Deepak Gupta | Dec 2, 2018 |

EPCG Scheme | Export Promotion Capital Goods Scheme

This is a very Beneficial Export Promotion Scheme through which Capital Goods required for Export Production is allowed Duty Free.

Objective

The objective of the EPCG Scheme is to facilitate import of capital goods for producing quality goods and services and enhance Indias manufacturing competitiveness.

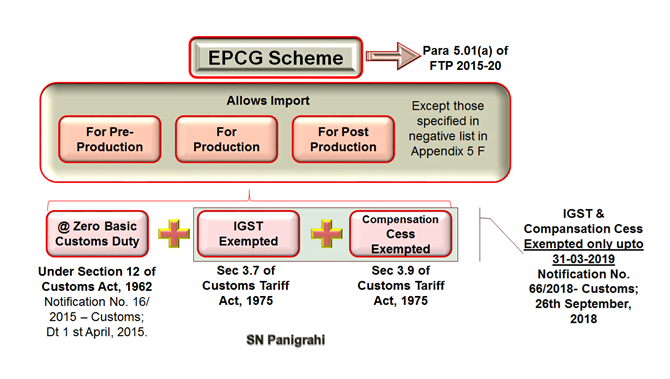

As per Para 5.01 of Foreign Trade Policy, EPCG Scheme allows import of capital goods (except those specified in negative list in Appendix 5 F) for pre-production, production and post-production at zero customs duty.

Capital goods imported under EPCG Authorisation for physical exports are also exempt from IGST and Compensation Cess upto 31-03-2019only

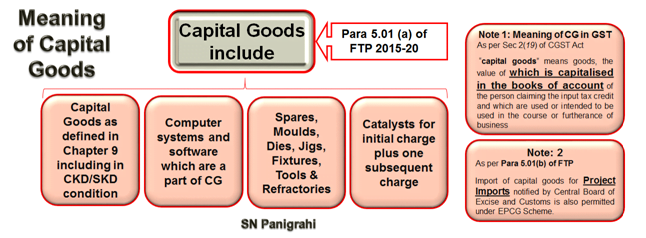

Capital goods for the purpose of the EPCG scheme shall include:

(i) Capital Goods as defined in Chapter 9 including in CKD/SKD condition thereof;

(ii) Computer systems and software which are a part of the Capital Goods being imported;

(iii) Spares, moulds, dies, jigs, fixtures, tools & refractories; and

(iv) Catalysts for initial charge plus one subsequent charge.

Import of capital goods for Project Imports notified by Central Board of Excise and Customs is also permitted under EPCG Scheme.

Meaning of Capital Goods:

Para 9.08 of FTP : “Capital Goods” means any plant, machinery, equipment or accessories required for manufacture or production, either directly or indirectly, of goods or for rendering services, including those required for replacement, modernisation, technological up-gradation or expansion. It includes packaging machinery and equipment, refrigeration equipment, power generating sets, machine tools, equipment and instruments for testing, research and development, quality and pollution control.

Capital goods may be for use in manufacturing, mining, agriculture, aquaculture, animal husbandry, floriculture, horticulture, pisciculture, poultry, sericulture and viticulture as well as for use in services sector.

Coverage of EPCG Scheme

Intimation of Blockwise Fulfiment of Export Obligation

As per Para 5.14 of HBP

.

(b) The Authorisation holder would intimate the Regional Authority on the fulfilment of the export obligation, as well as average exports, within three months of completion of the block, by secured electronic filing using digital signatures.

(c) Where EO of the first block is not fulfilled in terms of the above proportions, except in cases where the EO prescribed for first block is extended by the Regional Authority subject to payment of composition fee of 2% on duty saved amount proportionate to unfulfilled portion of EO pertaining to the block, the Authorization holder shall, within 3 months from the expiry of the block, pay duties of customs (along with applicable interest as notified by DOR) proportionate to duty saved amount on total unfulfilled EO of the first block.

