CA Pratibha Goyal | Feb 25, 2021 |

GST PMT-06 Challan for making payment under QRMP Scheme

GST PMT- Challan has gained wide importance these days, especially after the introduction of the QRMP Scheme. Through this article let us understand all about the Form.

What is GST PMT-06?

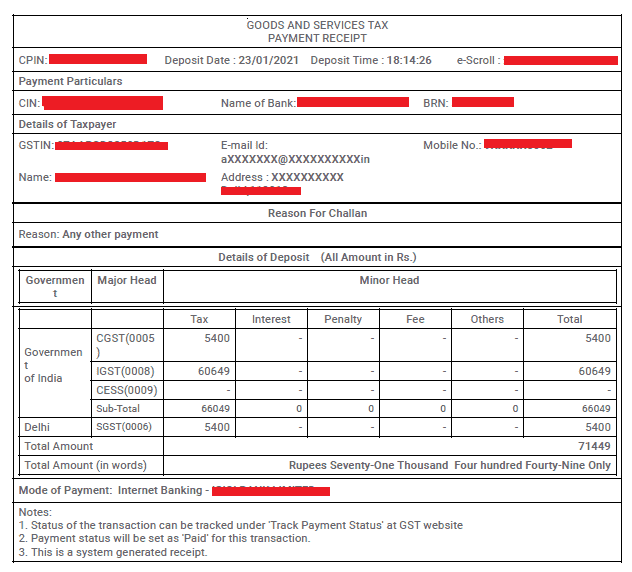

A taxpayer who wants to deposit tax, interest, penalty, fees or any other amount shall generate a challan in FORM GST PMT-06 on the common portal and enter the details of the amount to be deposited by him.

This is not a new concept. This is the same old challan we have been using to pay tax while filing GSTR-3B. Only the FORM GST PMT-06 has come into more notice amid QRMP Scheme.

How to Access the GST PMT-06 Challan?

What has changed in GST PMT-06 due to QRMP Scheme?

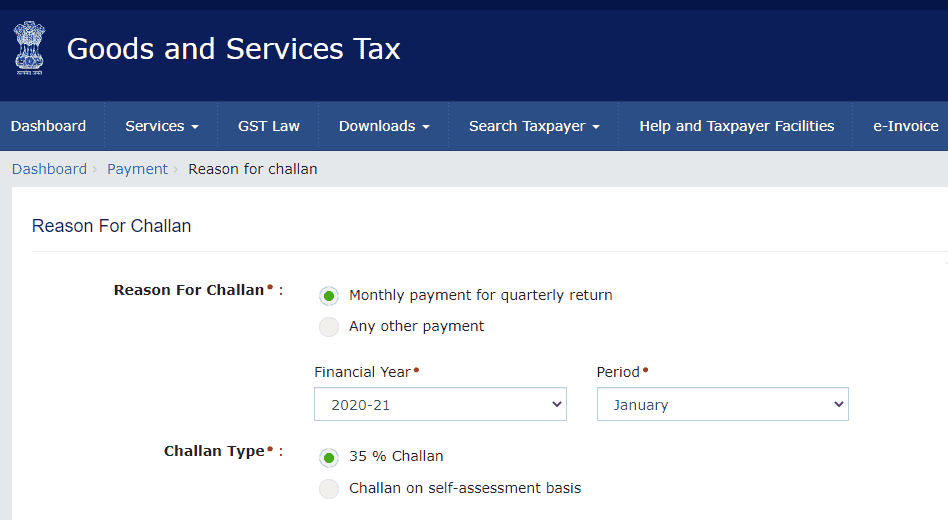

As such, there is no change in the particulars of the Challan Form. But yes, while generating the Challan Form we need to follow a specific process. The same is given below for reference:

While generating the Challan Taxpayer needs to provide the Specific Reason for making the payment. The Reson can be:

Monthly Payment for Quarterly Return will further be followed by:

Which reason should be selected by the Taxpayer while making payment through Challan GST PMT-06?

Option 1: Monthly Payment for Quarterly Return

This option will be selected by the taxpayer filing GSTR-3B on quarterly basis and intending to make payment for the first and second months of the quarter.

