Before reading about commonly found irregularities in TAR lets get an understanding of Section 44AB of Income Tax Act; triggering section for Applicability of Tax Audit.

CA Pratibha Goyal | Sep 5, 2023 |

Common Mistakes Found in Tax Audit Report

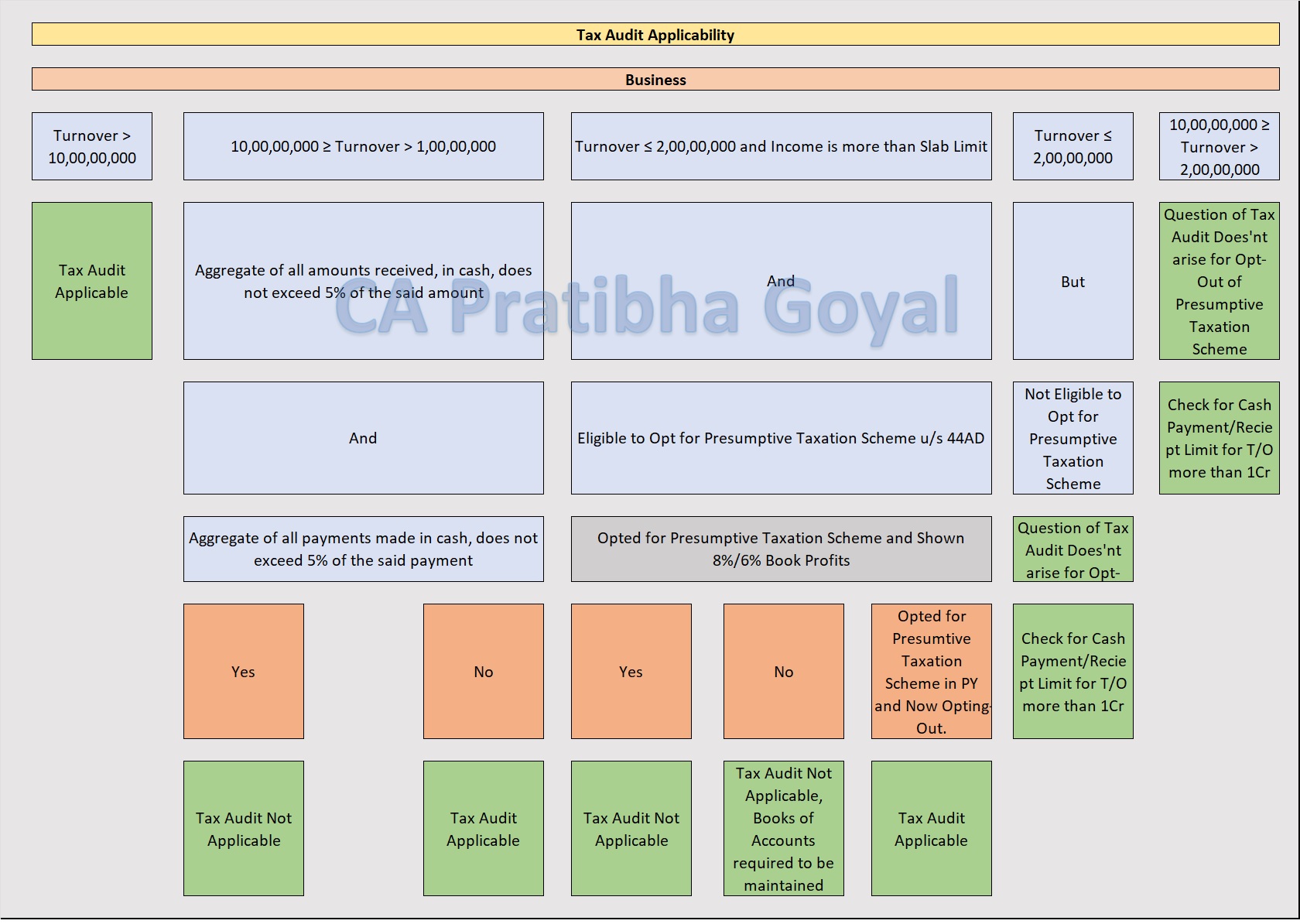

Before reading about commonly found irregularities in TAR lets get an understanding of Section 44AB of the Income Tax Act; the triggering section for Applicability of Tax Audit. Tax Audit Applicability as per Section 44AB in brief is given below:

