Reetu | Mar 10, 2021 |

Functionality to Search HSN/SAC by Name or Code on GST Portal now available at GST Portal

Recently GSTN came with the new funcitionality to search HSN/SAC code for registered taxpayers dealing in product and services. This functionality is now available on GST Portal.

Now the question arises –

What are HSN Code?

HSN or HS (Harmonised Commodity Description and Coding System) is a multipurpose international product nomenclature developed by the World Customs Organization (WCO).

WCO has 181 members, three-quarters of which are developing countries that are responsible for managing more than 98 percent of world trade. HSN standardizes the classification of merchandise under sections, chapters, headings, and subheadings. This results in a six-digit code for a commodity (two digits each representing the chapter, heading, and subheading).

India, a member of WCO since 1971, has been using HSN codes since 1986 to classify commodities for Customs and Central Excise. Customs and Central Excise added two more digits to make the codes more precise, resulting in an eight-digit classification.

What are HSN codes in GST?

HSN (Harmonized System of Nomenclature) codes are used to classify the goods and is accepted across the world. HSN codes help in filling the GST returns, import and export of goods.

Under GST, the majority of dealers will need to adopt two-, four-, or eight-digit HSN codes for their commodities, depending on their turnover the year prior.

How do I find my HSN code in GST?

Steps to follow :

