BCAS has made representation with Ministry of Finance for Immediate Rectification of Faulty Income Tax Return (ITR) Filing Utility

CA Pratibha Goyal | Jul 18, 2024 |

ITR utility Faulty: Needs immediate rectification

The Bombay Chartered Accountant Society (BCAS) has given representation to the Ministry of Finance (MOF) to rectify the faulty Income Tax Return (ITR) Filing utility. This is in the matter of the ITR utility update which came on the 5th of July, after which the utility stopped giving the benefit of Section 87A rebate for STCG u/s 111A and other special rate income.

The society has represented that the current ITR filing utility not giving Income Tax rebate on special rate incomes is contradictory to legislative provisions.

Society further said that the section 87A gives rebate of Rs. 12500 in Old Tax Regime if Income is up to Rs. 500,000 and Rs. 25,000 if Income is up to Rs. 700,000.

The Society quoted “Until July 5, 2024, there was no confusion regarding this, and the return filing utilities on the Income Tax Department’s e-filing portal were functioning correctly. However, as of July 5, 2024, the new income tax return filing utilities (ITR forms) uploaded on the e-filing portal are incorrectly disallowing the rebate under section 87A for all types of incomes taxable at special rates under Schedule SI. The new ITR filing utilities are not allowing the rebate under section 87A for various special rate incomes, including short-term capital gains on equity shares or equity- oriented mutual funds taxable at 15% under Section 111A. Unfortunately, these updated ITR filing utilities are restricting this rebate without any corresponding amendments in section 87A or any of the respective special income sections of the Income Tax Act. Consequently, taxpayers with total incomes up to Rs 5/7 lakhs under the old / new regimes are forced to pay income tax on their special rate taxable incomes (excluding Section 112A), contrary to the legislative provisions of the Income Tax Act, due to a faulty return filing utility.”

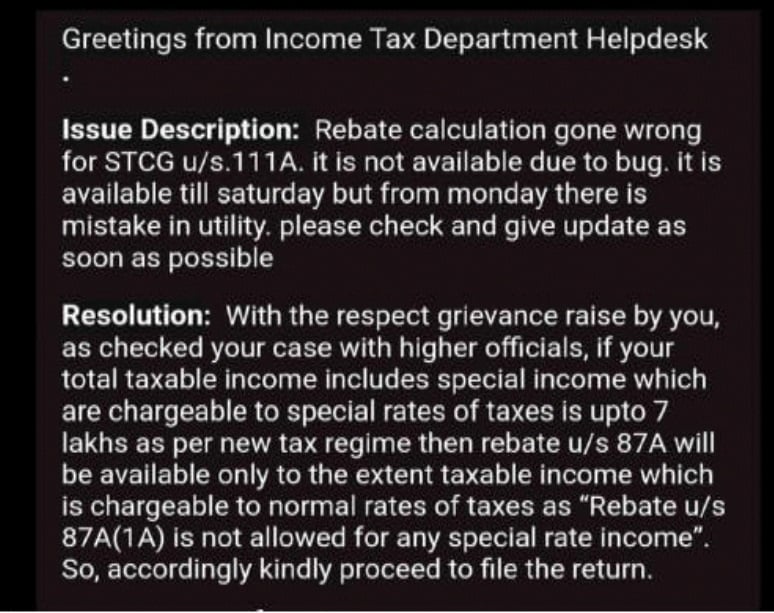

A Grievance redressal screenshot from the Income Tax Department’s helpdesk is being circulated on social media platforms. It states that “if your total taxable income includes special income chargeable to special rates of taxes up to 7 lakhs as per the new tax regime, then the rebate under Section 87A will be available only to the extent of taxable income chargeable to normal rates of tax, as rebate under Section 87A(1A) is not allowed for any special rate income. So kindly proceed to file the return.

It appears that the reference to subsection (1A) of Section 115BAC in the newly inserted proviso by the Finance Act 2023, pertaining to the new regime, has been misinterpreted as a new subsection (1A) in Section 87A, which does not exist.

Furthermore, the society requested that since the statutory deadline for return filing for non-auditable cases is fast approaching on July 31, 2024. It is imperative that these utilities are corrected immediately to avoid undue hardship to taxpayers and to ensure compliance with the Income Tax Act.

Link to read representation is given below:

In case of any Doubt regarding Membership you can mail us at contact@studycafe.in

Join Studycafe's WhatsApp Group or Telegram Channel for Latest Updates on Government Job, Sarkari Naukri, Private Jobs, Income Tax, GST, Companies Act, Judgements and CA, CS, ICWA, and MUCH MORE!"