Tax Department has issued a warning kind of reminder via a message in which it said that the deduction claimed under Section 80GGC for donation in ITR may be verified.

Reetu | Jan 28, 2025 |

Income Tax sends Warning to Salaried Taxpayers who made donations to political parties

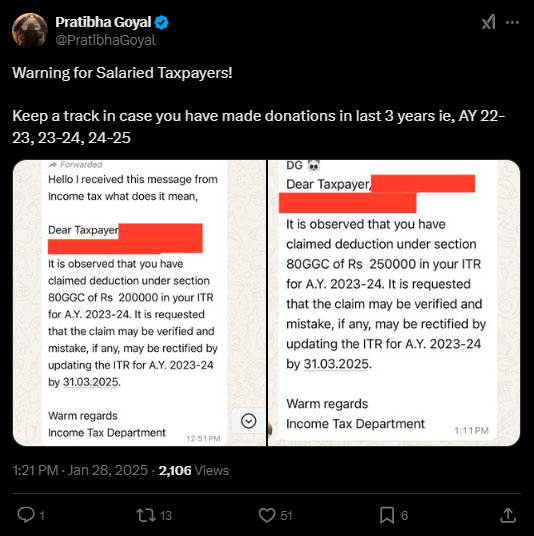

The Income Tax Department has issued a warning message in which it said that the deduction claimed under Section 80GGC for donation in ITR may be verified. Currently intimation has been received for Assessment Years 2022-23, 2023-24 and 2024-25. So, for salaried taxpayers, it is important to keep a track record of any donations made in these 3 years.

The message issued by the Income Tax Department to one of the taxpayers said, “Dear Taxpayer, It is observed that you have claimed deduction under section 80GGC of Rs 250000 in your ITR for A.Y. 2023-24. It is requested that the claim may be verified and mistake, if any, may be rectified by updating the ITR for A.Y. 2023-24 by 31.03.2025.”

Section 80G is a provision under the Income Tax Act of India that allows taxpayers to claim deductions for donations made to specified charitable institutions and funds. The purpose of this section is to encourage individuals and organizations to contribute towards charitable causes while also providing them with tax benefits.

Individuals can claim tax deductions on these donations while filing their income tax returns, contributing to both philanthropy and financial savings.

Section 80 GGC: Deduction in respect of contributions given by any person to political parties

As per this section, In computing the total income of an assessee, being any person, except local authority and every artificial juridical person wholly or partly funded by the Government, there shall be deducted any amount of contribution made by him, in the previous year, to a political party or an electoral trust.

Provided that no deduction shall be allowed under this section in respect of any sum contributed by way of cash.

For the purpose of this section, “political party” means a political party registered under section 29A of the Representation of the People Act, 1951 (43 of 1951).

What to do in case you have received this message?

This is a general Warning Message sent to people who have claimed a deduction u/s 80GGC

The message is aimed to trigger panic among people who have claimed fake deduction

No response is to be submitted if you verify the claim

ITR-U to be filed in case of a mistake or wrong claim.

In case of any Doubt regarding Membership you can mail us at [email protected]

Join Studycafe's WhatsApp Group or Telegram Channel for Latest Updates on Government Job, Sarkari Naukri, Private Jobs, Income Tax, GST, Companies Act, Judgements and CA, CS, ICWA, and MUCH MORE!"