Reetu | Mar 29, 2024 |

Compliance Due Date Calendar for April 2024

Here is the April 2024 Compliance Calendar for GST, Income Tax, MCA, PF and ESIC laws. We hope that this will help you finish your compliance before the last dates. We have also shared the information in chart form, along with the days of the week, so that the Tax Professional may plan properly.

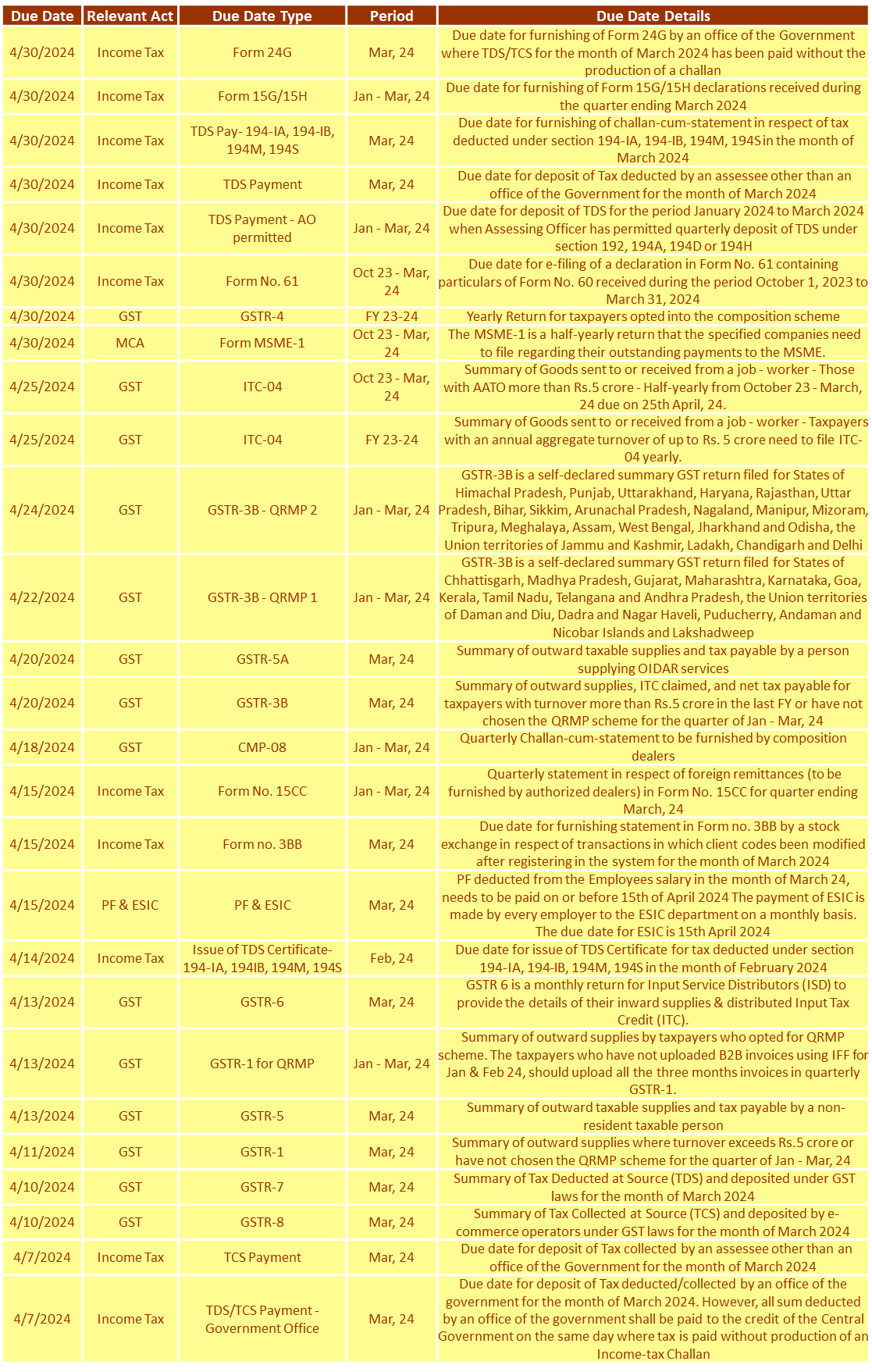

TCS Payment: Due date for depositing tax collected by an assessee other than a government office for the month of March 2024.

