The deadline for specified TDS payments was October 7, 2024, and the Income Tax e-filing portal had been experiencing glitches since 11 AM in the morning.

Reetu | Oct 8, 2024 |

TDS Payment Delayed Due to Income Tax Portal Glitches leaves Taxpayers Frustrated

The deadline for specified TDS and TCS payments for the month of September 2024 was October 7, 2024, and the Income Tax e-filing portal was experiencing glitches since 11 AM in the morning, according to several tax professionals and chartered accountants.

Because of the technical glitches that arose on the Tax portal, many taxpayers were unable to pay the TDS/TCS on time. The portal was unable to process the payment of TDS in favour of taxpayers.

As per Karnataka State Chartered Accountants Association, “Due to a technical issue on the Income Tax e-filing portal, taxpayers are facing difficulties in paying Tax Deducted at Source (TDS) for the month of September, the due date for which is today i.e. 07-Oct-2024.”

Many taxpayers showed their frustration. They expressed and tweeted about this matter.

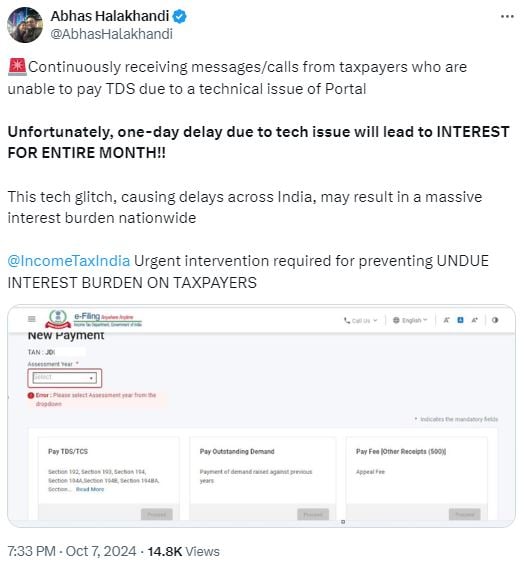

A person wrote, “🚨Continuously receiving messages/calls from taxpayers who are unable to pay TDS due to a technical issue of Portal. Unfortunately, a one-day delay due to a tech issue will lead to INTEREST FOR ENTIRE MONTH!! This tech glitch, causing delays across India, may result in a massive interest burden nationwide @IncomeTaxIndia. Urgent intervention required for preventing UNDUE INTEREST BURDEN ON TAXPAYERS.”

CA Akhil Pachori said, “Businesses want to pay timely TDS, but the non-effective portal will make them pay 1.5% extra due to no fault of the businesses #Incometaxportal”

CA Pratibha Goyal shared, “So many Taxpayers were not able to pay TDS yesterday due to the non-working of the portal. Just One Day Delay due to someone else fault and you end up with interest @ 1.5% pm. Is this justified?”

Taxology India shared his experience. It wrote, “The condition of the @IncomeTaxIndia website is horrible. It’s not even working. Great Job !! Today is the due date for Tax Audit filing & TDS/TCS Payment.”

If taxpayers fail to pay the same on time, they will levied with interest along with the payment of Tax.

Interest is payable in respect of any of the following defaults in case of TDS:

1. If the person responsible for deducting tax at source does not deduct tax at source wholly or partly under 192 to 196C.

1% per month or part – From the date on which tax was deductible to the date on which tax is actually deducted.

2. After deducting tax, he fails to pay the same as required by the Act.

1.5% per month or part – From the date on which tax was actually deducted to the date on which tax is actually paid.

Interest is payable in respect of any of the following defaults in case of TCS:

1. If the person fails to collect TCS: 1% per month or part – From the date on which tax was required to be collected to the date on which tax is actually collected.

2. After collection tax, the taxpayer fails to pay the same as required by the Act.

1% per month or part – From the date on which tax was actually collected to the date on which tax is actually paid. [Applicable up to March 31st, 2025]

Update by Finance Act 2024: With effect from 1st April 2025, interest @ 1.5% is applicable, if after collection tax, the Taxpayer fails to pay the same as required by the Act.

In case of any Doubt regarding Membership you can mail us at [email protected]

Join Studycafe's WhatsApp Group or Telegram Channel for Latest Updates on Government Job, Sarkari Naukri, Private Jobs, Income Tax, GST, Companies Act, Judgements and CA, CS, ICWA, and MUCH MORE!"