Please note that in the third month, the payment of Tax Liability will be Automatically routed to GST-PMT-06 Challan though Form-GSTR-3B. So Taxpayer is not required to select a specific option in 3rd Month. But if the taxpayer is generating challan manually in 3rd month, he has to choose Any other payment Option.

Option 2: Any other payment

A taxpayer who is not Filing returns under QRMP Scheme shall choose Any other payment option for making Tax Payment.

The following has been discussed in Brief:

| Taxpayer | Challan Option | ||

| M1 | M2 | M3 | |

| QRMP Opted | Monthly Payment for Quarterly Return | Monthly Payment for Quarterly Return | Any other payment |

| QRMP Not Opted | Any other payment | Any other payment | Any other payment |

What are the Due Dates for making Payment of GST Output Liability?

| Taxpayer | M1 | M2 | M3 |

| QRMP Opted | 25th of next Month | 25th of next Month | 22nd/or 24th as per your Place of Bussiness |

| QRMP Not Opted | 20th of next Month | 20th of next Month | 20th of next Month |

How to Calculate Outstanding Tax Liability for Taxpayers under QRMP Scheme and otherwise?

| Taxpayer | M1 | M2 | M3 | ||

| QRMP Opted | 35% Payment Option | If RP was a Quarterly Filler | 35% of Tax paid in cash in Previous Quarter | 35% of Tax paid in cash in Previous Quarter | Actual Liability via GSTR-3B |

| If RP was a Monthly Filler | 100% of Tax paid in cash in Previous month | 100% of Tax paid in cash in Previous month | Actual Liability via GSTR-3B | ||

| Self Assessment | Self Assessed Tax | Self Assessed Tax | Actual Liability via GSTR-3B | ||

| QRMP Not Opted | Actual Liability via GSTR-3B | Actual Liability via GSTR-3B | Actual Liability via GSTR-3B | ||

The Tax liability will be reduced by the amount present in the Cash and credit ledger of the taxpayer.

Please note the below-mentioned Scenario for Better understanding:

| Senarios | Taxpayer | Tax Liability to be discharged by GST PMT-09 | ||

| M1 | M2 | |||

| 1 | Nil Liability | 35% Payment Option | NA | NA |

| Self Assessment | NA | NA | ||

| 2 | Adequate Cash/ Credit Balance | 35% Payment Option | NA | NA |

| Self Assessment | NA | NA | ||

| 3 | Adequate Cash/ Credit Balance in M1 but not in M2 | 35% Payment Option | NA | Auto-Generated Challan |

| Self Assessment | NA | Self Assessed Amount | ||

| 4 | Inadequate Cash/ Credit Balance | 35% Payment Option | Auto-Generated Challan | Auto-Generated Challan |

| Self Assessment | Self Assessed Amount | Self Assessed Amount | ||

Please note that in the 3rd Scenario, the Taxpayer can choose a payment option in M2 as in M1 he was not required to make any tax payment, thus the question of choosing a payment option did not arise.

What is the Late Fees Applicable on delayed Filing of Form GST PMT-06?

No Late Fees is applicable on delayed Filing of Form GST PMT-06.

What is the interest Applicable on delayed payment/short payment of taxes via Form GST PMT-06?

It means delayed payment of Taxes. Yes, interest is applicable u/s 50 on delayed Filing of Form GST PMT-06. The Rate of Interest is 18% pa.

For Example, interest is applicable when Tax is paid after the due date of 25th in case you have opted for QRMP Scheme.

35% Payment Option or Fixed Sum Method

No Interest is applicable if the taxpayer makes payment as per pre-filled challan and discharges remaining tax liability on due date of filing GSTR-3B.

Self Assessment Method

Interest is applicable if the taxpayer makes payment as per the self-assessment method and discharges the remaining tax liability after the due date.

Discussion Point:

Some clarification is still pending that what will happen is the taxpayer chooses wrong payment Option for making Tax.

In case of any Doubt regarding Membership you can mail us at contact@studycafe.in

Join Studycafe's WhatsApp Group or Telegram Channel for Latest Updates on Government Job, Sarkari Naukri, Private Jobs, Income Tax, GST, Companies Act, Judgements and CA, CS, ICWA, and MUCH MORE!"