The GST formations and State/ UT Governments across the country are conducting a focused drive on the issue of non-existent/bogus registrations and the issuance of fake invoices.

Reetu | Jan 8, 2024 |

GST Evasion of Rs. 44,015 crore by 29,273 bogus firms detected by GST Officials

The GST formations under the Central Board of Indirect Taxes and Customs (CBIC) and the State/ UT Governments across the country are conducting a focused drive on the issue of non-existent/ bogus registrations and the issuance of fake invoices without any underlying supply of goods and services, this drive is initiated to combat fraud and increase compliance in the Goods and Services Tax (GST).

Since the special drive against fake registrations began in mid-May 2023, a total of 29,273 fictitious entities implicated in suspected ITC evasion totalling Rs.44,015 crore had been identified. This has saved Rs.4,646 crore, of which Rs.3,802 crore is due to ITC blocking and Rs.844 crore is due to recovery. So far, 121 people have been arrested in connection with the cases.

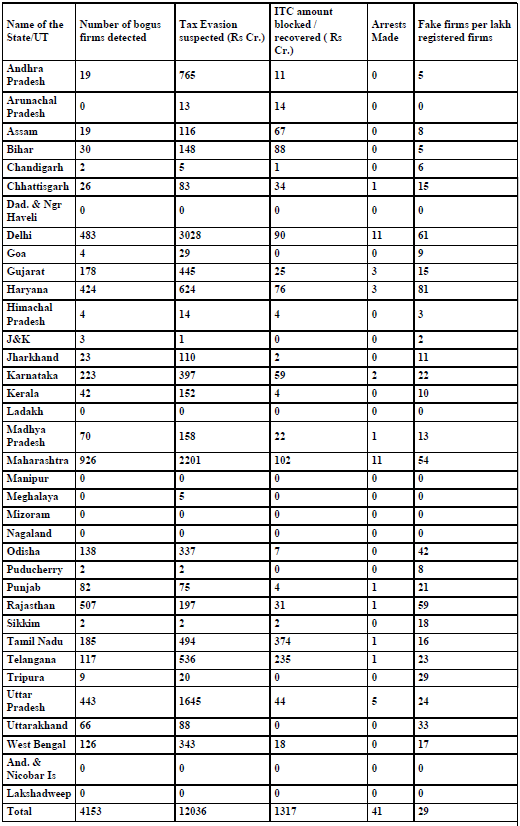

In the quarter ended December 2023, 4,153 fraudulent entities were discovered, involving potential ITC evasion of roughly Rs.12,036 crore. The Central GST Authorities discovered 2,358 of these fake organisations. This has safeguarded Rs.1,317 crore in revenue, of which Rs.319 crore has been realised and Rs.997 crore has been safeguarded by blocking ITC. In these cases, 41 people were arrested. Central GST authorities were responsible for 31 of these arrests. State-specific information is included.

The government has taken a number of steps to improve the GST registration procedure. Pilot projects for biometric Aadhar authentication during registration have been initiated in Gujarat, Puducherry, and Andhra Pradesh.

Furthermore, the government has attempted to reduce tax evasion through measures such as sequential filing of GST returns, system generated intimation for reconciliation of the gap in tax liability in GSTR-1 and GSTR-3B returns, as well as the gap between ITC available under GSTR-2B and ITC availed under GSTR-3B returns, use of data analytics and risk parameters for detection of fake ITC, and so on.

Action against bogus firms during Quarter ending in December 2023

In case of any Doubt regarding Membership you can mail us at [email protected]

Join Studycafe's WhatsApp Group or Telegram Channel for Latest Updates on Government Job, Sarkari Naukri, Private Jobs, Income Tax, GST, Companies Act, Judgements and CA, CS, ICWA, and MUCH MORE!"