Studycafe | Dec 23, 2019 |

GST E-invoicing : How will E-invoicing System Work

Background

E-Invoicing has been proposed by Central Government, so as to promote a standard process in GST eco system. For this the GST Council has approved the standard of e-invoice in its 37th meeting held on 20th sept 2019 and the same along with schema (utility) has been published on GST portal

In connection to above, few points explaining, the concept of e invoicing system are given below:

1. Data published by the GSTN (The documents published by GSTN in this regard can be accessed at https://www.gstn.org/e-invoice/invoice/); and

2. Number of notifications issued on 13 Dec 2019 by the Central Board of Indirect taxes and Customs (‘ CBIC’) for giving effect of such recommendations can accessed at http://www.cbic.gov.in/htdocs-cbec/gst/central-tax-notfns-2017

Notifications issued on E-Invoicing till now are given below:

| Notifications | Subject |

| 72/2019-Central Tax ,dt. 13-12-2019 | Seeks to notify the class of registered person required to issue invoice having QR Code. |

| 71/2019-Central Tax ,dt. 13-12-2019 | Seeks to give effect to the provisions of rule 46 of the CGST Rules, 2017. |

| 70/2019-Central Tax ,dt. 13-12-2019 | Seeks to notify the class of registered person required to issue e-invoice. |

| 69/2019-Central Tax ,dt. 13-12-2019 | Seeks to notify the common portal for the purpose of e-invoice. |

| 68/2019-Central Tax ,dt. 13-12-2019 | Seeks to carry out changes in the CGST Rules, 2017. |

Lets go through below mentioned article, so as to know that How will E-invoicing System Work.

What is E invoicing

1. It is a misconception that ‘E invoicing’ or ‘electronic invoicing’ means generation of invoice on an electronic portal run by the Government. In fact e invoicing is a system in which B2B invoices issued by suppliers are uploaded on an e-portal notified by the Government and authenticated electronically by such e portal for further use in various compliances such as preparation of GST returns, e way bills etc. on the GST system.

2. Once uploaded by the supplier the notified e portal [Invoice Registration Portal (‘IRP’) to be managed by the GST Network] will generate an identification number [Invoice Reference Number (‘IRP’)] against every invoice.

3. Once the system becomes operational there is no need for manual data entry while filing the new GST returns. Further part A of the e way bill will also be generated automatically once, the e invoice is uploaded on the GST portal.

4. The suppliers will continue to generate invoice using their regular software system. However, details of the invoice will al so be uploaded on the e-invoice portal.

5. Further, the e invoicing process is required to be followed not only in case of invoices, but also in other relevant documents under GST Law such as credit note, debit note etc.

Digital Signing by e-Invoice Registration Portal:

The invoice data will be uploaded on the IRP, which will generate IRN. The GSTN will verify IRN so as to ensure that it is unique and then will digitally sign it with the private key of the IRP. The taxpayer as an alternative can generate IRN independently before pushing data to IRP. The GSTN will be required to validate even such IRN. The IRP will sign the e-invoice with IRN and such e-invoice digitally signed by the IRP will be a valid e-invoice which can be used by GST/E-Way bill system.

QR Code:

The IRP will also generate a QR code containing the unique IRN (‘hash’) along with some important parameters of invoice and digital signature so that it can be verified on the central portal as well as by an Offline App. This will be helpful for tax officers checking the invoice on the roadside where Internet may not be available all the time. The web user will get a printable form with all details including QR code.

The QR code will consist of the following e-invoice parameters:

a) GSTIN of supplier & Recipient

b) Invoice number as given by Supplier

c) Date of generation of invoice

d) Invoice value (taxable value and gross tax)

e) Number of line items

f) HSN Code of main item (the line item having highest taxable value)

g) Unique Invoice Reference Number (hash)

