The gross GST revenue collected in month of July, 2023 is Rs.1,65,105 crore of which CGST is Rs.29,773 crore, SGST is Rs.37,623 crore, IGST is Rs.85,930 crore and cess is Rs.11,779 crore.

Reetu | Aug 1, 2023 |

GST Revenue Collection of Rs.1,65,105 crore for July 2023; Records 11% Year-on-Year growth

The gross GST revenue collected in the month of July, 2023 is Rs.1,65,105 crore of which CGST is Rs.29,773 crore, SGST is Rs.37,623 crore, IGST is Rs.85,930 crore (including Rs.41,239 crore collected on import of goods) and cess is Rs.11,779 crore (including Rs.840 crore collected on import of goods).

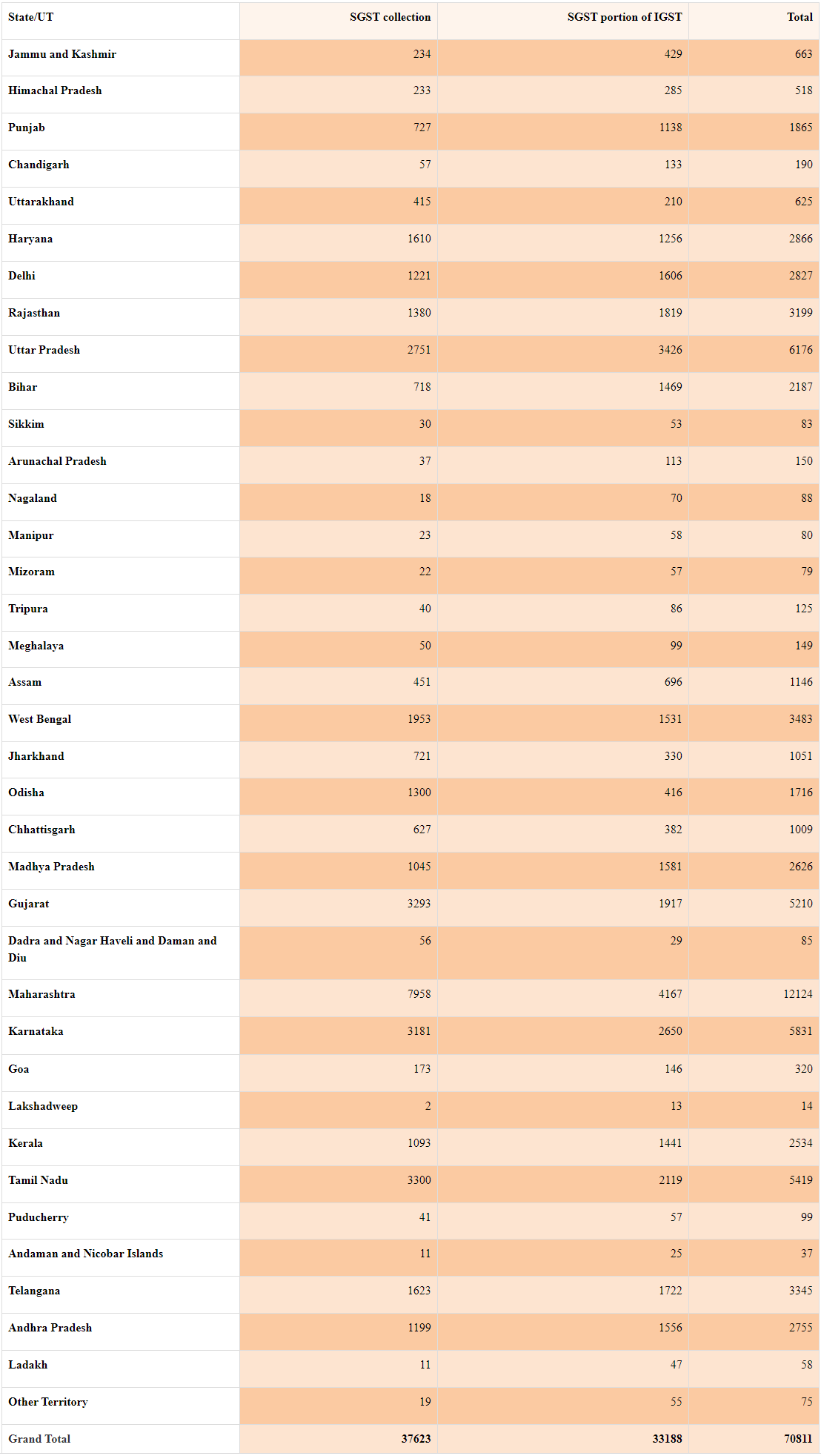

The government has transferred Rs.39,785 crore from IGST to CGST and Rs.33,188 crore to SGST. After normal settlement, the total income of the Centre and the States in July 2023 is Rs.69,558 crore for CGST and Rs.70,811 crore for SGST.

