Reetu | Aug 2, 2022 |

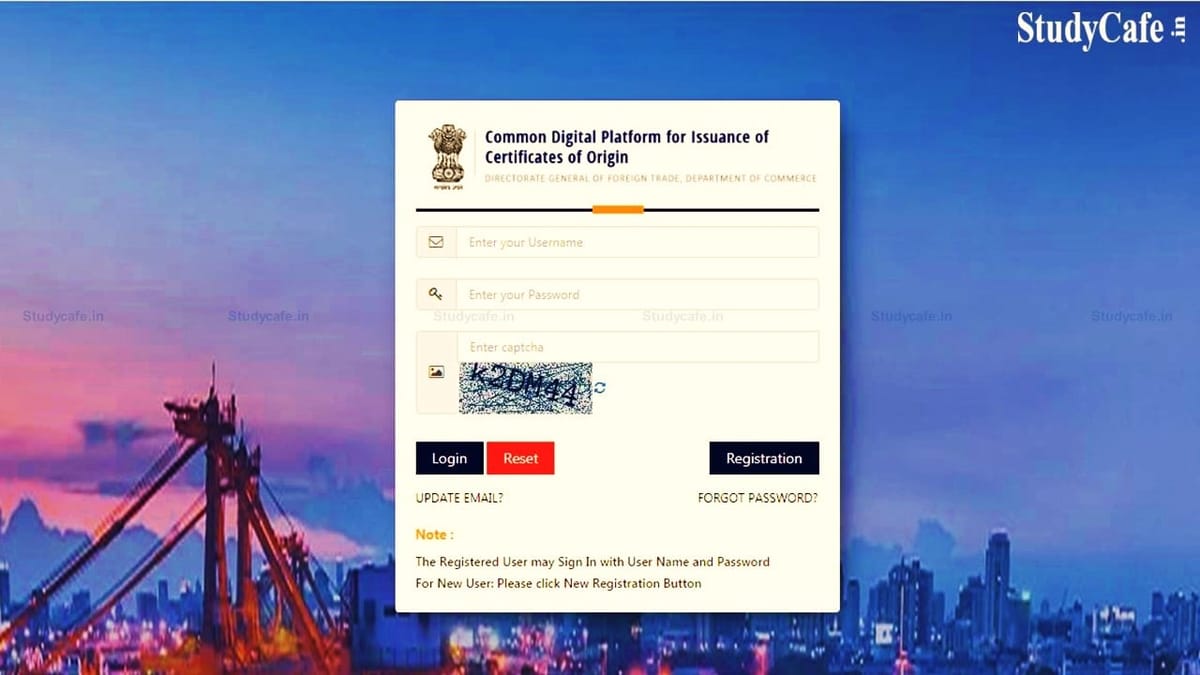

DGFT Extends Date for Mandatory electronic filing of Non-Preferential Certificate of Origin

The Directorate General of Foreign Trade (DGFT) issued Trade Notice to Extends Date for Mandatory electronic filing of Non-Preferential Certificate of Origin.

The Notice Stated that, “In continuation to the earlier Trade Notice 24/2021-22 dated 15.11.2021, Trade Notice 42/2020-2021 dated 19.02.2021, 48/2020-2021 dated 25.03.2021, 10/2021-2022 dated 19.07.2021, 19/2021-2022 dated 01.10.2021, 21/2021-22 dated 18.10.2021, 32/2021-22 dated 24.01.2022 and 04/2022-2023 dated 27.04.2022, it is informed that the transition period for mandatory filing of applications for Non-Preferential Certificate of Origin through the e-CoO Platform has been further extended till 31st March 2023.”

While using the internet system is an option for exporters and NP CoO Issuing Agencies, it won’t be required until March 31, 2023. The current manual/paper systems of processing non-preferential CoO applications are permitted.

Therefore, it is necessary for the authorised agencies to educate the exporting community and their constituents well in advance about the online system and its registration requirements. You may also notify us of any problems with the IT system or how it is being used so that we can take the necessary action.

For Official Notification Download PDF Given Below:

In case of any Doubt regarding Membership you can mail us at [email protected]

Join Studycafe's WhatsApp Group or Telegram Channel for Latest Updates on Government Job, Sarkari Naukri, Private Jobs, Income Tax, GST, Companies Act, Judgements and CA, CS, ICWA, and MUCH MORE!"