ICAI has made a Representation on allowing rebate on STCG u/s 111A and LTCG u/s 112

CA Pratibha Goyal | Jul 18, 2024 |

ICAI Representation on allowing rebate on STCG u/s 111A and LTCG u/s 112

The Direct Tax Committee of the Institute of Chartered Accountants of India (ICAI) has made a representation with the Ministry of Finance to allow rebate u/s 87A of Income Tax on Long Term Capital Gain (LTCG) chargeable to Tax u/s 112 and Short Term Capital Gain (STCG) chargeable to Tax u/s 111A.

Rebate under Income Tax Act

Rebate under section 87A of Income Tax Act is available for Resident and is a provision which helps the taxpayers to reduce the tax liability. Under the Old Tax Regime, this section is available to the person whose income does not exceed Rs. 5 Lakhs. The tax liability of person becomes nil if he claims rebate under section 87A.

The rebate limit was raised from Rs.12,500 to Rs.25,000 under Section 87A of the Income Tax Act if the Taxpayer opts for the New Tax Regime. In New Tax regime this section is available to the person whose income does not exceed Rs. 7 Lakhs.

The Issue

The issue is that on 5th July, the ITR online utility was updated, and after the update the utility stopped giving the benefit of Section 87A rebate for STCG u/s 111A and other special rate income. Before 5th July, ITR Utility and Calculator were allowing 87A rebate against STCG u/s 111A and other special rate incomes other than Long Term Capital Gain (LTCG) u/s 112A where such rebate is specifically barred by Section 112A itself.

Interpretation followed by Income Tax Portal

It was provided that where the total income of the assessee chargeable to tax under sub-section (1A) of section 115BAC, does not exceed Rs. 700,000, the assessee shall be entitled to a rebate, of an amount equal to 100% of such income-tax or Rs. 25000, whichever is less.

This would mean that in case the assessee has opted for the New Tax Regime, then the rebate shall be available only on those income which are chargeable to tax u/s 115BAC. Special Income Chargeable to tax under other sections like Short Term Capital Gain (STCG) u/s 111A, 115BBH, etc. will not get the benefit of Rebate.

A new issue has been noticed in this regard. In some of cases, ITR Utility is providing the benefit of the rebate in the New Tax Regime, even if the total Income is more than Rs. 700,000.

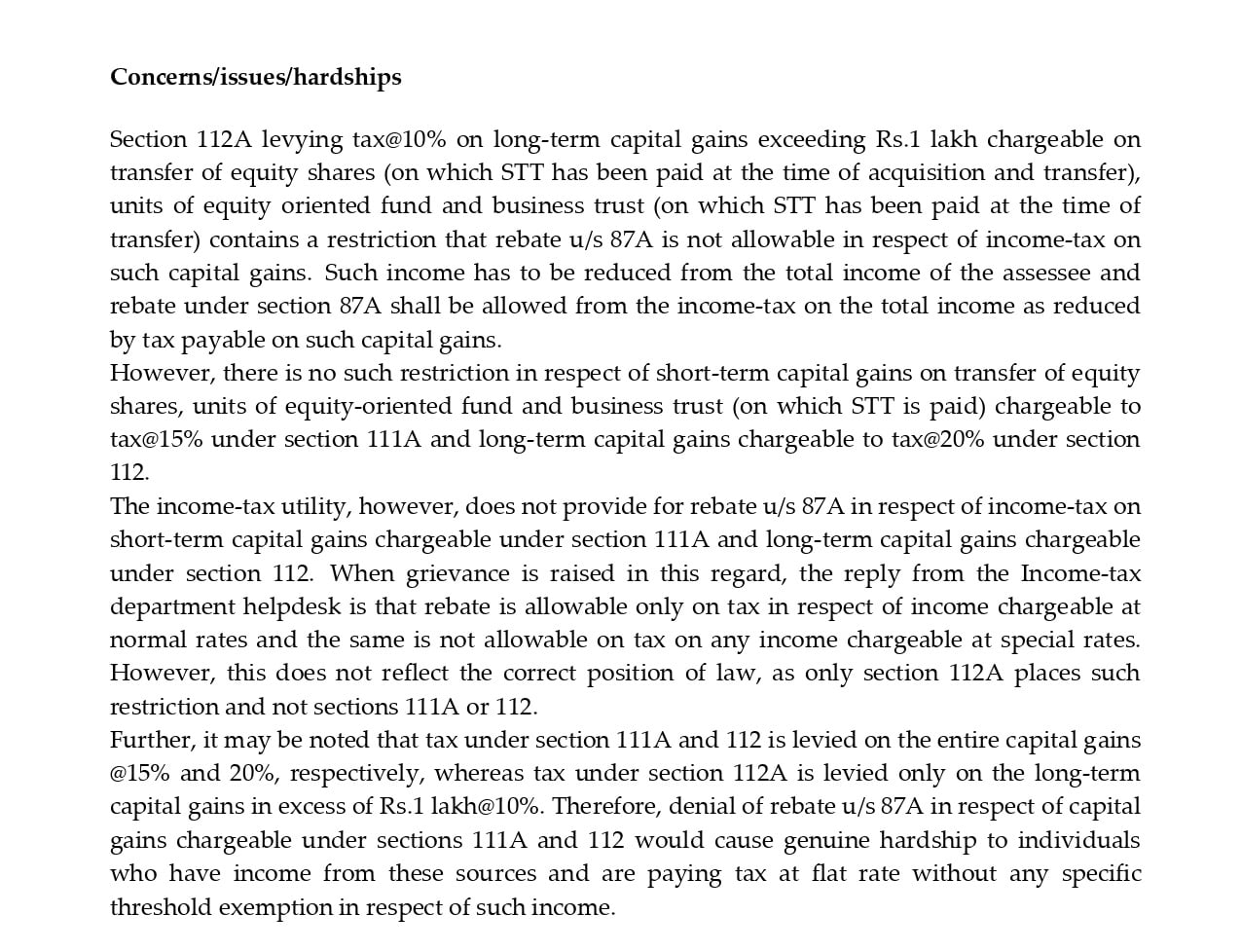

Concerns/ Hardship of Taxpayer as represented by ICAI

ICAI Representation

ICAI has suggested that required changes should be made in ITR Utility to allow rebate u/s 87A on Long Term Capital Gain (LTCG) chargeable to Tax u/s 112 and Short Term Capital Gain (STCG) chargeable to Tax u/s 111A.

In case of any Doubt regarding Membership you can mail us at [email protected]

Join Studycafe's WhatsApp Group or Telegram Channel for Latest Updates on Government Job, Sarkari Naukri, Private Jobs, Income Tax, GST, Companies Act, Judgements and CA, CS, ICWA, and MUCH MORE!"