CA Nitin Kanwar has prepared Draft Management Representation Letter for Non-Corporate Entity for the purpose of Tax audit.

Reetu | Sep 6, 2023 |

Draft Management Representation Letter for Tax Audit of Non-Corporate Entity

CA Nitin Kanwar has prepared Draft Management Representation Letter for Non-Corporate Entity for the purpose of Tax audit.

Audits are undertaken under various laws, such as company audits/statutory audits conducted under company law requirements, cost audits, stock audits, and so on. Similarly, income tax legislation requires a ‘Tax Audit‘ audit.

Tax audit, as the name implies, is an inspection or review of the accounts of any business or profession carried out by taxpayers from an income tax standpoint. It simplifies the process of calculating income for the purpose of submitting income tax returns.

DRAFT MANAGEMENT REPRESENTATION LETTER FOR NON- CORPORATE ENTITY

To,

______________________

Chartered Accountants

Add: _________________________________________

Sub: Representation for the purpose of Tax audit for the financial year 2022-2023 (Assessment year 2023-2024)

Dear Sir/Madam,

This representation letter is provided in connection with Tax audit of the books of accounts of the _________________________________ for the Year ended on 31/03/2023 for the purpose to ascertain/derive/report the requirements of Form Nos. 3CA/3CB and 3CD, to ensure that the books of account and other records are properly maintained, that they truly reflect the income of the taxpayer and claims for deduction/relief are correctly made by him & to checking fraudulent practices. We acknowledge our responsibility to keep and maintain such books of account and other documents as may enable the Tax auditor to do tax audit u/s 44AB, in accordance with the provisions of Income Tax Act, 1961.

I/We understand our responsibility for the preparation of Form 3CD. Form 3CD should be duly filled & authenticated by me/us. Yourself will only verify and confirm the same & on that basis form the opinion & issue the report in Form 3CA/3CB Subject to the observation, if any as the case may be.

We confirm, to the best of our knowledge and belief, the following:-

1. The name of the assessee as per PAN card is ______________. Copy of PAN Card has been attached herewith.

2. I/we am/are liable/not liable to pay indirect taxes & if yes, for that registration number is as follows:

a) Service Tax:

b) VAT:

c) Excise:

d) Import Export Code:

e) GST:

Copy of Registration Certificates has been attached herewith.

3. The relevant clause of Section 44AB under which the Tax Audit is being conducted is :

Please Tick whichever is applicable.

(a) carrying on business shall, if his total sales, turnover or gross receipts, as the case may be, in business exceed or exceeds one crore rupees in any previous year :

(b) carrying on profession shall, if his gross receipts in profession exceed fifty lakh rupees in any previous year:

(c) carrying on the business shall, if the profits and gains from the business is lower than deemed the profits and gains under section 44AE or section 44BB or section 44BBB:

(d) carrying on the profession shall, if the profits and gains from the profession is lower than deemed the profits and gains under section 44ADA:

(e) carrying on the business shall, if the provisions of sub-section (4) of section 44AD are applicable in his case and his income exceeds the maximum amount which is not chargeable to income-tax in any previous year:

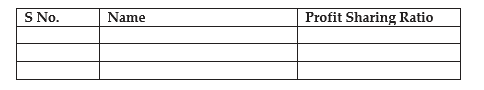

4. The following is the members/partners of the firm & their profit sharing Ration is as follow:

5. There is no change in partners or members or in their Profit Sharing Ratio since the last date of the preceding year.

OR

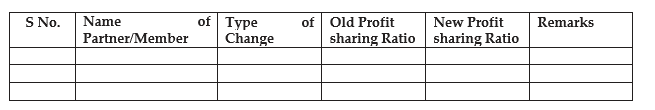

There is change in partners or members or in their Profit Sharing Ratio since the last date of the preceding year. The particulars of the change is as follow:

Certified copy of Partnership deed/LLP Agreement has been attached herewith.

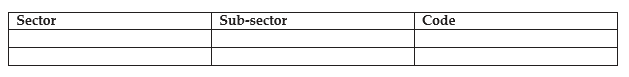

6. Nature of Business or Profession carried during the year, along with sector, subsector, code is as follows:

To Read More – Click Here

The Author of the Article can be reached at canitinkanwar@nitinkanwarandassociates.in

In case of any Doubt regarding Membership you can mail us at contact@studycafe.in

Join Studycafe's WhatsApp Group or Telegram Channel for Latest Updates on Government Job, Sarkari Naukri, Private Jobs, Income Tax, GST, Companies Act, Judgements and CA, CS, ICWA, and MUCH MORE!"