Reetu | Mar 27, 2024 |

DGFT Amends policy condition of Crude Oil under HS Code 27090010

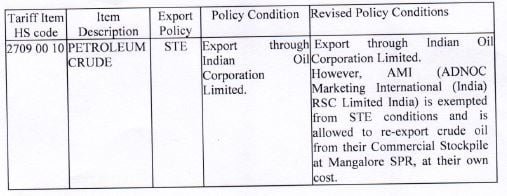

The Directorate General of Foreign Trade (DGFT) notified amendment in the Policy condition of Crude Oil under HS Code 27090010 via issuing a Notification.

The Notification Read as follows:

The Central Government, in the exercise of powers conferred by Section 3 read with Section 5 of the Foreign Trade (Development & Regulation) Act, 1992 (No. 22 of 1992), as amended, read with Para 1.02 and 2.01 of the Foreign Trade Policy, 2023, hereby amends policy condition of Petroleum Crude (ITC HS code 27090010) of ITC HS Export Policy, 2023, as under:-

Effect of this Notification:

STE conditions for export of Petroleum Crude (ITC HS code 27090010) for AMI (ADNOC Marketing International (India) RSC Limited India) is exempted and is allowed to re-export crude oil, from their Commercial Stockpile at Mangalore SPR, at their own cost.

For Official Notification Download PDF Given Below:

In case of any Doubt regarding Membership you can mail us at [email protected]

Join Studycafe's WhatsApp Group or Telegram Channel for Latest Updates on Government Job, Sarkari Naukri, Private Jobs, Income Tax, GST, Companies Act, Judgements and CA, CS, ICWA, and MUCH MORE!"