This has been explained via the following charts:

Tax Audit Applicability for Business:

Tax Audit Applicability for Profession:

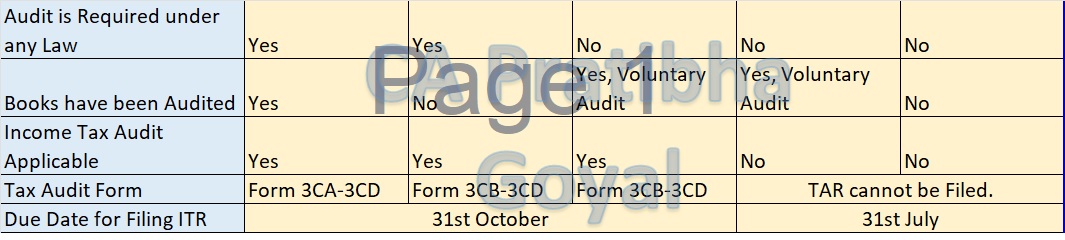

The Forms for Tax Audit have been prescribed in Rule 6G.

The report of audit of the accounts of a person required to be furnished under section 44AB shall,

(a) in the case of a person who carries on business or profession and who is required by or under any other law to get his accounts audited, be in Form No. 3CA;

(b) in the case of a person who carries on business or profession, but not being a person referred to in clause (a), be in Form No. 3CB.

The particulars which are required to be furnished under section 44AB shall be in Form No. 3CD.

Penalty for not Getting Accounts Audited:

Failure to get accounts audited.

271B. If any person fails to get his accounts audited in respect of any previous year or years relevant to an assessment year or furnish a report of such audit as required under section 44AB, the Assessing Officer may direct that such person shall pay, by way of penalty, a sum equal to one-half per cent of the total sales, turnover or gross receipts, as the case may be, in business, or of the gross receipts in profession, in such previous year or years or a sum of one hundred fifty thousand rupees, whichever is less.

Some Examples (a) Resignation of the tax auditor and consequent delay; (b) Bona fide interpretation of the term `turnover’ based on expert advice; (c) Death or physical inability of the partner in charge of the accounts; (d) Labour problems such as strike, lock out for a long period, etc.; (e) Loss of accounts because of fire, theft, etc. beyond the control of the assessee; (f) Non-availability of accounts on account of seizure; (g) Natural calamities, commotion, etc. (i) Resignation of the accountant and his consequent non-cooperation. (j) Official E filing portal (of the Income-tax department) failure

Penalty on CA for furnishing incorrect information:

The Assessing Officer or any other authority who is authorised to issue summons and to call for evidence or documents, can call upon the tax auditor who has audited the accounts to give any evidence or produce documents. For this purpose, notice under section 131 or 133(6) can be issued by the Assessing Officer or other tax authority mentioned in the said section. Also, Section 271J of the Income-tax Act, 1961 dealing with Penalty for furnishing incorrect information in reports or certificates states that where the Assessing Officer or the Commissioner (Appeals), in the course of any proceedings under the Income-tax Act, 1961, finds that an accountant has furnished incorrect information in any report or certificate furnished under any provision of Income tax Act or the rules made thereunder, the Assessing Officer or the Commissioner (Appeals) may direct that such accountant, shall pay, by way of penalty, a sum of ten thousand rupees for each such report or certificate. Thus, the said provision should also be kept in mind while certifying the above forms.

Click here to Download PPT on commonly found irregularities in TAR

In case of any Doubt regarding Membership you can mail us at [email protected]

Join Studycafe's WhatsApp Group or Telegram Channel for Latest Updates on Government Job, Sarkari Naukri, Private Jobs, Income Tax, GST, Companies Act, Judgements and CA, CS, ICWA, and MUCH MORE!"