The ITR Filing deadline is just one day away and taxpayers still facing issues on the income tax portal in last-minute filing.

Reetu | Jul 30, 2024 |

Taxpayers still facing issues on IT Portal amid Deadline

The ITR Filing deadline is just one day away and taxpayers still facing issues on the income tax portal in last-minute filing.

The Income Tax India portal has been experiencing substantial technical troubles, generating frustration among users attempting to file Income Tax Returns (ITRs) before the July 31 deadline.

Users have experienced difficulties accessing and downloading required forms such as Form 26AS, AIS, and TIS, as well as problems with the e-filing and payment systems. Some users have reported delays and technological issues, prompting calls for an extension of the ITR filing deadline to ensure a smooth and efficient filing procedure. Despite these problems, some users have successfully submitted taxes and received refunds. The event has spurred discussions about the portal’s performance and the need for adjustments to avoid similar problems in future tax filing seasons.

The CBDT Chairman noted taxpayers’ worries about the delay in issuing TDS and Form 16 certificates, as well as the “slowness” of the IT system, but confirmed that these issues have been resolved.

“Even hourly filings have reached an all-time level. As a result, I am certain we will be able to fix it within the next six days. The majority of the issues have been addressed and remedied, and there was no apparent reporting of any of these difficulties, such as downtime yesterday, and there is still no problem today,” he said last Thursday afternoon.

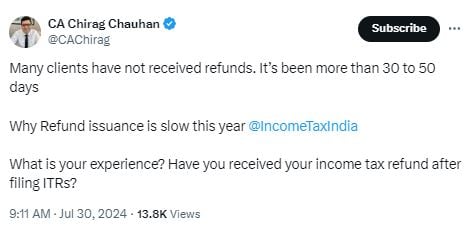

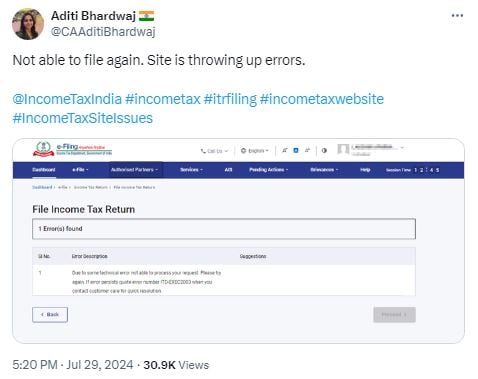

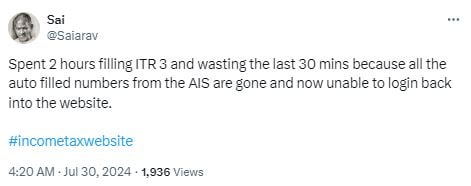

Taxpayers who are still facing errors and issues shared their experiences on Twitter.

One user wrote, “Many clients have not received refunds. It’s been more than 30 to 50 days. Why Refund issuance is slow this year @IncomeTaxIndia What is your experience? Have you received your income tax refund after filing ITRs?”

Another user said, “Not able to file again. Site is throwing up errors. @IncomeTaxIndia #incometax #itrfiling #incometaxwebsite #IncomeTaxSiteIssues”

One person said, “Spent 2 hours filling ITR 3 and wasting the last 30 mins because all the auto filled numbers from the AIS are gone and now unable to login back into the website. #incometaxwebsite”

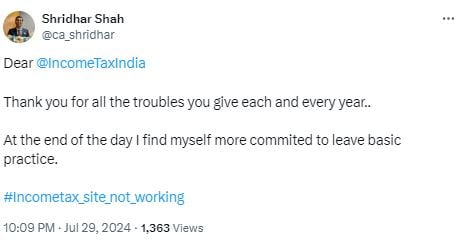

Another person said, “Dear @IncomeTaxIndia Thank you for all the troubles you give each and every year.. At the end of the day I find myself more commited to leave basic practice. #Incometax_site_not_working”

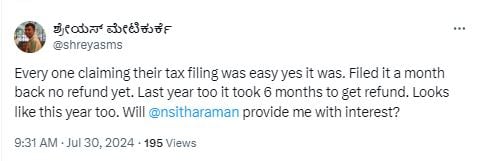

One more person tweeted, “Everyone claiming their tax filing was easy yes it was. Filed it a month back no refund yet. Last year too it took 6 months to get a refund. Looks like this year too. Will @nsitharaman provide me with interest?”

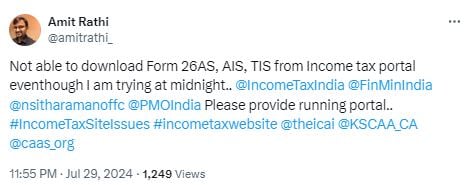

One user tweeted, “Not able to download Form 26AS, AIS, TIS from Income tax portal even though I am trying at midnight.. @IncomeTaxIndia @FinMinIndia @nsitharamanoffc @PMOIndia Please provide running portal.. #IncomeTaxSiteIssues #incometaxwebsite @theicai @KSCAA_CA @caas_org”

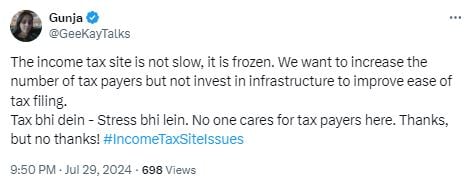

Another user shared, “The income tax site is not slow, it is frozen. We want to increase the number of taxpayers but not invest in infrastructure to improve ease of tax filing. Tax bhi dein – Stress bhi lein. No one cares for taxpayers here. Thanks, but no thanks! #IncomeTaxSiteIssues”

Do Comment your experience of ITR Filing.

In case of any Doubt regarding Membership you can mail us at [email protected]

Join Studycafe's WhatsApp Group or Telegram Channel for Latest Updates on Government Job, Sarkari Naukri, Private Jobs, Income Tax, GST, Companies Act, Judgements and CA, CS, ICWA, and MUCH MORE!"