Reetu | Jun 3, 2023 |

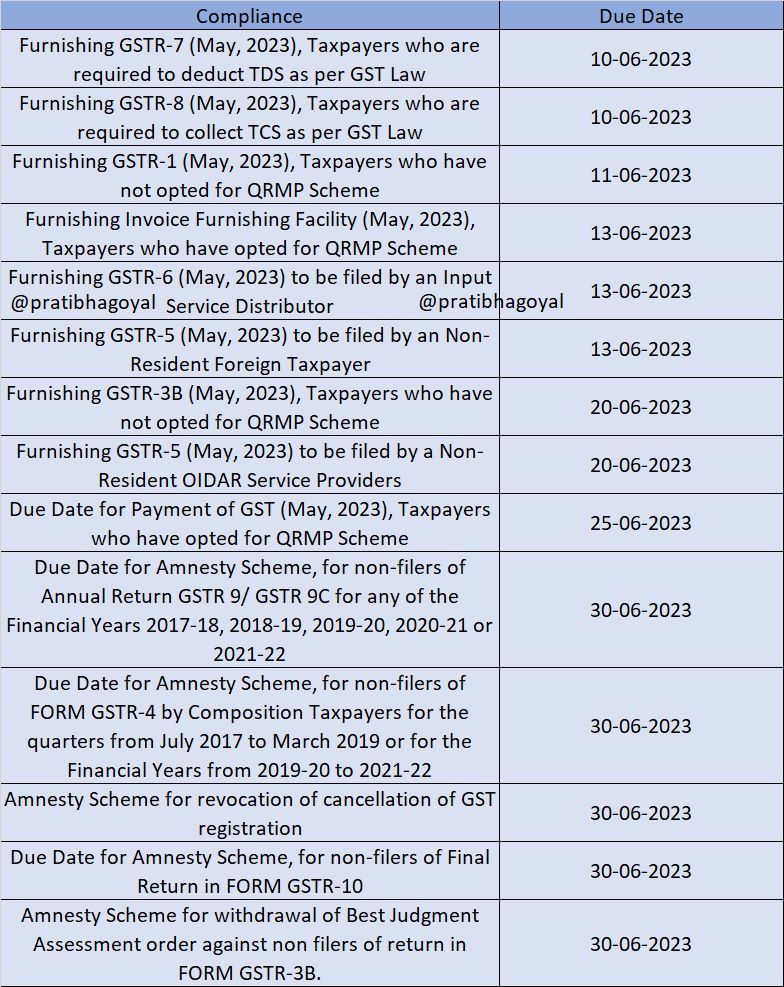

GST Due Date Compliance Calendar for June 2023

Compliance Calendar for May 2023 explains Compliance requirement under GST 2017 for the Month of June 2023.

Furnishing GSTR-7 (May, 2023), Taxpayers who are required to deduct TDS as per GST Law.

Furnishing GSTR-8 (May, 2023), Taxpayers who are required to collect TCS as per GST Law.

Furnishing GSTR-1 (May, 2023), Taxpayers who have not opted for QRMP Scheme.

Furnishing Invoice Furnishing Facility (May, 2023), Taxpayers who have opted for QRMP Scheme.

Furnishing GSTR-6 (May, 2023) to be filed by an Input Service Distributor.

Furnishing GSTR-5 (May, 2023) to be filed by an Non-Resident Foreign Taxpayer.

Furnishing GSTR-3B (May, 2023), Taxpayers who have not opted for QRMP Scheme.

Furnishing GSTR-5 (May, 2023) to be filed by a Non-Resident OIDAR Service Providers.

Due Date for Payment of GST (May, 2023), Taxpayers who have opted for QRMP Scheme.

Due Date for Amnesty Scheme, for non-filers of Annual Return GSTR 9/ GSTR 9C for any of the Financial Years 2017-18, 2018-19, 2019-20, 2020-21 or 2021-22.

Due Date for Amnesty Scheme, for non-filers of FORM GSTR-4 by Composition Taxpayers for the quarters from July 2017 to March 2019 or for the Financial Years from 2019-20 to 2021-22.

Amnesty Scheme for revocation of cancellation of GST registration.

Due Date for Amnesty Scheme, for non-filers of Final Return in FORM GSTR-10.

Amnesty Scheme for withdrawal of Best Judgment Assessment order against non filers of return in FORM GSTR-3B.

In case of any Doubt regarding Membership you can mail us at [email protected]

Join Studycafe's WhatsApp Group or Telegram Channel for Latest Updates on Government Job, Sarkari Naukri, Private Jobs, Income Tax, GST, Companies Act, Judgements and CA, CS, ICWA, and MUCH MORE!"