The revenues for the month of July 2023 are 11% greater than the GST collections for the same month last year. Domestic transaction revenues (including service imports) were 15% higher this month than they were the previous month. For the fifth time, the overall GST collection has surpassed Rs.1.60 lakh crore.

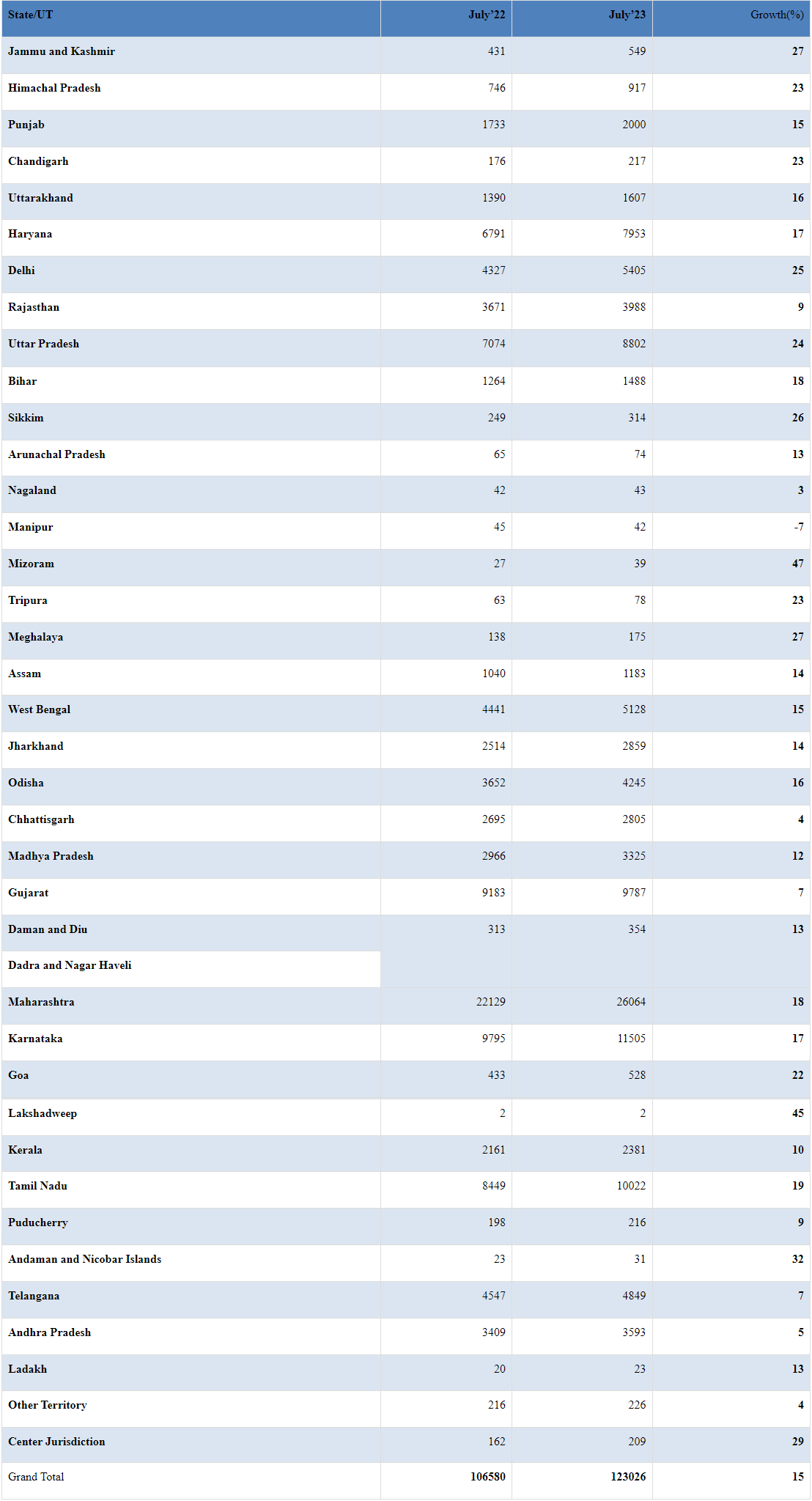

The chart below shows trends in monthly gross GST revenues during the current year. The table-1 shows the state-wise figures of GST collected in each State during the month of July 2023 as compared to July 2022 and table-2 shows the SGST and SGST portion of the IGST received/settled to the States/UTs in July’2023.

Image

In case of any Doubt regarding Membership you can mail us at [email protected]

Join Studycafe's WhatsApp Group or Telegram Channel for Latest Updates on Government Job, Sarkari Naukri, Private Jobs, Income Tax, GST, Companies Act, Judgements and CA, CS, ICWA, and MUCH MORE!"