Reetu | Sep 1, 2022 |

GSTN enabled Changes in table 4 of GSTR-3B related to claim of ITC

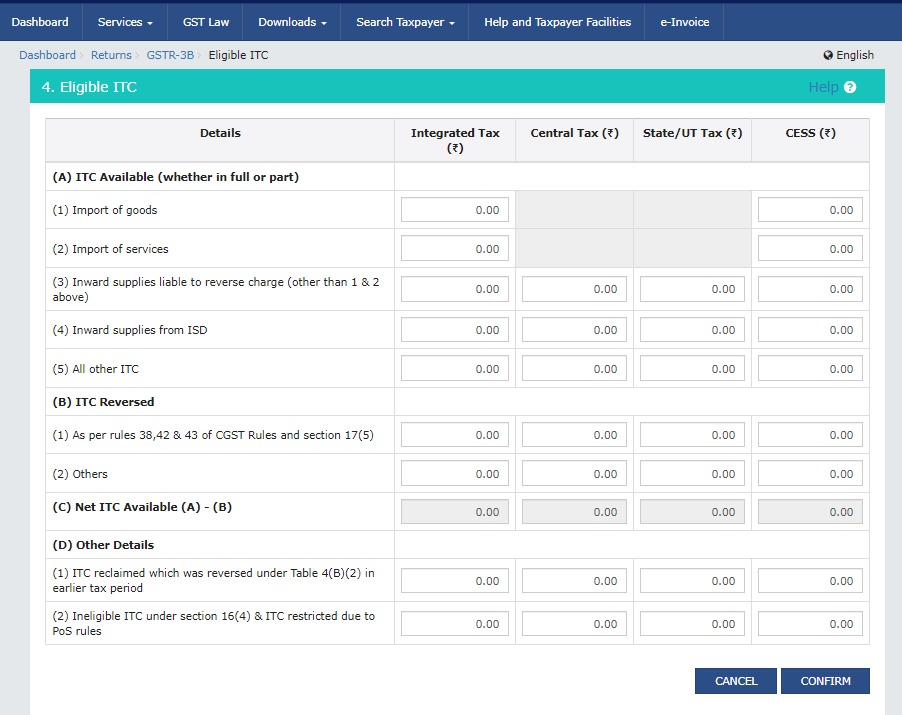

The Goods and Services Tax Network (GSTN) has made live the changes in Table 4 of GSTR-3B related to the claim of Input Tax credit on the GST Portal. Changes notified for Form GSTR 3B are now implemented in Aug-22 GSTR-3B

You May Also Refer: Changes in ITC reporting in GSTR – 3B

Table -4 represents Eligible ITC.

The Government vide Notification No. 14/2022 – Central Tax dated 05th July, 2022 has notified few changes in Table 4 of Form GSTR-3B requiring taxpayers to report information on ITC correctly availed, reversal thereof and declaring ineligible ITC in Table 4 of GSTR-3B.

The notified changes in Table 4 of GSTR-3B have now been implemented on the GST Portal

In case of any Doubt regarding Membership you can mail us at [email protected]

Join Studycafe's WhatsApp Group or Telegram Channel for Latest Updates on Government Job, Sarkari Naukri, Private Jobs, Income Tax, GST, Companies Act, Judgements and CA, CS, ICWA, and MUCH MORE!"