Difference between form 3CA & 3CB - Income Tax Audit Form

Reetu | Dec 8, 2021 |

Difference between form 3CA & 3CB – Income Tax Audit Form

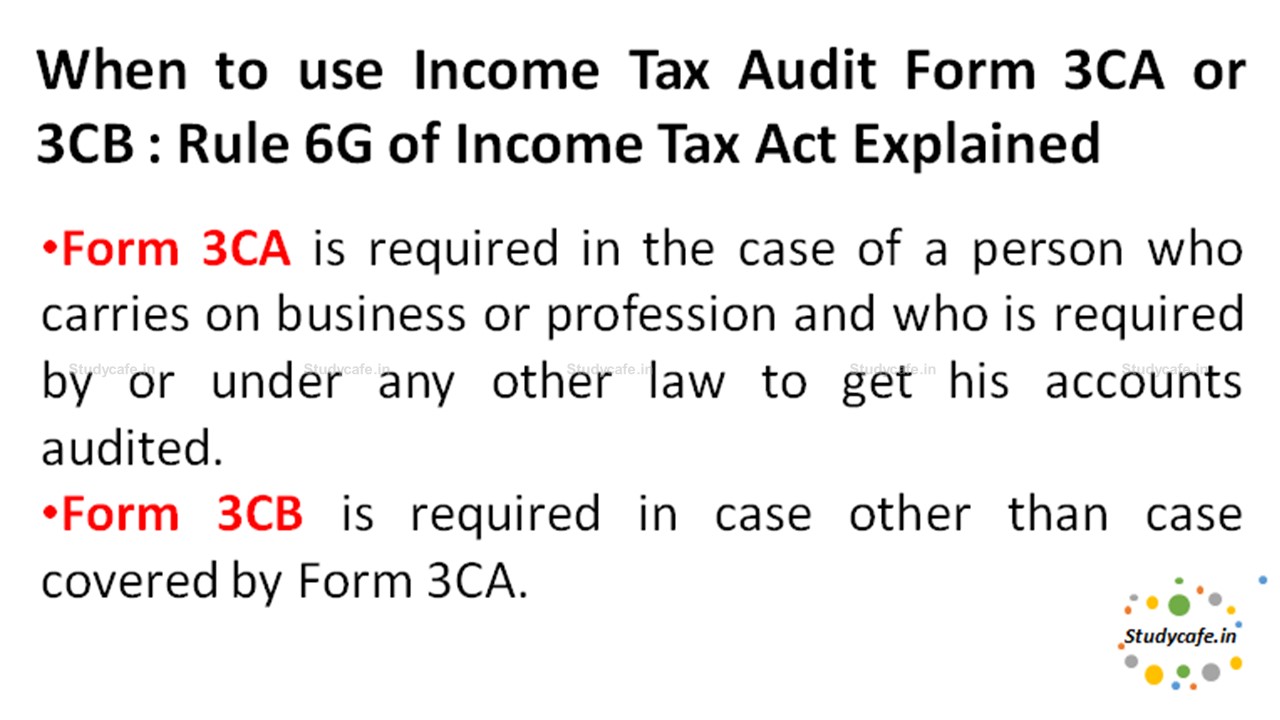

Relevant Rule : Rule 6G of Income Tax Act:

Report of audit of accounts to be furnished under section 44AB.

6G. (1) The report of audit of the accounts of a person required to be furnished under section 44AB shall,

(a) in the case of a person who carries on business or profession and who is required by or under any other law to get his accounts audited, be in Form No. 3CA;

(b) in the case of a person who carries on business or profession, but not being a person referred to in clause (a), be in Form No. 3CB.

(2) The particulars which are required to be furnished under section 44AB shall be in Form No. 3CD.

Form 3CA is required in the case of a person who carries on business or profession and who is required by or under any other law to get his accounts audited.

CASE A : For Example a company is required to get it’s account audited under Company Act 2013 and therefore in case we have to do Tax Audit for the company, we shall file Income Tax Audit Form 3CA.

Form 3CB is required in case other than case covered by Form 3CA.

CASE B : For Example Turnover of an individual is INR 5 Crs. Now he is not required to get his accounts Audited under any other act, but we have to do his audit as per Income Tax Act, therefore in this case Income Tax Audit Form 3CB shall be filed.

These two forms as the case may be are required to be filed along with Form 3CD which is again a detailed form having 44 clauses analyzing and auditing the accounts of taxpayer as per Income Tax Act.

Therefore now we know that in CASE A one shall file Tax Audit Report in Form 3CA-3CD and in CASE B one shall file Tax Audit Report in Form 3CB-3CD

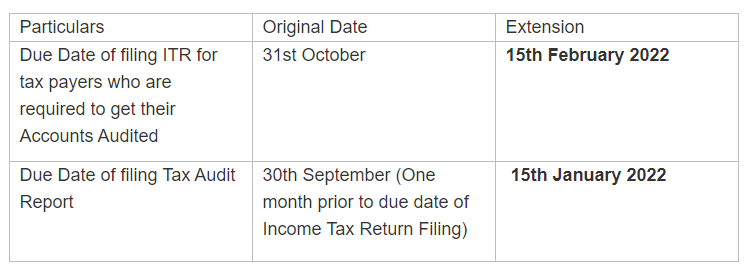

Change in Due Date of Tax Audit and Income Tax Return Filing:

A minimum penalty can be 0.5% of the total sales, turnover or gross receipts, which can go up to Rs. 1,50,000 is applicable in case Tax Audit Report is not filed. However, if the taxpayer gives reasonable cause for non-compliance, no penalty will be imposed.

In case of any Doubt regarding Membership you can mail us at [email protected]

Join Studycafe's WhatsApp Group or Telegram Channel for Latest Updates on Government Job, Sarkari Naukri, Private Jobs, Income Tax, GST, Companies Act, Judgements and CA, CS, ICWA, and MUCH MORE!"