Reetu | Mar 8, 2024 |

GOI extends RoDTEP to additional export sectors of SEZ, EOU and Advance Authorisation

The Directorate General of Foreign Trade (DGFT) under the Government of India has notified an extension of RoDTEP support to additional export sectors of SEZ, EOU and Advance Authorisation via issuing Notification.

In exercise of the powers conferred by Section 5 of the Foreign Trade (Development and Regulation) Act, 1992 read with Para 1.02 of the Foreign Trade Policy 2023, as amended from time to time, and taking into account the recommendations of the RoDTEP Committee Report, the Central Government hereby makes the following amendments in the Foreign Trade Policy, 2023.

Para 4.55: Ineligible supplies/items/categories under the Scheme-

The serial numbers (viii), (x), (xi) and (xii) of Para 4.55 of FTP 2023 are deleted with effect from 11.03.2024.

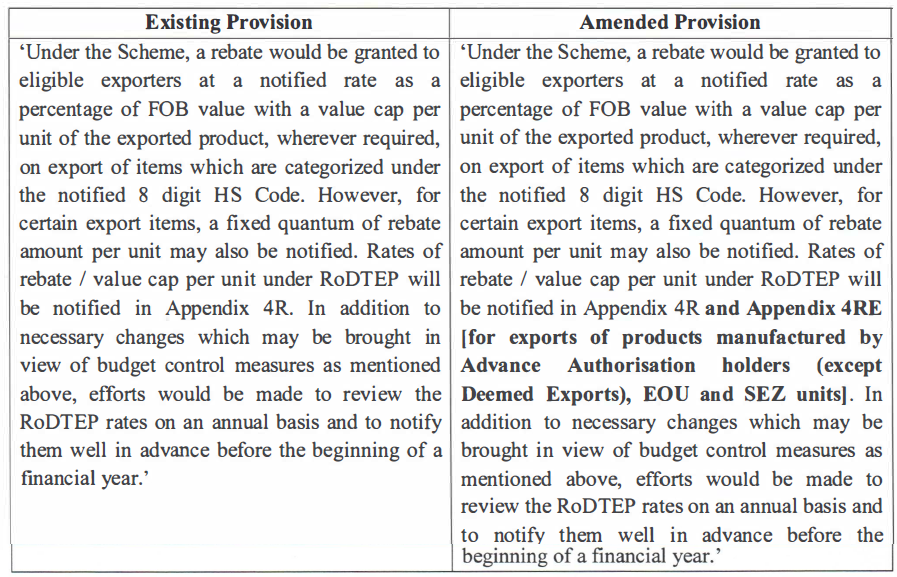

Serial number (vii) of Para 4.54 is amended to be read as follows:

A new Para 4.59A is added to be read as follows:

‘For exports of products manufactured by AA holders (except Deemed Exports), EOU and SEZ units, the eligible RoDTEP export items, rates and per unit value caps, wherever applicable, are contained in Appendix 4RE and is available at the DGFT portal (www.dgft.gov.in) under the link> Regulations> RoDTEP’.

(a) In line with serial number (x) of Para 4.54, the implementation date/period for exports under Appendix 4RE is being notified for exports of products manufactured by Advance Authorisation holders (except Deemed Exports) and Export Oriented Units (EOUs) from 11.03.2024 till 30.09.2024 only.

(b) The RoDTEP implementation for exports of products manufactured by SEZ units will happen once the IT integration of SEZ units with Customs Automated System (ICEGATE) takes place, which is expected to be operational from 01.04.2024. The implementation period for exports of products manufactured by Free Trade Warehousing Zone or SEZ units will be from the date of implementation till 30.09.2024 only.

(c) However, to adhere to the budgetary framework as provided under Para 4.54 of FTP 2023 so that the outgo remains within the approved Budget of the Scheme, necessary changes including revisions or deletions, wherever necessary, will be made in Appendix 4R & Appendix 4RE as and when required.

In order to carry out alignments in the RoDTEP schedule necessitating out of the recommendations of the RoDTEP Committee relating to AA holders (except Deemed Exports), EOU and SEZs, revised RoDTEP rates for 25 HS codes in Appendix 4R are being notified.

In supersession of Notification No. 33 /2023 dated 26th September 2023, the RoDTEP scheme is being extended beyond 30.06.2024 and shall be applicable till 30.09.2024 now.

The notified new Appendix 4RE and the revised rates for 25 export items (8-digit HS codes for Appendix 4R) are available at DGFT portal under the link > Regulations > RoDTEP’.

Effect of this Notification:

i. RoDTEP is being extended to AA holders (except Deemed Exports) & EOU units from 11.03.2024 till 30.09.2024 as per Appendix 4RE.

ii. Extension of RoDTEP to SEZ units as per Appendix 4RE will take place on IT integration of SEZs with Customs Automated System (ICEGATE).

iii. RoDTEP rate revisions in 25 HS Codes are also being made in Appendix 4R.

iv. RoDTEP Scheme extended earlier in September 2023 till 30.06.2024, is being further extended for exports till 30.09.2024.

For Official Notification Download PDF Given Below:

In case of any Doubt regarding Membership you can mail us at [email protected]

Join Studycafe's WhatsApp Group or Telegram Channel for Latest Updates on Government Job, Sarkari Naukri, Private Jobs, Income Tax, GST, Companies Act, Judgements and CA, CS, ICWA, and MUCH MORE!"