Reetu | May 16, 2022 |

GST Input Tax Credit | Rules To Claim ITC on Capital Goods

Capital Goods are common occurrences in the manufacturing businesses as well as service based businesses.

The costs of these capital goods are high and so are the GST amounts paid on the purchases. Hence, it is important to know whether the businesses can claim Input credit on these purchases. And if yes, then what are the rules pertaining to it?

In this short article we discuss the Input Tax Credit rules that apply for claiming credit on the Capital Goods. We also understand what does ‘Capital Goods’ actually mean under GST.

Section 2, sub-section 19 of the CGST Act of 2017 defines the term ‘Capital Goods’ as the goods whose values are CAPITALIZED in the Purchase Records or Books of Accounts.

However, it’s essential that these goods are used for the further business purposes only.

Examples of Capital Goods are – Vehicles used for business purpose, heavy machineries, heavy products, etc.

Businesses are eligible to claim GST Input Tax Credit for the GST paid on the purchases of Capital Goods.

TO NOTE:

Goods that are NOT capitalized or NOT Debited to the respective asset account are not eligible to avail any ITC under GST on these goods.

Services are not considered under the ‘Capital Goods’ category.

Example of Capital Goods

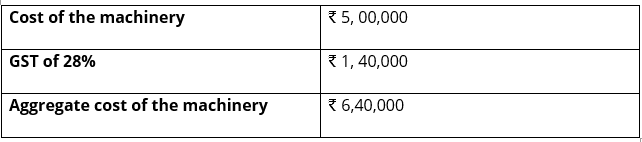

A firm buys a ‘Heavy machinery setup’ for the purpose manufacturing process.

This capital good will be used for the business processes.

Following is the breakup of the GST amount paid on this purchase:

If this firm capitalizes the taxable value of this ‘Machinery’ in their balance sheet, then this ‘Machinery setup’ will be considered as a ‘Capital Goods’.

And this Capital good will be eligible to claim Input Tax Credit under GST.

If this firm wishes to add this purchase details to the Profit & Loss Account, then this good shall NOT be considered as ‘Capital Goods’. This machinery will then be considered as an ‘Input good’ and ITC claim shall not be allowed on the same.

Can software be considered as capital goods?

No. software cannot be considered as capital goods.

Hence, businesses cannot claim Input Tax Credit on the purchases of software.

As per Schedule 2 of the CGST Act of 2017, it is clear that the software that businesses use is classified under ‘INPUT SERVICES’.

Let us understand the process of claiming ITC on purchases of the capital goods.

For example a firm ‘Vision associates’ buys 60 desktop machines for its office.

This purchase costs ₹ 8, 00,000 and the purchase was done in December 2021.

Total GST paid (28%) = ₹ 2, 24,000

Total taxable value of this purchase = ₹ 8, 00,000

Business adds this transaction in its books of accounts & capitalizes it.

From the GST perspective, the Desktop machines will now be considered as Capital goods. Hence, they will also be eligible for ITC claims.

Now, the businesses are in confusion whether they can claim this ITC for this purchase in the current month or should the credit be claimed in proportion?

Solution:

Vision Associates can claim Input Credit on this purchase in the current month itself.

However, the business has to satisfy certain conditions prior to claiming ITC:

1. The business CANNOT sell these capital goods.

2. The business CANNOT Remove or discard these goods for 5years (20 quarters) from the date of issuance of the invoice.

However, if a business wishes to sell these goods within the period of 5 years it can do so by following the method given below:

What if the business wishes to sell the desktop machines before 5 years?

According to the Section 18 (6) of the CGST Act of 2017 defines TWO different ways to sell the goods before the end of FIVE years period.

Method 1:

For example this business has decided to sell their desktops after TWO years of usage:

Amount received on selling 60 machines = ₹ 5, 00,000

GST Collected (28%) = ₹ 1, 40,000

The GST amount collected on this sale shall be completely payable to the government as the outward tax liability.

GST paid to the government on this transaction = ₹ 1, 40,000

Method 2:

Let’s assume that the firm uses these machines for complete period of FIVE years and then decides to sell them.

In this case, the 100% ITC can be availed by the business on this transaction.

However, if the business sells before end of 20 quarters then how is the calculation done?

Example- Business uses the machines for just 10 quarters & then decide to sell.

The calculation then changes as follows:

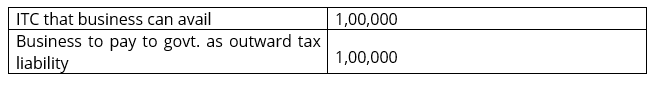

From the above section it is evident that if 100% ITC is allowed for 20 quarters, then 5% ITC will be allowed for each quarter (for the sake of calculation).

Business has used the capital goods for 10 quarters.

Here, ITC allowed = 10 * 5% = 50%

The remaining 50% of the ITC amount shall be payable to the government as an outward tax liability.

The total ITC availed on the PURCHASE of these 60 machines was, say ₹ 2, 00,000

Total amount payable to the Govt. as an outward tax liability is

2,00,000 * 50% = ₹ 1,00,000

To summarise,

From all these examples, you must have got an idea that the ITC reconciliation is NOT an easy task. It is a tedious task and can be very complicated for large businesses.

Hence businesses must use automated ITC reconciliation software that use reconciles your ITC data by comparing your Purchase records and GSTR 2B to give you a flawless reconciliation report.

Following are some of the benefits of GSTR 2B Reconciliation software :

Hence, businesses must prefer automated reconciliation over the manual reconciliations as they are faster and accurate.

In this short article, we introduced our readers on the process and methods of claiming ITC on the Capital Goods.

From simple examples we understood that, claiming of ITC on various goods can be tedious and involves multiple GST compliance requirements.

When businesses opt for automated GSTR 2B reconciliation software like GSTHero, they are resting their compliance burden on the service provider. Accurate reconciliation is the only way to claim 100% eligible ITC under GST.

In case of any Doubt regarding Membership you can mail us at [email protected]

Join Studycafe's WhatsApp Group or Telegram Channel for Latest Updates on Government Job, Sarkari Naukri, Private Jobs, Income Tax, GST, Companies Act, Judgements and CA, CS, ICWA, and MUCH MORE!"