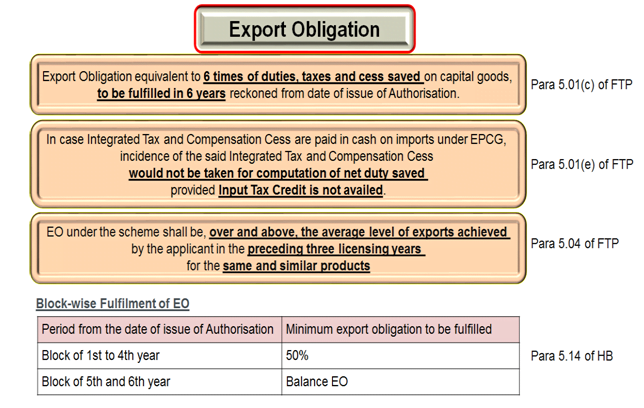

Conditions for Export Obligation

As per Para 5.04 of FTP :

Following conditions shall apply to the fulfilment of EO:-

(a) EO shall be fulfilled by the authorisation holder through export of goods which are manufactured by him or his supporting manufacturer / services rendered by him, for which the EPCG authorisation has been granted.

(b) EO under the scheme shall be, over and above, the average level of exports achieved by the applicant in the preceding three licensing yearsfor the same and similar products within the overall EO period including extended period, if any; except for categories mentioned in paragraph 5.13(a) of HBP. Such average would be the arithmetic mean of export performance in the preceding three licensing years for same and similar products.

(c) In case of indigenous sourcing of Capital Goods, specific EO shall be 25% less than the EO stipulated in Para 5.01.

(d) Shipments under Advance Authorisation, DFIA, Drawback scheme or reward schemes under Chapter 3 of FTP; would also count for fulfillment of EO under EPCG Scheme.

(e) Export shall be physical export. However, supplies as specified in paragraph 7.02 (a), (b), (e), (f) & (h) of FTP (Deemed Exports) shall also be counted towards fulfillment of export obligation, along with usual benefits available under paragraph 7.03 of FTP.

(f) EO can also be fulfilled by the supply of ITA-I items to DTA, provided realization is in free foreign exchange.

(g) Royalty payments received by the Authorisation holder in freely convertible currency and foreign exchange received for R&D services shall also be counted for discharge under EPCG.

(h) Payment received in rupee terms for such Services as notified in Appendix 5D shall also be counted towards discharge of export obligation under the EPCG scheme.

Validity for Import

Vide Public Notice No. 47/2015-20; Dated the 16thNovember, 2018, Para 5.01(d) of FTP was amended to extended Validity period for importfrom 18 months to 24 months.

Actual User Condition

As per Para 5.03 of FTP, Imported CG shall be subject to Actual User condition till export obligation is completed and EODC is granted.

Certificate of Installation of Capital Goods

Public Notice No. 31/2015-20, Dated 29thAugust, 2018; Dated the 29thAugust, 2018

Para 5.04(a) of HBP:

Authorization holder shall produce, within six months from date of completion of import, to the concerned RA, a certificate from the jurisdictional Customs authority or an independent Chartered Engineer, at the option of the authorisation holder, confirming installation of capital goods at factory / premises of authorization holder or his supporting manufacturer(s).

The RA may allow one time extension of the said period for producing the certificate by a maximum period of 12 months with a composition fee of Rs.5000/-.

Where the authorisation holder opts for independent Chartered Engineers certificate, he shall send a copy of the certificate to the jurisdictional Customs Authority for intimation/record.

Para 5.04(b) of HBP

In the case of import of spares, the installation certificate shall be submitted by the Authorization holder within a period of three years from the date of import.

Shifting of Capital Goods imported under EPCG Scheme

Public Notice No. 31/2015-20, Dated 29thAugust, 2018; Dated the 29thAugust, 2018

Para 5.04(a) of HBP:

The authorization holder shall be permitted to shift capital goodsduring theentire export obligation periodto other units mentioned in the IEC and RCMC of the authorization holder subject to production of fresh installation certificatetothe RA concerned within six months of the shifting.