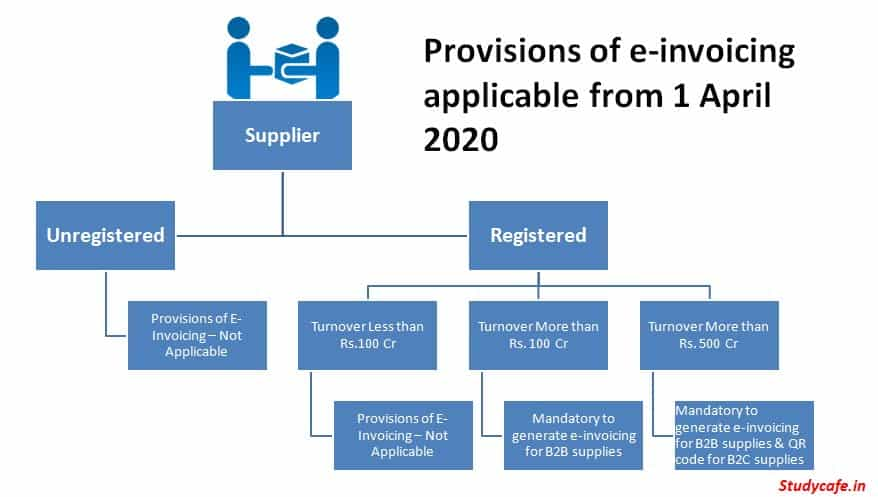

Provisions of e-invoicing applicable from 1 April 2020

GST E-invoicing : How will E-invoicing System Work

Supply(ies) to Registered person (B2B supplies):

1. A registered person whose aggregate turnover in a financial year exceeds INR 100 Crs, will be required to prepare an ‘e-invoice’ in terms of Rule 48 (4) of CGST Rules, 2017 where Form GST INV- 01 containing various particulars is required to be uploaded on specified GST portal to generate IRN.

2. A list of 10 websites is notified as Common Goods and Services Tax Electronic Portal for the generation of the IRN.

3. Invoices not issued as above shall be treated as invalid under GST.

Supply(ies) to Unregistered person (B2C supplies):

1. Further, invoice issued to an unregistered person i.e. B2C by a registered person whose aggregate turnover in a financial year exceeds INR 500 Crs, is required to contain QR Code to be generated.

2. Where such registered person is paid via the application of a Dynamic QR Code made available to the recipient through a digital display, such invoice containing cross reference of the payment via the Dynamic QR code shall be deemed to meet the criteria.