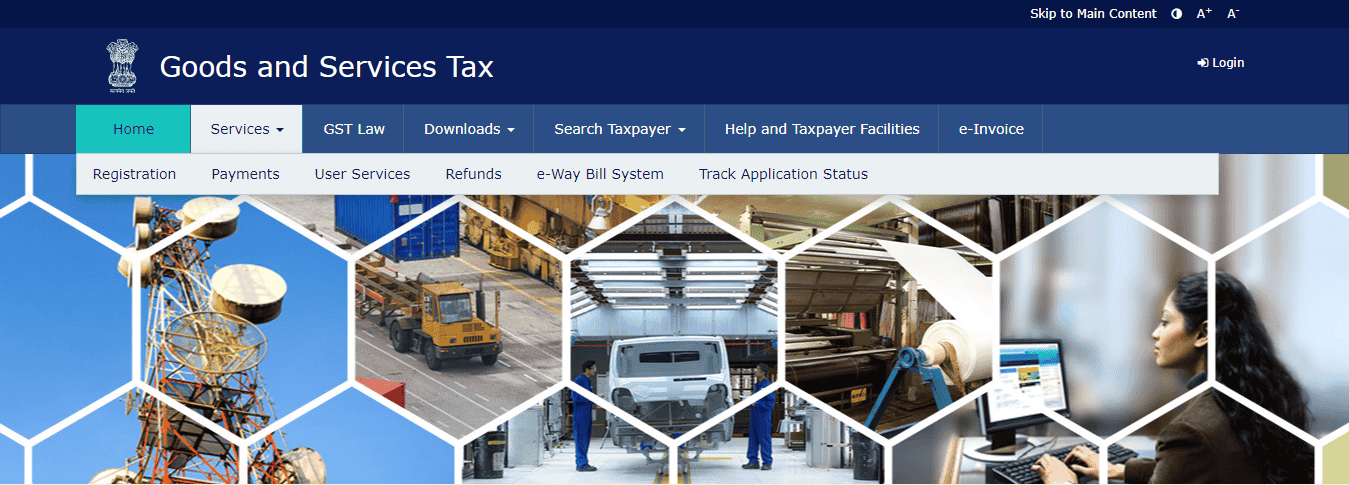

STEP 1

STEP 2

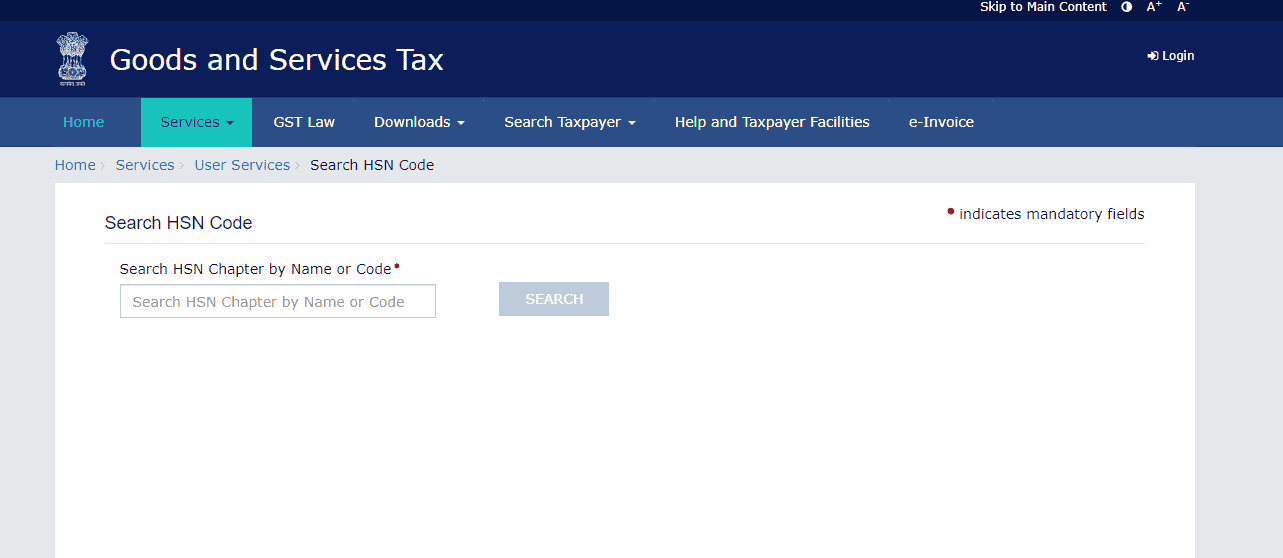

STEP 3

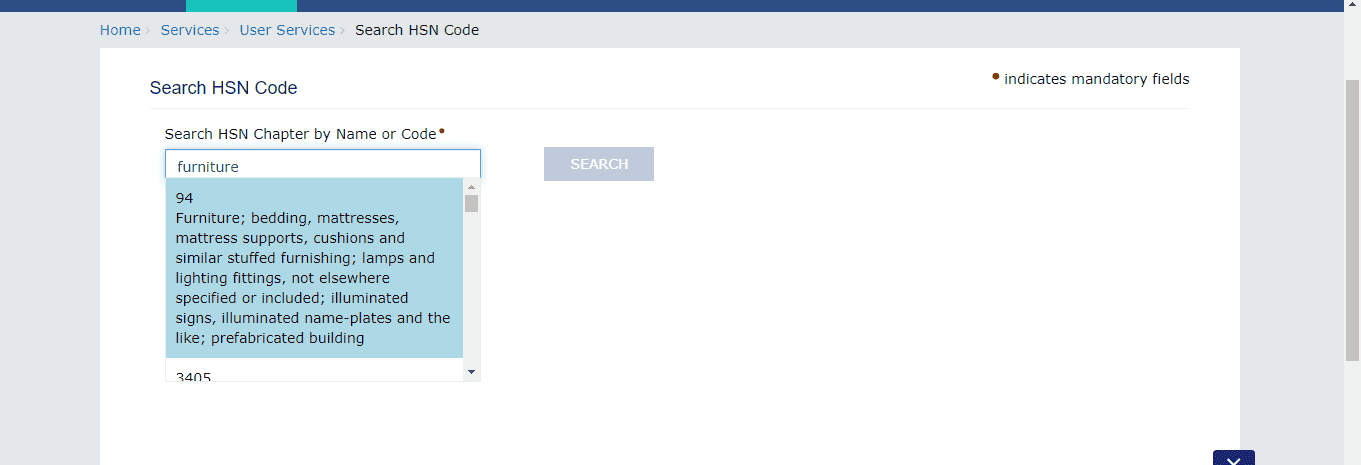

STEP 4

It will show you the HSN Code for relevant commodity/products or services.

In case of any Doubt regarding Membership you can mail us at [email protected]

Join Studycafe's WhatsApp Group or Telegram Channel for Latest Updates on Government Job, Sarkari Naukri, Private Jobs, Income Tax, GST, Companies Act, Judgements and CA, CS, ICWA, and MUCH MORE!"