TDS/TCS Payment – Government Office: The due date for depositing the tax deducted/collected by a government office in the of March 2024. However, any sums deducted by a government office must be deposited to the Central Government’s credit on the same day that tax is paid, without the submission of an Income-tax Challan.

GSTR-7: Summary of Tax Deducted at Source (TDS) and submitted under GST regulations in March 2024.

GSTR-8: Summary of Tax Collected at Source (TCS) and Deposited by E-Commerce Operators Under GST Laws for March 2024.

GSTR-1: Summary of outward supplies where turnover exceeds Rs.5 crore or have not chosen the QRMP plan for the quarter of January to March, 24

GSTR-6: GSTR 6 is a monthly return for Input Service Distributors (ISDs) that provides information about their inward supply and disbursed Input Tax Credit (ITC).

GSTR-1 for QRMP: A summary of outbound supply by taxpayers who choose the QRMP scheme. Taxpayers who did not upload B2B invoices utilizing IFF for January and February 24, shall upload all three months’ invoices in the quarterly GSTR-1.

GSTR-5: A summary of outward taxable supplies and taxes owed by a non-resident taxable person.

TDS Certificate Issue- 194-IA, 194-IB, 194M, 194S: The deadline for issuing TDS Certificates for taxes deducted under sections 194-IA, 194-IB, 194M, and 194S is February 2024.

Form No. 15CC: Quarterly statement in relation to overseas remittances (to be submitted by authorized dealers) in Form No. 15CC for the quarter ending March 24.

Form no. 3BB: Due date for providing a statement in Form no. 3BB by a stock exchange in respect of transactions in which client codes were amended after registration in the system for the month of March 2024.

PF and ESIC: PF deducted from the employee’s salary in the month of March 24 must be paid on or before April 15th, 2024. Every employer pays ESIC to the ESIC department monthly. The deadline for ESIC is April 15, 2024.

CMP-08: Composition dealers must provide quarterly challans and statements.

GSTR-5A: A summary of outward taxable supplies and tax owed by an individual who provides OIDAR services.

GSTR-3B: Summary of outward supplies, ITC claimed, and net tax payable for taxpayers with a turnover of more than Rs.5 crore in the previous financial year or who have not chosen the QRMP scheme for the January-March quarter, 24.

GSTR-3B – QRMP 1: The GSTR-3B is a self-declared summary GST return filed by the states of Chhattisgarh, Madhya Pradesh, Gujarat, Maharashtra, Karnataka, Goa, Kerala, Tamil Nadu, Telangana, and Andhra Pradesh, as well as the union territories of Daman and Diu, Dadra and Nagar Haveli, Puducherry, Andaman and Nicobar Islands, and Lakshadweep.

GSTR-3B – QRMP 2: GSTR-3B is a self-declared summary GST return filed for the states of Himachal Pradesh, Punjab, Uttarakhand, Haryana, Rajasthan, Uttar Pradesh, Bihar, Sikkim, Arunachal Pradesh, Nagaland, Manipur, Mizoram, Tripura, Meghalaya, Assam, West Bengal, Jharkhand, and Odisha, as well as the union territories of Jammu and Kashmir, Ladakh, Chandigarh, and Delhi.

ITC-04:

Form 24G: Due date for submitting Form 24G by a government office where TDS/ TCS for the month of March 2024 has been paid without the production of a challan.

Form 15G/15H: Due date for submitting Form 15G/15H declarations received during the quarter ending March 2024.

TDS Pay- 194-IA, 194-IB, 194M, 194S: Due date for filing challan-cum-statement in respect of tax deducted under section 194-IA, 194-IB, 194M, and 194S in the month of March 2024.

TDS Payment: Due date for depositing tax deducted by an assessee other than a government office for the month of March 2024.

TDS Payment – AO: Permitted Due date for depositing TDS for the period January 2024 to March 2024 when the Assessing Officer has permitted quarterly deposit of TDS under sections 192, 194A, 194D, or 194H.

Form No. 61: Due date for electronic filing of a declaration in Form No. 61 including particulars of Form No. 60 received between October 1, 2023 and March 31, 2024.

GSTR-4: Yearly Return for taxpayers who opted for the composition scheme.

Form MSME-1: The MSME-1 is a half-yearly return that designated enterprises are required to file regarding their outstanding payments to the MSME.

In case of any Doubt regarding Membership you can mail us at [email protected]

Join Studycafe's WhatsApp Group or Telegram Channel for Latest Updates on Government Job, Sarkari Naukri, Private Jobs, Income Tax, GST, Companies Act, Judgements and CA, CS, ICWA, and MUCH MORE!"