Reetu | Jun 1, 2023 |

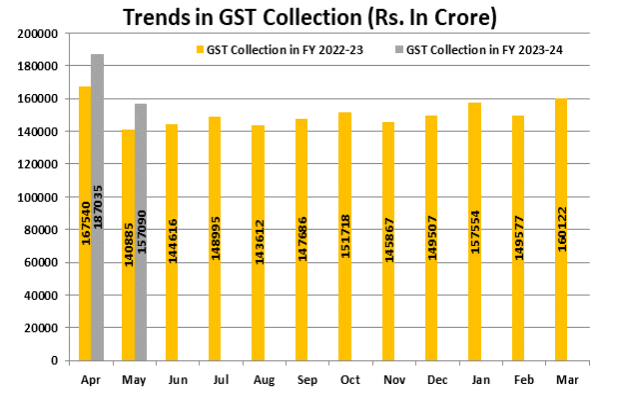

GST Revenue of Rs.1,57,090 Crore Collected in May 2023; Represents 12% Year-on-Year Increase

The Gross Goods & Services Tax (GST) revenue collected in the month of May, 2023 is Rs.1,57,090 crore of which CGST is Rs.28,411 crore, SGST is Rs.35,828 crore, IGST is Rs.81,363 crore (including Rs.41,772 crore collected on import of goods) and cess is Rs.11,489 crore (including Rs.1,057 crore collected on import of goods).

The government has settled Rs.35,369 crore to CGST and Rs.29,769 crore to SGST from IGST. After normal settlement, the Centre and the States will have earned a combined amount of Rs.63,780 crore for the CGST and Rs.65,597 crore for the SGST in the month of May 2023.

The revenues for the month of May 2023 are 12% higher than the GST revenues in the same month last year. During the month, revenue from import of goods was 12% higher and the revenues from domestic transactions (including import of services) are 11% higher than the revenues from these sources during the same month last year.

The chart below shows trends in monthly gross GST revenues during the current year. The table shows the state-wise figures of GST collected in each State during the month of May 2023 as compared to May 2022.

State-wise growth of GST Revenues during May 2023

In case of any Doubt regarding Membership you can mail us at [email protected]

Join Studycafe's WhatsApp Group or Telegram Channel for Latest Updates on Government Job, Sarkari Naukri, Private Jobs, Income Tax, GST, Companies Act, Judgements and CA, CS, ICWA, and MUCH MORE!"