CA Pratibha Goyal | Mar 22, 2020 |

Filling of Form CAR by Companies & LLPs: Frequently Asked Questions: Company Affirmation of Readiness towards COVID-19

As per MCA announcement, Companies & LLPs are required to file web form CAR (Company Affirmation of Readiness towards COVID-19) affirming readiness towards Coronavirus. The web form named CAR (Company Affirmation of Readiness towards COVID-19) should be filed by an authorized signatory of Companies & LLPs. CAR-2020 shall be deployed on the 23rd of March, 2020.

Frequently Asked Questions for Filling of Form CAR by Companies & LLPs are given below:

What is the Purpose of deploying Form CAR?

In order to generate greater awareness and confidence on our state of readiness, the Ministry of Corporate Affairs is in the process of developing and deploying a simple web form for companies/ LLPs to confirm their readiness to deal with the COVID-19 threat.

When will CAR be deployed?

CAR will be deployed on 23rd March 2020.

Is there any legal provision under Companies Act 2013, regarding, implementaion of CAR?

No, as of now there is no legal provision under Companies Act 2013, regarding, implementaion of CAR. The form is aimed at creating awareness from CORONA Virus and to ensure that policy of “Work From Home” is followed by the organized sector i.e. Companies & LLPs.

Is digital signature required to file this form?

The circular says that the web form CAR (Company Affirmation of Readiness towards COVID-19) should be filed by an authorized signatory of Companies & LLPs. It is just like web-based DIR-3KYC and no DSC be required.

Who all are required to file this form?

All the Companies & LLPs are required to file this form. Here government is ensuring that atleast Organised Corporate sector is following norms to fight COVID-19.

It it madatory that that the policy, should be approved in Board Meeting?

No, it is not madatory that the policy should be approved in a board meeting or by Board of Directors. But generally it is in common parlance that the important policies are approved by Board. However in this case the policy can be approved by Human Resource, as the same is related with employees of the company.

Upto when the “Work from Home” policy will be effective?

As of now it is advised to be followed upto 31st March 2020. However it can be extended if sitation becomes more critical.

What is the due date of filling CAR?

This form has to be filled upto 30th March 2020.

Is their any MCA fees for filling CAR?

As of now no fees has been prescribed for filling CAR

Is their any Late fees or penalty for Late filling of CAR?

As of now no Late fees or penalty has been prescribed for filling CAR.

What information required to be uploaded in CAR?

Following information is required to be uploaded:

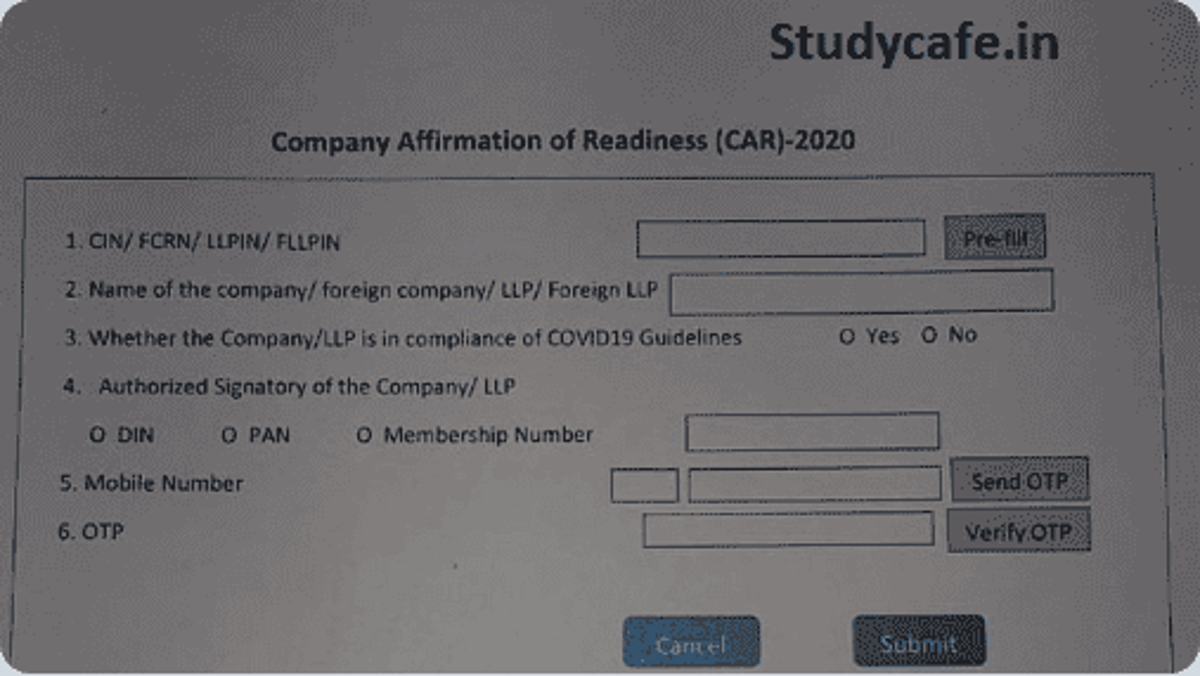

What is Format of Form CAR (Company Affirmation of Readiness towards COVID-19)?

Format of Form CAR (Company Affirmation of Readiness towards COVID-19)

How can we file the same?

After filling following information:

OTP is then recived on the Mobile. After Authentication form can be uploaded.

Disclaimer: The entire contents of this document have been prepared on the basis of relevant provisions and as per the information existing at the time of the preparation. Although care has been taken to ensure the accuracy, completeness and reliability of the information provided, I assume no responsibility therefore. Users of this information are expected to refer to the relevant existing provisions of applicable Laws. The user of the information agrees that the information is not a professional advice and is subject to change without notice. I assume no responsibility for the consequences of use of such information. In no event shall I shall be liable for any direct, indirect, special or incidental damage resulting from, arising out of or in connection with the use of the information

Please comment in the comment Section Given below for discussion on above topic.

In case of any Doubt regarding Membership you can mail us at [email protected]

Join Studycafe's WhatsApp Group or Telegram Channel for Latest Updates on Government Job, Sarkari Naukri, Private Jobs, Income Tax, GST, Companies Act, Judgements and CA, CS, ICWA, and MUCH MORE!"