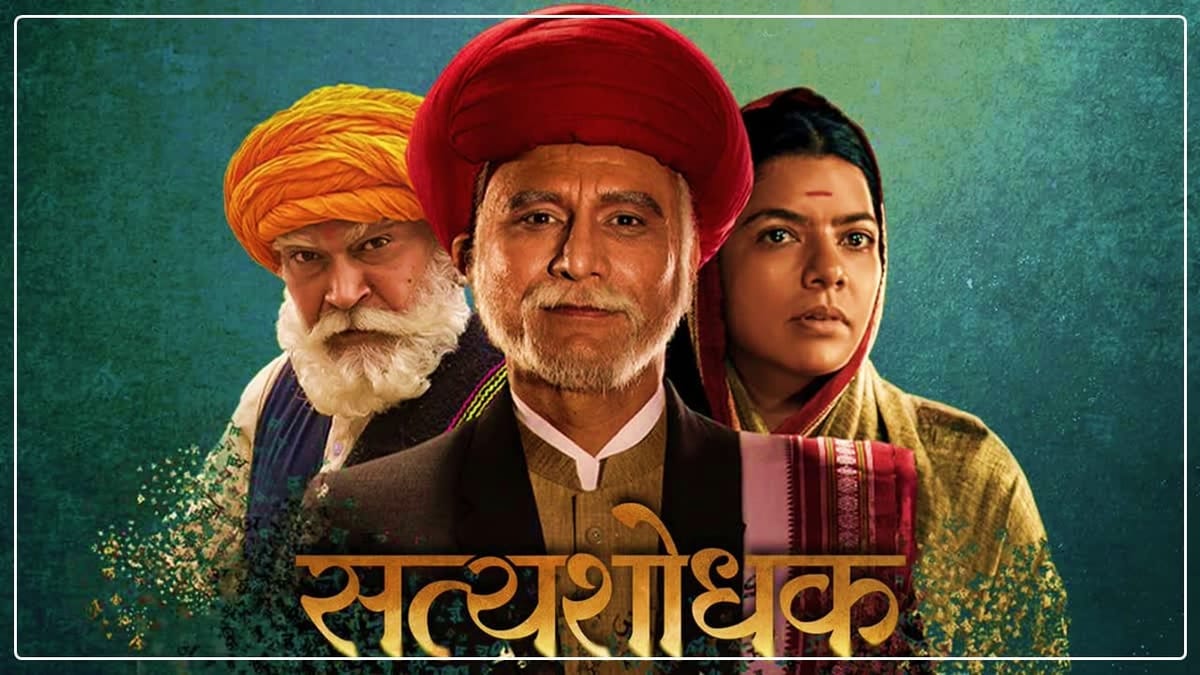

The Maharashtra GST Dept has issued a procedure for submission and processing of refund applications relating to reimbursement of the SGST component to the registered theatre with respect to the Satyashodhak movie via issuing Circular.

Reetu | Feb 3, 2024 |

GST Department of Maharashtra issued Guidelines for Reimbursement of SGST applicable on Tickets of Satyashodhak Movie

The Maharashtra GST Department has issued a procedure for the submission and processing of refund applications relating to reimbursement of the SGST component to the registered theatre with respect to the Satyashodhak movie via issuing Circular.

The Circular Read as follows:

The government of Maharashtra has issued Government Resolutions (GR) regarding reimbursement, to the registered theatres, of the component of State Goods and Services Tax (SGST), prominently indicated in the ticket which was issued for the supply of service by way of admission to the exhibition of movies “Super 30”, “Mission Mangal”, “Panipat” and “Tanhaji: The Unsung Warrior” for the specified periods. Accordingly, Trade Circulars 43T of 2019 dated 7th August 2019, 48T of 2019 dated 13th Sept 2019 and Master Trade Circular No. IT of 2020 dated 6th February 2020 was issued in this regard.

The Government of Maharashtra has now issued GR regarding reimbursement of SGST in the case of the movie “Satyashodhak”. On an examination of the same, it is felt that the procedure prescribed through Master Trade Circular needs some modification. Hence, in the exercise of powers conferred by section 168 of the Maharashtra Goods and Services Tax Act, 2017 (hereinafter referred to as the MGST Act), hereby lays down the procedure for submission and processing of refund applications in supersession of earlier Trade Circular No. 1 T of 2020.

It is made clear that this is a revised master circular which shall be applicable to all such GRs, if any, whenever they are issued by the Government of Maharashtra. Needless to say, the timelines given in the individual GRs be followed but broad instructions given in the master circular be applicable to all such cases without any further instructions from this office. The GRs as and when issued by the Government of Maharashtra will be put on the official website of the Government of Maharashtra and the Department of Goods and Services Tax.

Registered theatre after indicating CGST and SGST in the price of the ticket shall reduce the ticket price by an amount equal to SGST in order to pass on the benefit to the consumer.

“Registered theatre” means theatre registered under the MOST Act. Registered theatre shall prominently indicate the component of SGST, CGST and the amount of discount on account of reimbursement to be claimed from the Government of Maharashtra in the ticket price of the movie.

Example-

Suppose the basic ticket price is Rs.200. SGST applicable is Rs.18 and CGST applicable is Rs.18. Total price comes to Rs 236. Here, the Government is going to reimburse the amount equal to SGST payable which is Rs.18. The theatre shall reduce this amount of SGST to be reimbursed by the State Government at Rs.18 from Rs.236 and collect the balance amount of Rs.218 from the consumer. The theatre shall prominently indicate this reimbursement amount of Rs.18 which is equal to SGST in the ticket.

The registered theatre shall pay the tax, SGST as well as CGST, in a regular manner. If the registered theatre has recovered the full amount from the consumer without reducing the amount equal to SGST, then no refund of such amount will be granted to the theatre. In order to claim a refund of SGST paid, the registered theatre is required to pass on the benefit of this scheme to the consumer.

Registered theatres which are going to benefit from this scheme shall prominently display in their theatre premises a board to the effect that the Government of Maharashtra is going to reimburse the component of SGST to the registered theatre and the cost of the ticket is reduced accordingly. Jurisdictional officers may visit the theatre to verify whether the theatre is passing on this benefit to consumers or not.

After filing the return under section 39 of the MGST Act, the registered theatre shall make an application to the State jurisdictional officer for reimbursement of the SGST component which he has paid in the return period in Annexure-1 within thirty days from the filing of the return and payment of tax for the said period. If the registered theatre is under the jurisdiction of the Central authority, then he will apply to the concerned divisional Joint Commissioner of State Tax or to the locational administrative head of the office.

Registered theatre shall produce the books of accounts for the verification before jurisdictional officer for ascertaining refund claims as and when required. Apart from the verification of books of accounts, the jurisdictional officer will also verify whether the registered theatre has fulfilled all the conditions prescribed in the Government Resolution. After due verification, the refund will be disbursed to the registered theatre. The refund shall be disbursed within 30 days from the date of the application.

For Official Circular Download PDF Given Below:

In case of any Doubt regarding Membership you can mail us at [email protected]

Join Studycafe's WhatsApp Group or Telegram Channel for Latest Updates on Government Job, Sarkari Naukri, Private Jobs, Income Tax, GST, Companies Act, Judgements and CA, CS, ICWA, and MUCH MORE!"