Modes of generation of e-invoicing

• Web based

• API based

• SMS based

• Offline tool based

• GSP based

GST E-invoicing : How will E-invoicing System Work

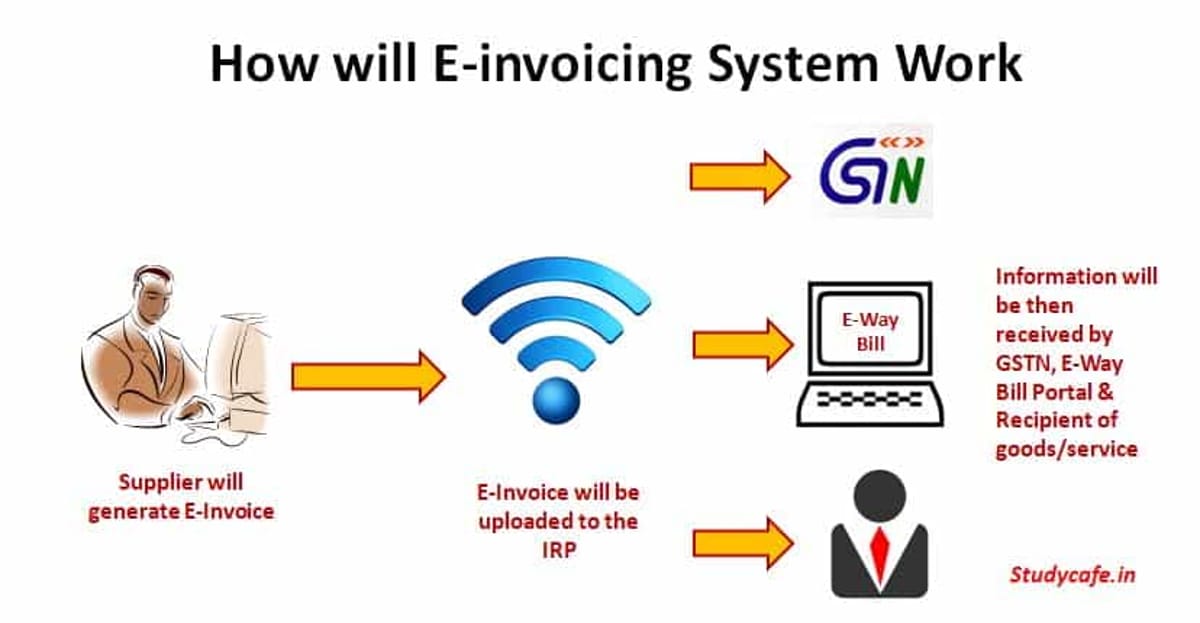

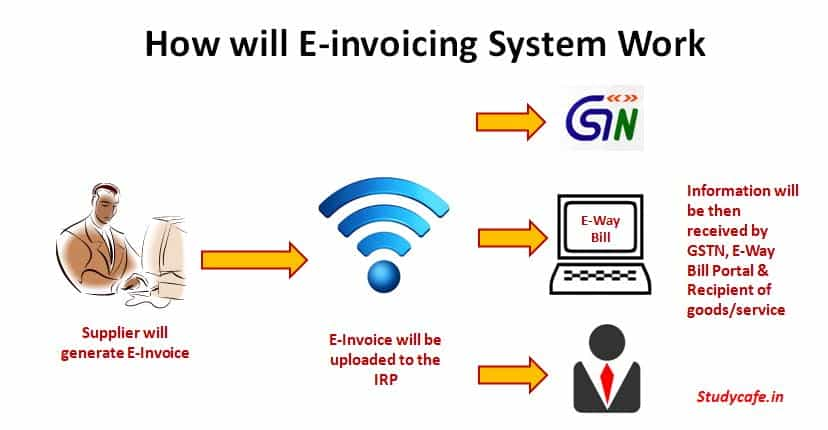

Process flow under e-invoicing system or How will E-invoicing System Work in GST

1 | • Generation of the invoice by the seller in his own accounting or billing system • The invoice must conform to the e-invoice schema (standards) that is published and have the mandatory parameters • The supplier’s software should be capable to generate a JSON of the final invoice that is ready to be uploaded to the IRP as IRP will only take JSON of the e-invoice • The supplier’s upload the JSON of the e-invoice (along with the hash, if generated) into the IRP by the seller. The JSON may be uploaded directly on the IRP or through GSPs or through third party provided Apps |

2 | • IRP will generate the IRN, actually this is an optional step. The seller can also generate this and upload along with invoice data. The 3 parameters which will be used to generate IRN (hash) are: i. Supplier GSTIN, ii. Supplier’s invoice number and, iii. Financial year (YYYY-YY). (The IRN or hash generation algorithm will be prescribed by GSTN in the e-invoice standard) • upload the JSON of the e-invoice (along with the hash, if generated) into the IRP by the seller • The JSON may be uploaded directly on the IRP or through GSPs or through third party provided Apps • The IRP will also generate the hash and validate the hash of the uploaded json, if uploaded by the supplier. The IRP will check the hash from the Central Registry of GST System to ensure that the same invoice from the same supplier pertaining to same Fin Year is not being uploaded again • On receipt of confirmation from Central Registry, IRP will add its signature on the Invoice Data as well as a QR code to the JSON • The QR code will contain GSTIN of seller and buyer, Invoice number, invoice date, number of line items, HSN of major commodity contained in the invoice as per value, hash etc. • The hash computed by IRP will become the IRN (Invoice Reference Number) of the e-invoice. This shall be unique to each invoice and hence be the unique identity for each invoice for the entire financial year in the entire GST System for a taxpayer. • GST Systems will create a central registry where hash sent by all IRPs will be kept to ensure uniqueness of the same • The registered invoice will also be sent to the seller and buyer on their mail ids as provided in the invoice |

3 | • Share the signed e-invoice data along with IRN (same as that has been returned by the IRP to the seller) to the GST System as well as to E-Way Bill System • The GST System will update the ANX-1 of the seller and ANX-2 of the buyer, which in turn will determine liability and ITC • E-Way bill system will create Part-A of e-way bill using this data to which only vehicle number will have to be attached in Part- B of the e-way bill |

Benefit of e-invoice under GST

1. The Invoice Reference Number (IRN) is unique for each document i.e. invoice, credit note, etc. which inherently will ensure intended correlation of documents such as invoice, e-way bill and then the ITC availed by the recipient.

2. Only one time reporting of B2B invoice data which effectively will reduce duplication in reporting (one for GSTR – 1 and other for e-way bill, etc.).

3. It will automatically generate outward and inward supply register (ANX – 1 and ANX – 2) and will provide ease in filing returns in new return system i.e. RET – 1, etc.

4. It will become part of the business process of the taxpayer.

5. Substantial reduction in input credit verification issues as same data will get reported to tax department as well as to buyer in his inward supply (purchase) register.

6. It will help the recipient to do reconciliation of ITC register, purchase register and then take appropriate action to accept/reject the invoice within time.

7. The tax authorities can expect reduction of tax evasion by having complete trail of B2B invoices and will drastically reduce cases of fake invoices.

Click Here to Buy CA Final Pendrive Classes at Discounted Rate

For Regular Updates Join : https://t.me/Studycafe

In case of any Doubt regarding Membership you can mail us at contact@studycafe.in

Join Studycafe's WhatsApp Group or Telegram Channel for Latest Updates on Government Job, Sarkari Naukri, Private Jobs, Income Tax, GST, Companies Act, Judgements and CA, CS, ICWA, and MUCH MORE!"