The Income Tax Department has reminded the taxpayer that the due date of filing an Updated ITR for AY 2021-2022 is approaching soon.

Reetu | Nov 23, 2023 |

Due Date for filing Updated ITR for AY 2021-2022 Soon

The Income Tax Department has reminded the taxpayer that the due date for filing an Updated ITR for AY 2021-2022 is approaching soon.

The Updated return can be filed only if the taxpayer has not previously filed an income tax return or if the originally filed return has mistakes or omissions. The Updated return can only be filed if the person has to reveal any extra income that was overlooked previously and must pay more taxes.

On his official Twitter account, Income Tax Department tweeted:

“Kind Attention Taxpayers!

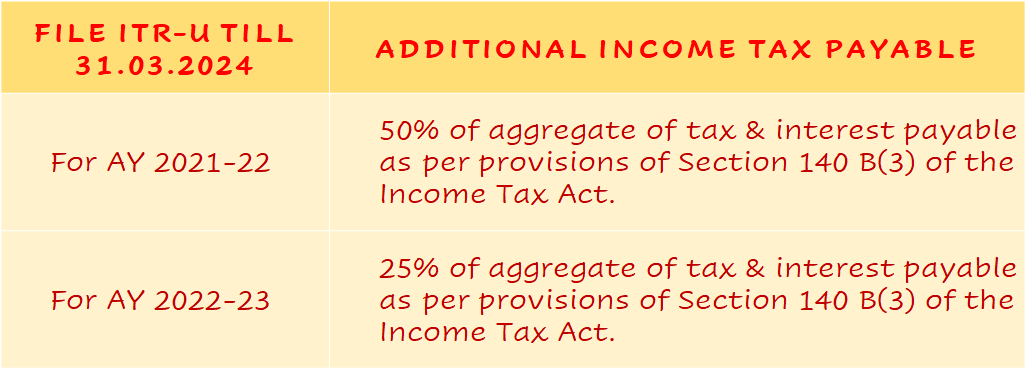

Last date for filing your Updated Income Tax Return for Assessment Year 2021-2022 is 31st March, 2024.

Don’t delay, file today!”

File an Updated Income Tax Return (ITR-U) for AY 2021-22 by 31st March 2024.

For more information please refer to Section 139 (BA) & 140 B(3) of Income tax Act, 1961.

In case of any Doubt regarding Membership you can mail us at [email protected]

Join Studycafe's WhatsApp Group or Telegram Channel for Latest Updates on Government Job, Sarkari Naukri, Private Jobs, Income Tax, GST, Companies Act, Judgements and CA, CS, ICWA, and MUCH MORE!"