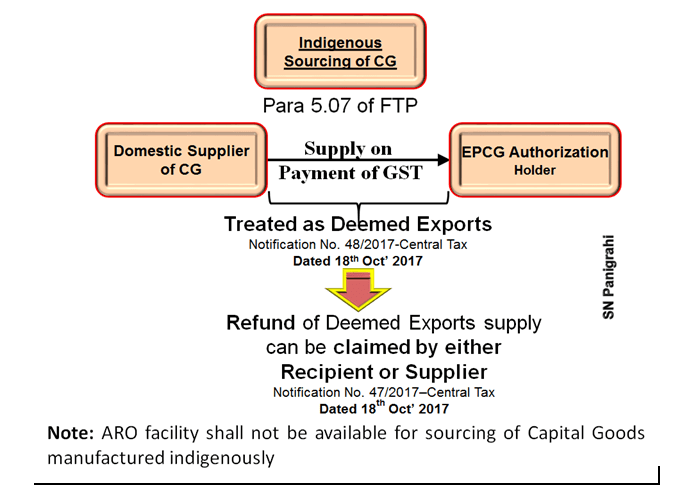

Indigenous Sourcing of CG: Benefits to Domestic Supplier

Para 5.07 of FTP

A person holding an EPCG authorisation may source capital goods from a domestic manufacturer. Such domestic manufacturer shall be eligible for deemed export benefits under paragraph 7.03 of FTP and as may be provided under GST Rules under the category of deemed exports.

Such domestic sourcing shall also be permitted from EOUs and these supplies shall be counted for purpose of fulfilment of positive NFE by said EOU as provided in Para 6.09 (a) of FTP.

The Domestic Supplier to EPCG Authorization holder has to Collect and Pay GST and then claim such GST paid as Deemed Export Refund.

Monitoring of Export Obligation

Para 5.15 of HBP

Authorisation holder shall submit to RA concerned by 30th April of every year, report on fulfilment of export obligation by secured electronic filing using digital signatures/ or hard copy thereof.

Comments :

Though the EPCG Scheme is a beneficial Export Promotion Scheme is most misused scheme, as there is no proper monitoring of Export Obligation. Even after expiry of the authorization no actions are being taken by the Concerned authorities. If the cases are opened up it may turn to be a biggest scam since such defaults are happening in collusion with corrupt officials.

More over the scheme is not WTO Compliant and face any time exit.

Notifications

| Title | Notification No. | Date |

| Exempt Integrated Tax / Cess on import of goods under AA / EPCG Schemes |

Notification 16/2015 – Customs, Notification 79/2017 – Customs | 01/04/2015 03/10/2017 |

| Evidences required to be produced by supplier of deemed exports for claiming refund | Notification 49/2017 Central Tax | 18/10/2017 |

| CBEC notifies certain supplies as deemed exports under CGST Act 2017 | Notification 48/2017 Central Tax | 18/10/2017 |

| GST Refund of as deemed exports supply can be claimed by either receipt or supplier | Notification 47/2017 Central Tax | 18/10/2017 |

| GST Refund of : a) Input Tax Credit b) Integrated Taxes Paid | Notification 54/2018 Central Tax | 19/10/2018 |

For more details please see the You Tube @ the following Link

https://www.youtube.com/watchv=04NauOGVQtU&t=2s

Disclaimer :The views and opinions; thoughts and assumptions; analysis and conclusions expressed in this article are those of the authors and do not necessarily reflect any legal standing.

Author : SN Panigrahi, GST Consultant, Practitioner, Corporate Trainer & Author

Can be reached @ [email protected]

In case of any Doubt regarding Membership you can mail us at [email protected]

Join Studycafe's WhatsApp Group or Telegram Channel for Latest Updates on Government Job, Sarkari Naukri, Private Jobs, Income Tax, GST, Companies Act, Judgements and CA, CS, ICWA, and MUCH MORE!"