The deadline for filing ITRs is quickly approaching. Individuals who have already filed their ITRs are now waiting for their tax refunds.

Reetu | Jul 30, 2024 |

Expecting an Income Tax Refund for FY 2023-24; Know How Long it will Take

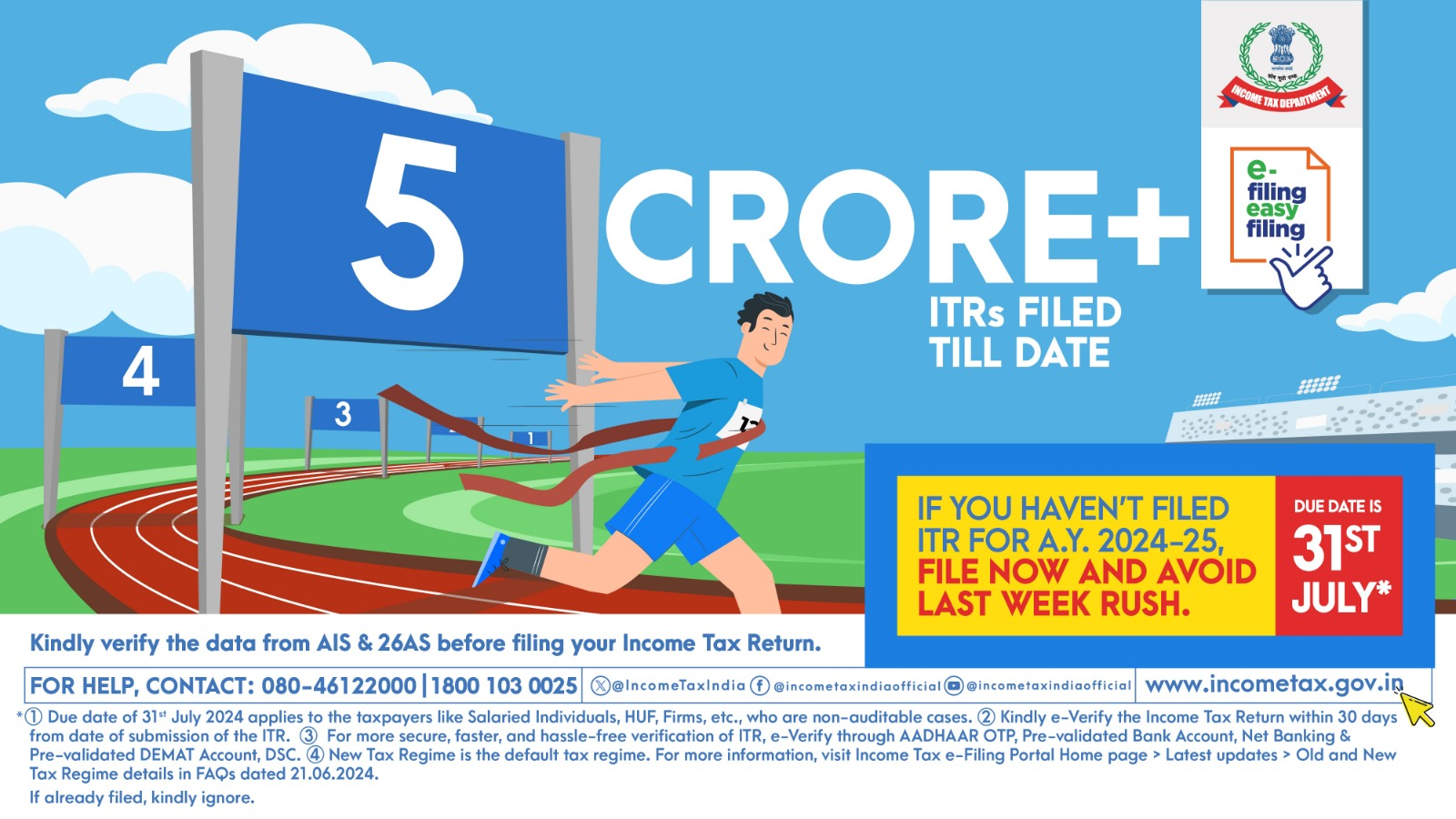

The deadline for filing Income Tax Returns (ITRs) is quickly approaching, with only one day left. If you are new to submitting an ITR or are doing it for the first time, you must finish the process by July 31, 2024.

Most importantly, as the deadline approaches, the Income Tax Department may see increased traffic, making it difficult for taxpayers to file their forms at the last minute.

Last year, a total of 8.43 crore ITRs were filed, and this figure is likely to climb further in the financial year 2024–25. As per Income Tax Portal Data, 60,914,986 Returns have been filed on 30th July 2024. The increase in filing implies that more Indian taxpayers are becoming aware of the importance of complying with tax regulations, as well as that more people earn more than the basic exemption threshold.

Individuals who have filed their ITRs are now waiting for their tax refunds. Many taxpayers find themselves waiting for tax refunds. As more individuals file their taxes, it’s understandable that taxpayers are looking forward to receiving their tax refunds.

When it comes to boosting ITR processing times, the Income Tax Department has made great progress. Routine operations have been automated, reducing processing time significantly, and improved data analytics allow for speedier tax return verification.

A large number of taxpayers may now expect to get their refunds much faster than in previous years, thanks to technological developments and more efficient procedures. While the majority of taxpayers will receive their refunds quickly, it is essential to be aware of potential delays caused by factors such as complicated returns or discrepancies in the data filed.]

Many taxpayers have expressed concern about the unpredictability of ITR processing delays and refund disbursements for the Assessment Year 2024-2025.

There are several reasons that contribute to this uncertainty –

Base of Taxpayers Increased: The increasing number of taxpayers puts a burden on the Income Tax Department’s processing capability.

Complex Tax Laws: The complex structure of tax rules may require manual verification, which may cause delays.

Improvements of System: Processing speeds may lag briefly owing to normal department system updates and upgrades.

Data Correspondence and Validation: Processing delays may arise as a result of thorough screening to prevent fraudulent claims.

This instability makes it difficult for people to plan and manage their finances. Delays in refunds can disrupt cash flow and complicate budgeting. In addition, uncertainty over the availability of refunds may influence investment decisions. Tax planning is further hampered by changing tax laws and inconsistent processing timeframes.

Consider the following strategies to tackle the situation while we wait for improvements to the processing system.

Returns should be Accurate and Complete: To reduce the likelihood of scrutiny, ensure that your ITR is error-free.

E-verification: E-verification of Returns can help speed up the process.

Track Refund Status: Check the Income Tax portal often to see how your refund is proceeding forward.

Emergency Funds: Maintain an adequate emergency fund to handle unexpected expenses.

Advice of Expert: Consult a tax advisor if you have any complicated tax issues.

Prevalidation of Bank Account: Ensure your Bank Account is prevalidated for timely credit of Income Tax Refund.

Refund processing has surely increased in recent years. Refunds are generally moving faster, although delays do exist, particularly during busy filing seasons.

In case of any Doubt regarding Membership you can mail us at [email protected]

Join Studycafe's WhatsApp Group or Telegram Channel for Latest Updates on Government Job, Sarkari Naukri, Private Jobs, Income Tax, GST, Companies Act, Judgements and CA, CS, ICWA, and MUCH MORE!"