Sushmita Goswami | Dec 24, 2021 |

GST to be implemented at 12% from 01.01.2022: FM Rejects Proposal of CIAT

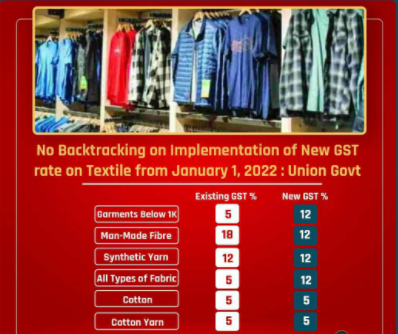

Finance Minister Nirmala Sitharaman said on Tuesday that the government’s recent announcement on a uniform 12 percent goods and services tax (GST) for the textile and apparel sector was aimed at addressing the inverted duty structure that was causing companies to accumulate input tax credits. She did not share the industry’s concerns that this would result in higher finished product prices.

Finance minister Mrs. Nirmala Sitharaman rejects proposals from the textiles ministry and requests from CIAT (Confederation of All India Traders) for deferring the taxation increase from 5% to 12%. Henceforth from 01.01.2022, all fabrics and other textile products will have 12% GST.

“Adjustments in rates may not always result in price increases for clients.” Bigger input rates resulted in higher reimbursements to taxpayers, which needed to be corrected. “The GST Council resolved to correct the inverted duty structure,” she said at a press conference during her two-day tour to Jammu and Kashmir.

Many in the business have reacted negatively to the notification issued by the Central Board of Indirect Taxes and Customs.

According to Sanjay Kumar Jain of Delhi-based TT, which has its major manufacturing facility in Tiruppur, Tamil Nadu, the decision will benefit barely 15% of the sector. The remaining 85%, primarily from the micro, small, and medium business (MSMEs) sector, will be badly hit.

“It’s a poor deal for the industry on a number of levels. Since the costs of clothing under $1,000 presently carry a 5% GST, consumers will have to pay 6-7 percent extra starting January 1. Because MSMEs produce 85 percent of these clothing, it will have a negative impact on demand and revenue in a sector that is already facing the effects of Covid-19,” Jain noted.

Pricing in the garment industry have already risen by roughly 20% in the last year due to increases in cotton and yarn prices.

Given that some dyeing inputs, such as pure terephthalic acid and monoethylene glycol, fall under the higher GST bracket of 18%, associations believe the inverted duty structure will continue.

“It’s a cause for concern among domestic players.” They must increase charges to end-customers from 5% to 12%. This is a positive step for exporters. According to Raja Shanmugam, head of the Tiruppur Exporters’ Association, “it will ease any accumulation that may occur due to input tax credit.”

According to the sector, the change will have an impact on demand, causing a spike in working capital requirements and a squeeze on output.

According to the textile ministry, the measure will assist the man-made fibre (MMF) segment flourish and become a major job source in the country.

It claimed that the textile and clothing industries had been pressing for the abolition of the inverted tax structure in the MMF value chain for a long time, first under sales tax, then under value-added tax, and ultimately under the GST regime.

“The GST rates on MMF, MMF yarn, and MMF textiles were 18%, 12%, and 5%, respectively. Credit accumulation and cost escalation resulted from the taxation of inputs at higher rates than completed products. It also resulted in the piling of taxes at various points of the MMF value chain, as well as the blocking of critical operating capital for the industry, according to a statement from the textile ministry.

Experts say that while the GST Council‘s decision would fix the inverted duty structure, it will increase the cost of goods for buyers.

“Undoubtedly, this would help in enhancing cash flow and reducing the compliance load for the assesse,” said Rajat Bose, partner at Shardul Amarchand Mangaldas & Co. It has the potential to raise the cost of final items.”

The action, according to Kumar Rajagopalan, Chief Executive Officer of the Retailers Association of India, is not in anyone’s best interests.

“On the business side, it will add to an already-stressed sector’s financial load, slow its recovery, and impair working capital requirements, particularly for MSMEs, which account for 90% of the industry.” On the consumer side, it will result in an increase in clothing prices, reducing demand. On the government’s side, it could result in many unorganised firms escaping the GST net,” Rajagopalan added.

“It is feared that such a significant hike in GST rates may force MSME businesses out of the GST net, hence increasing tax evasion,” said Ritesh Kanodia, partner at Dhruva Advisors.

The easier mechanism, according to Parag Mehta, partner at N. A. Shah Associates, would have been to refund the accumulated input tax credit to the manufacturer or dealer. “This would have resulted in a reduction in the pricing of textile goods and an overall ease in working capital,” Mehta said.

In case of any Doubt regarding Membership you can mail us at [email protected]

Join Studycafe's WhatsApp Group or Telegram Channel for Latest Updates on Government Job, Sarkari Naukri, Private Jobs, Income Tax, GST, Companies Act, Judgements and CA, CS, ICWA, and MUCH MORE!"