ITR Filing season is going on. If have switched jobs within a year, you are likely to have more than one Form 16.

Reetu | Jul 17, 2024 |

Filing ITR: What to do if You have more than one Form 16?

ITR Filing season is going on and the last date to file Inome Tax Return (ITR) is approaching soon. Taxpayers are filing their returns as soon as possible to avoid the last-minute rush. But before filing a return, taxpayers need to focus on a few things to not make any mistakes. If taxpayers change jobs multiple times in a year, then they need to collect all Form 16 from their employers. In this article, we’ll see what to do in case of more than one Form 16.

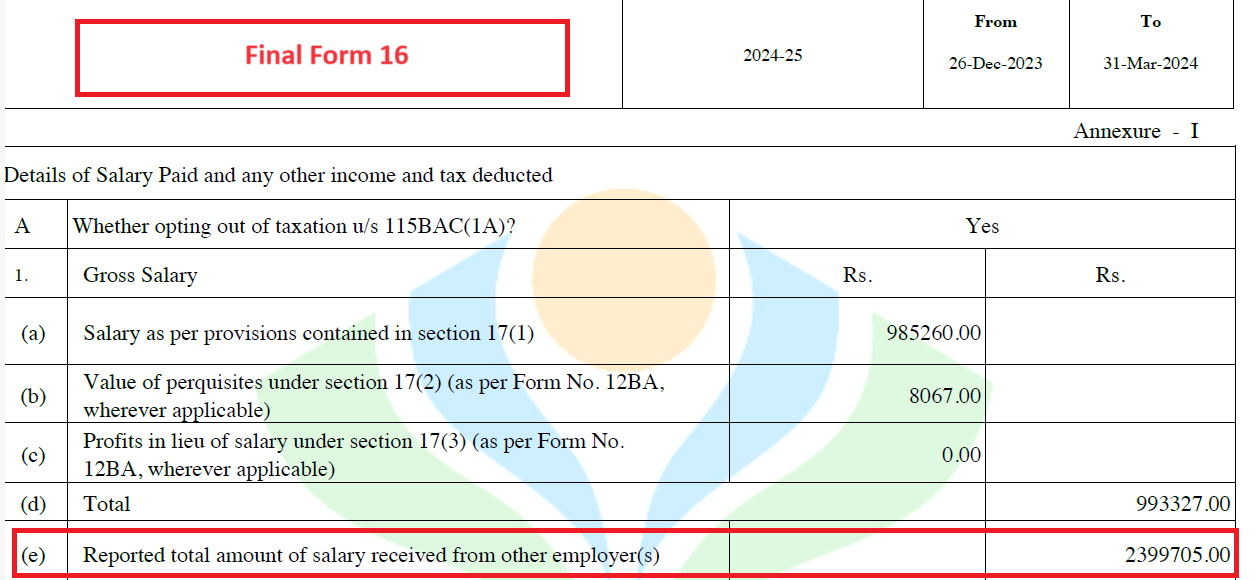

You are likely to have more than one Form 16 if have switched jobs within a year. The salary from your previous employer should be disclosed in Final Form 16 from your current Employer. Else same can lead to duplication of Exemption/ Deductions and Tax Liability at stage of filing ITR.

Example: Mr A did not disclose his salary from his Previous Employer to current employer.

Salary: Rs. 7,00,000

No TDS was deducted by his Previous Employer as he Chose New Tax Regime.

How his salary was computed with his current Employer.

| Particulars | Amount (in Rupees) |

| Salary | 9,00,000 |

| Salary from Previous Employer | 0 |

| Standard Deduction | 50,000 |

| Taxable Income | 8,50,0000 |

| Tax | 41,600 |

In this case, his Actual salary is Rs. 16Lakhs. The actual TDS that should have been deducted is Rs. 1,71,600.

Since the complete TDS was not deducted earlier, the remaining amount has to be paid with Interest under Section 234B and Section 234C.

Many times it has been seen that Standard Deduction/ Slab/ 80C/ 80D benefits are duplicated in case of switch of employment within a year, leading to a high tax liability along with interest at the ITR Filing Stage.

What to do if employee has Switched Jobs within a year and he does’t have form 16 from the Previous employer. How to file ITR?

In case of any Doubt regarding Membership you can mail us at [email protected]

Join Studycafe's WhatsApp Group or Telegram Channel for Latest Updates on Government Job, Sarkari Naukri, Private Jobs, Income Tax, GST, Companies Act, Judgements and CA, CS, ICWA, and MUCH MORE!"