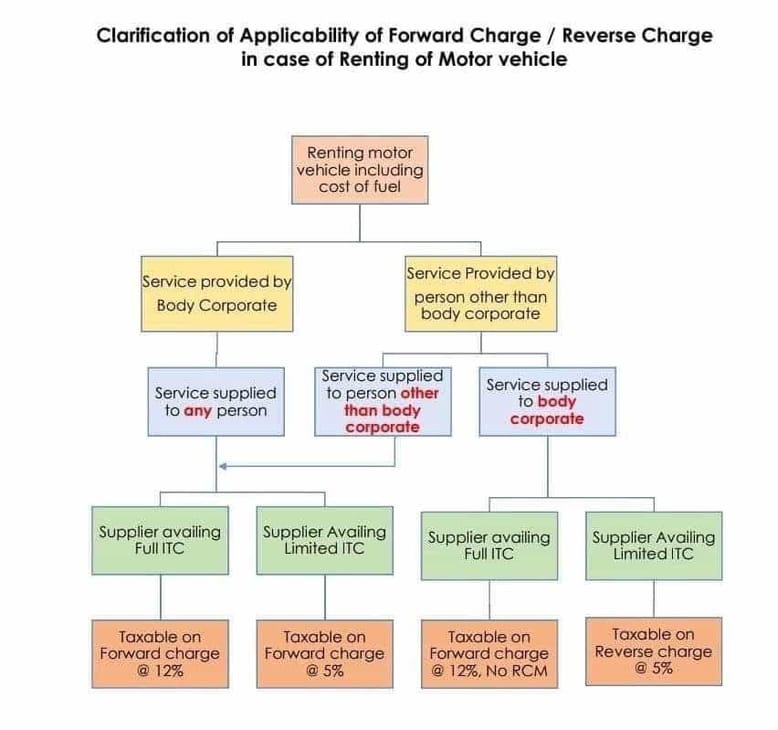

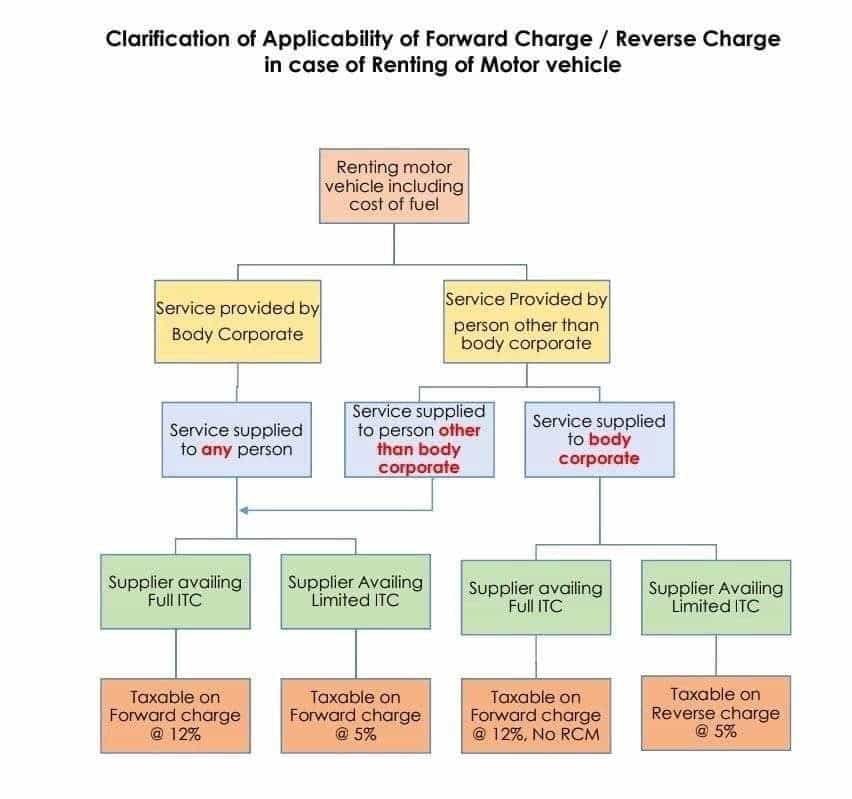

Government has issued Notification No. 28/2019 (Integrated Tax Rate) & 29/2019 (Central Tax Rate) notifying applicability of RCM on Renting of Motor Vehicle designed to carry passenger dtd. 31.12.2019 and also clarified vide CGST circular issued on same date that above notification is only Clarificatory in nature. Original Notification in this respect has been issued vide Ntf. No. 22/2019 (Central Tax Rate) & 21/2019 (Integrated Tax Rate) dtd. 30.09.2019. RCM would be applicable on Renting on Motor Vehicle wef 01.10.2019 only subject to below mentioned conditions:

1. cost of Fuel must be included in consideration charged from service recipient for the above mentioned service

2. supplier of Service is other than body corporate

3. recipient of service is a body corporate

4. does not issue an invoice charging GST @ 12% from service recipient

There are only two rates applicable on the service of renting of motor vehicles, 5% with limited ITC and 12% with full ITC.

Interpretation of above clarification is that:

(a) where the supplier of the service charges GST @ 12% from the service recipient, the service recipient shall not be liable to pay GST under RCM; and

(b) where the supplier of the service doesn’t charge GST @ 12% from the service recipient, the service recipient shall be liable to pay GST under RCM

It may be noted that the present amendment of the notification is merely clarificatory in nature and therefore for the period 01.10.2019 to 31.12.2019 also, clarification given above shall apply.

Clarificatory Notification w.r.t. RCM applicability on Renting of Motor Vehicle

For further clarification & consultancy, get in touch with easeoftaxtaion team.

This article has been shared by CA Kamal Aggarwal. He is a practicing chartered accountant and runs a Facebook Page “easeoftaxation”.

For Regular Updates Join : https://t.me/Studycafe

Tags : GST, GST Notification

In case of any Doubt regarding Membership you can mail us at contact@studycafe.in

Join Studycafe's WhatsApp Group or Telegram Channel for Latest Updates on Government Job, Sarkari Naukri, Private Jobs, Income Tax, GST, Companies Act, Judgements and CA, CS, ICWA, and MUCH MORE!"