Reetu | Apr 12, 2023 |

FAQs for Grant of Registration as Alternative Investment Fund

The Securities of Exchange Board of India(SEBI) has released FAQs for Grant of Registration as Alternative Investment Fund.

Frequently Asked Questions are Given Below:

The applicant has to visit the www.siportal.sebi.gov.in and file application for grant of registration as an AIF. The system generates a login ID for the applicant on receipt of the application for registration as an Alternative Investment Fund. On creation of the login SI portal, the Login ID and Password is automatically sent to the applicant through the system.

On receipt of the Login ID and Password, the applicant must fill up all the details by clicking “Fresh Registration” under the tab “AIF” given on the SEBI portal and pay required Application fees of Rs.1,00,000/- + 18% Goods & Services Tax (GST) through online mode available on SI Portal or by way of bank draft in favour of “The Securities and Exchange Board of India”, payable at Mumbai. The applicant is encouraged to make the requisite payment through the online mode only.

The applicant is required to submit information as specified under First Schedule of SEBI (AIF) Regulations, 2012 and other information as specified in the later sections of this document. The applicant needs to provide the details in various fields of theSIPortal and wherever specific fields are not provided, the applicant needs to upload the documents on the SIPortal under ‘optional attachments’. Instructions on how to fill the details is available under every field and the same can be accessed by clicking the “Blue Question Mark” on the top right hand corner of every page. Once all the details are filled up, the applicant to submit the online application form by clicking the “Final Submit” button.

Once the applicant submits the online application, the same is received by SEBI. The status of the application can be tracked by the applicant using the application number allotted for each application after the final submission.

For ease of processing the application, the applicant also needs to make a physical submission of the application to SEBI containing all the documents/information as mentioned in this document.

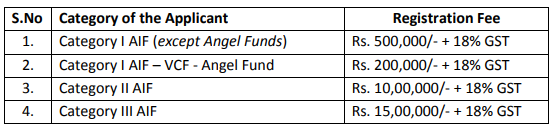

On receipt of approval from SEBI, the applicant are required to pay applicable registration fee as under:

Upon receipt of registration fee, SEBI will grant registration to the applicant as an Alternative Investment Fund.

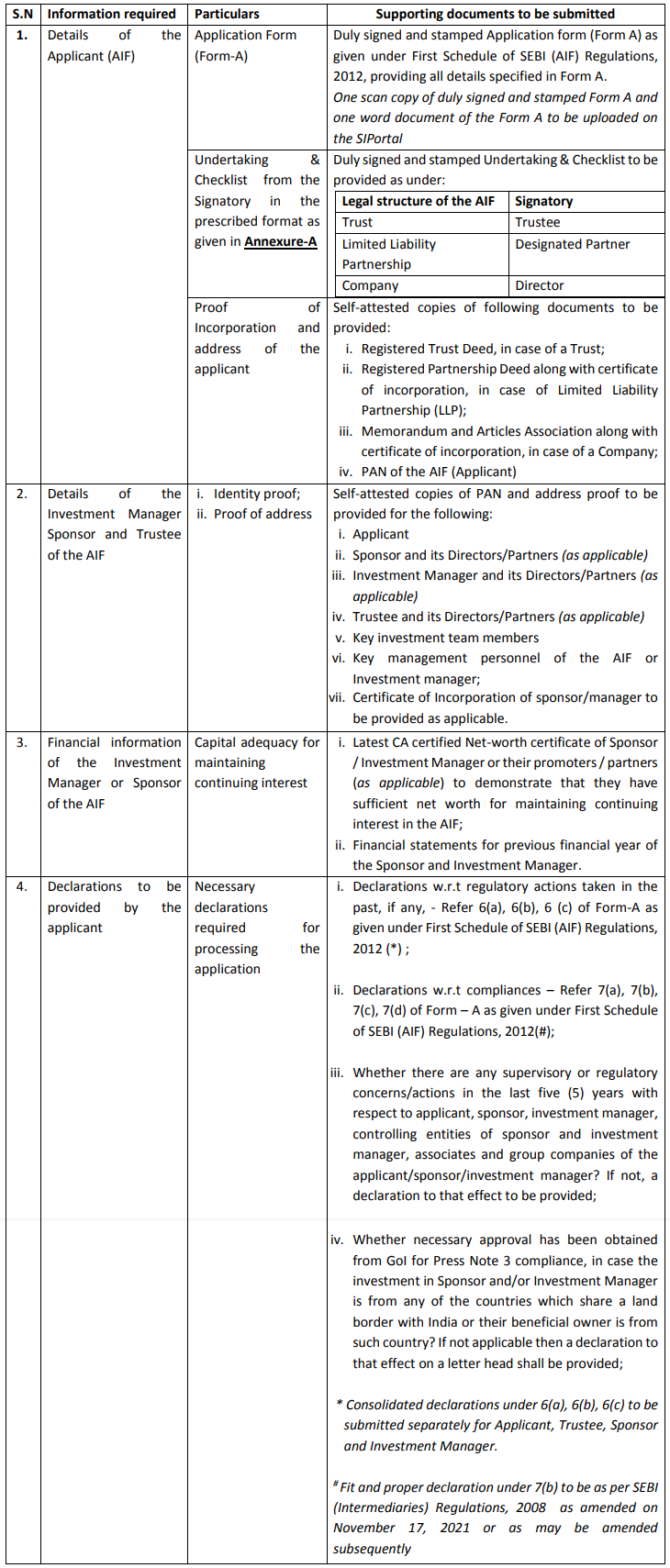

The list of various documents/ information required to be submitted/uploaded by the applicant at the time of filing application on the SI Portal for registration as an Alternative Investment Fund are as given below in the table:

To Read More Download PDF Given Below:

In case of any Doubt regarding Membership you can mail us at [email protected]

Join Studycafe's WhatsApp Group or Telegram Channel for Latest Updates on Government Job, Sarkari Naukri, Private Jobs, Income Tax, GST, Companies Act, Judgements and CA, CS, ICWA, and MUCH MORE!"