CA Pratibha Goyal | Feb 24, 2024 |

GST Portal Update: Facility for opting Composition Scheme for FY 2024-25 now live on GST Portal

The Goods and service Tax Portal has announced that Taxpayers can opt for Composition Scheme for the Financial Year 2024-25 by accessing the GST Portal, which will be open upto March 31, 2024. Use Navigation ‘Services -> Registration -> Application to Opt for Composition Levy’, and file Form CMP-02 to opt for the same.

GSTN issues Advisory on Enhanced E-Invoicing Initiatives and E-Invoicing Portal

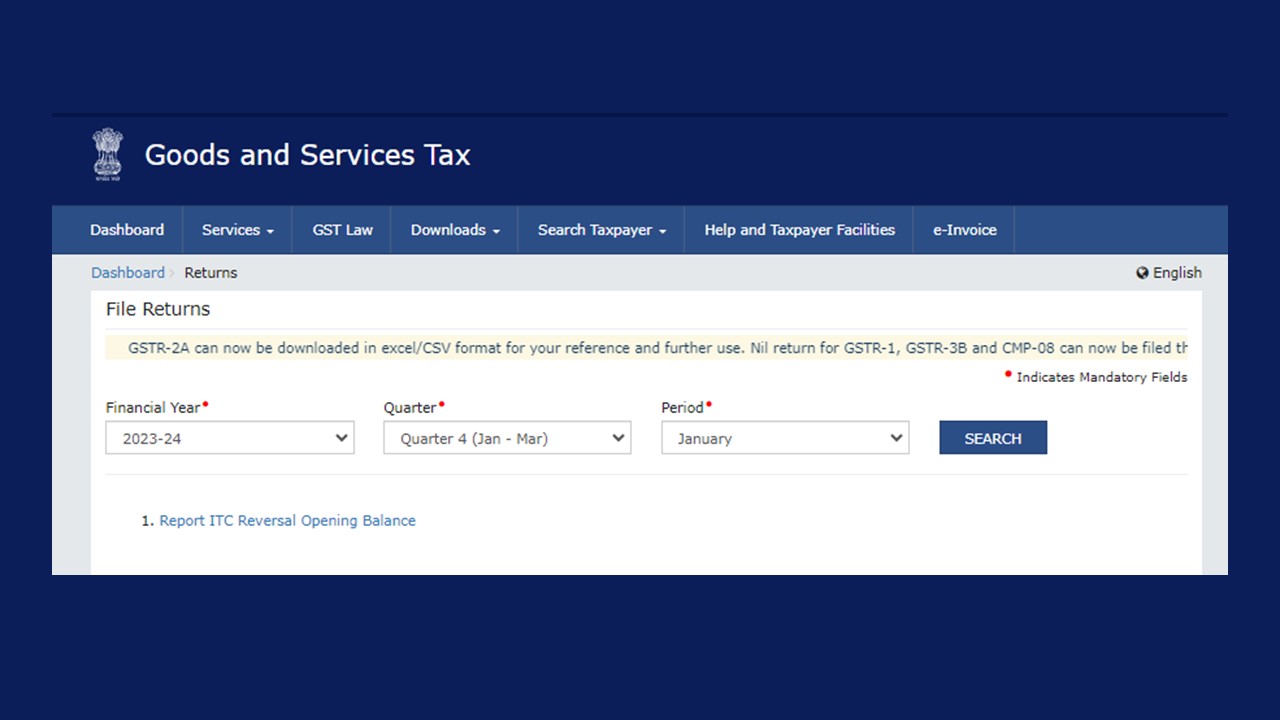

Another update Available on the GST Portal is that GSTR-2A can now be downloaded in excel/CSV format for your reference and further use.

GSTN also announced that Nil return for GSTR-1, GSTR-3B and CMP-08 can now be filed through SMS.

In case of any Doubt regarding Membership you can mail us at [email protected]

Join Studycafe's WhatsApp Group or Telegram Channel for Latest Updates on Government Job, Sarkari Naukri, Private Jobs, Income Tax, GST, Companies Act, Judgements and CA, CS, ICWA, and MUCH MORE!"