Section 80GG under the Income Tax Act offers tax deductions for those who are paying rent.

Reetu | Jul 5, 2024 |

Rent Paid but no HRA in form 16: Here is what you can do to claim deduction in ITR

Many of you may have heard of section 80GG of the Income Tax Act of 1961. Section 80GG under the Income Tax Act offers tax deductions for those who are paying rent. Let us know more about this section and how you can get benefits from it.

Those individuals who do not receive House Rent Allowance (HRA) from their employers can get the benefits of Section 80GG. If you get a salary that does not include the facility of HRA and you’re paying rent, you might be eligible for this deduction.

To claim this deduction you will need to meet a few conditions:

1. No HRA: HRA should not be included as a part of your salary.

2. Rent Payment: You should be paying rent for living in the accommodation.

3. No Own Property: There should not be any residential property owned by you or your spouse and even your minor child in the city you are currently residing and working.

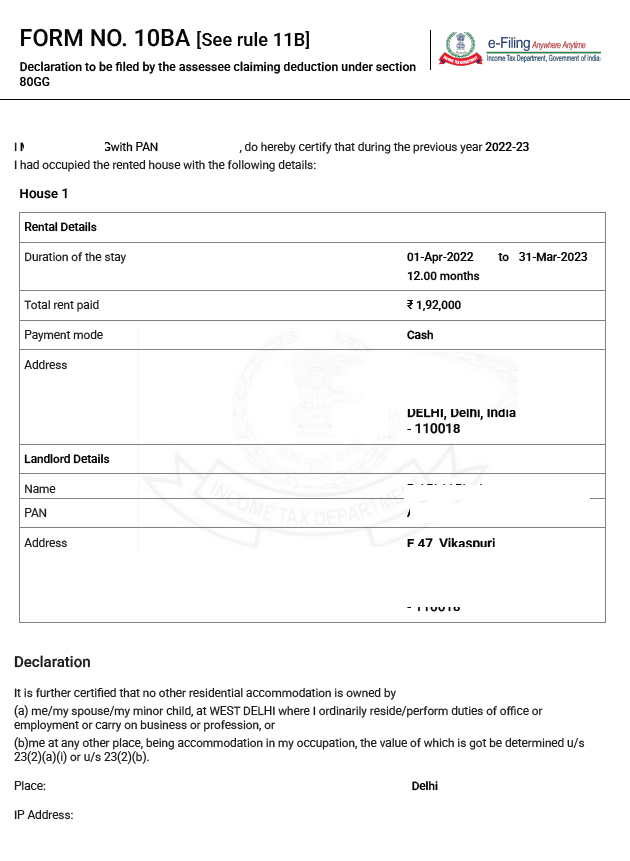

4. Self Declaration: You should file a declaration in Form 10BA confirming that you meet all these conditions.

The amount you can claim under Section 80GG is the least of the following:

1. Rs.5,000 per month.

2. 25% of your Adjusted Gross total income.

3. Actual rent paid minus 10% of your total income.

Adjusted Gross total Income is “Total Income excluding capital gains and deductions” (Deductions excluding deduction us/ 80GG).

There are some exceptions under Section 80GG:

1. HRA Beneficiaries: You can not claim this deduction if you are receiving HRA.

2. Multiple Properties: If you have your owned residential property in the same city where you are working, then you’re disqualified

3. Documentation: You need to fill out Form 10BA to declare that you meet all conditions.

Individuals get a salary and are self-employed paying rent but do not receive HRA, for them, Section 80GG is a very important provision. If you learn to understand and use this section properly, you can easily reduce your taxable income and save your taxes.

You must fill out Form 10BA right to get your Section 80GG deduction. Follow these steps:

1. Your Information: Write your name, PAN details, and where you live.

2. Rent Information: Put down how much rent you pay, where you rent, and who your landlord is.

3. How Long You Stayed: Say when you paid rent and for what dates.

4. Your Word: Say that you, your wife/husband, or your young kids don’t own a house where you live now.

1. Proof You Paid: Keep slips that show you paid rent.

2. Rental Deal: Have a copy of the deal you made to rent.

3. Landlord’s PAN: If you pay over Rs.1,00,000 a year in rent, you need your landlord’s PAN.

4. Form 10BA: You must submit a completed Form 10BA to certify that you are not claiming the benefit of Self-Occupied Property on a home in another place or the same location as your work.

You’ll breeze through your Section 80GG claim by nailing these details and documents. Renters without HRA should look into Section 80GG deductions. This could save you a bundle on taxes. Just make sure you tick all the boxes and submit the right documents.

In case of any Doubt regarding Membership you can mail us at [email protected]

Join Studycafe's WhatsApp Group or Telegram Channel for Latest Updates on Government Job, Sarkari Naukri, Private Jobs, Income Tax, GST, Companies Act, Judgements and CA, CS, ICWA, and MUCH MORE!"