Changes in ITC reporting in GSTR – 3B

Amendment of Table 4(B) & (D) of Form GSTR – 3B vide NN 14/2022 and clarification issued regarding reporting of the same vide Circular 170/02/2022, we believe many taxpayers will have to revisit their manner of recording ITC in their books to ensure correct reporting as per the amended Form GSTR – 3B

Here, in our update, we have tried to capture and explain the operational impact of the said amendment and clarification:

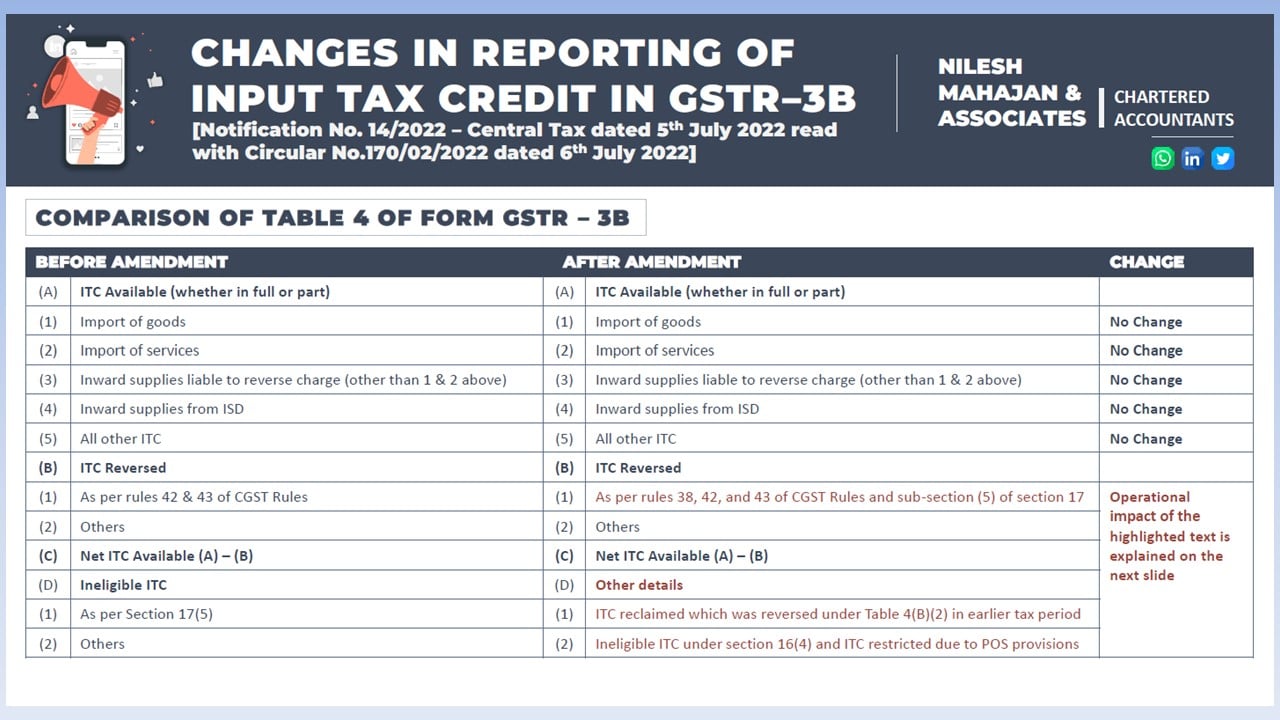

OPERATIONAL IMPACT OF CHANGES IN TABLE 4 (B) & 4 (D) OF FORM GSTR – 3B

- Currently, many taxpayers have been recording ITC on the eligible inward supply only in their ITC ledger including where ITC is required to be revered in the following scenarios:

- Where ITC is required to be reversed on account of common inward supply used for taxable as well as exempt outward supply in terms of Rule 42 & 43; or

- Reversal & Reclaim of ITC in case of non-payment of consideration to vendors within 180 days from the date of invoice; or

- Any reversal on account of earlier wrong availment & utilization of ITC

- In respect of ITC on inward supplies covered under 17(5), taxpayers are not recording the same & transfer such ITC directly to the P&L account

- Further, at the time of availing ITC in GSTR – 3B, reconciliation is done between the Static ITC statement in Form GSTR – 2B vs ITC recorded in books of accounts as per the abovestated manner

- After such reconciliation & subject to other provisions of Section 16 & 17 of the CGST Act read with Rules made thereunder, the credit will be reported in the respective fields of table 4 of GSTR – 3B

- However, considering the fact that declaration of ineligible ITC as per Section 17(5) in table 4(D)(1) was just informative in nature and further direct expense out treatment given to such credit in books of account, many taxpayers were not reporting the amount of ineligible ITC as per Section 17(5) in GSTR – 3B

- After the amendment in Table 4(B) of GSTR – 3B, it has been clarified that all ITC as available in GSTR 2B including ITC ineligible in terms of section 17(5), Rule 42,43 and 38 and re-availed ITC (earlier reversed due to ineligibility as per section 16(2)(c) & (d) and Rule 37) needs to be taken to Table 4(A). Thereafter, ineligible ITC as per the aforesaid provisions will have to be separately taken to Table 4(B). Consequently, Net ITC as per Table 4(C) i.e., [4(A) – 4(B)] shall only be credited to the electronic credit ledger.

- Thus it is mandatory to record all ineligible ITC as well, even if it is absolute in nature and not reclaimable e.g., Ineligible ITC under Rule 38 or Section 17(5), etc.

- Accordingly, We believe taxpayers will have to make changes in their manner of accounting for recording ITC by categorizing the same in accordance with various applicable provisions under GST law. We have captured a list of those categories for ease of reference

- Ineligible ITC in terms of Section 17(5)

- Ineligible & eligible to reclaim ITC in terms of Rule 37 (non-payment of consideration within 180 days)

- Ineligible ITC in terms of Rule 38 (reversal of credit by a banking company or a financial institution)

- Ineligible ITC in terms of Rule 42 (common credit on inward supply of inputs or input services used for outward supply of taxable as well exempted supply)

- Ineligible ITC in terms of Rule 43 (common credit on inward supply of capital goods used for outward supply of taxable as well exempted supply)

- Ineligible ITC due to difference in place of supply

- Ineligible ITC on time-barred invoices in terms of Section 16(4)

- Ineligible ITC in the current tax period due to non-fulfilment of conditions of Section 16 e.g., receipt of invoice in the current month but supply received in the next month

- Ineligible ITC used exclusively or party for other than business purpose

- All other eligible ITC

- Form GSTR – 2B will also auto-categorize ITC into ineligible ITC in the following two cases :

- Ineligible ITC in case of intra-State supply where the location of the recipient is different than the place of supply

- Ineligible ITC on time-barred invoices in terms of Section 16(4)

- Considering the changes in reporting of ITC in tables 4(B) & (D) of GSTR – 3B, every taxpayer needs to revisit their current method of the recording ITC in books of accounts and make appropriate changes to ensure the availability of correct data for reconciliation with ITC in GSTR – 2B and smooth reporting in Form GSTR – 3B

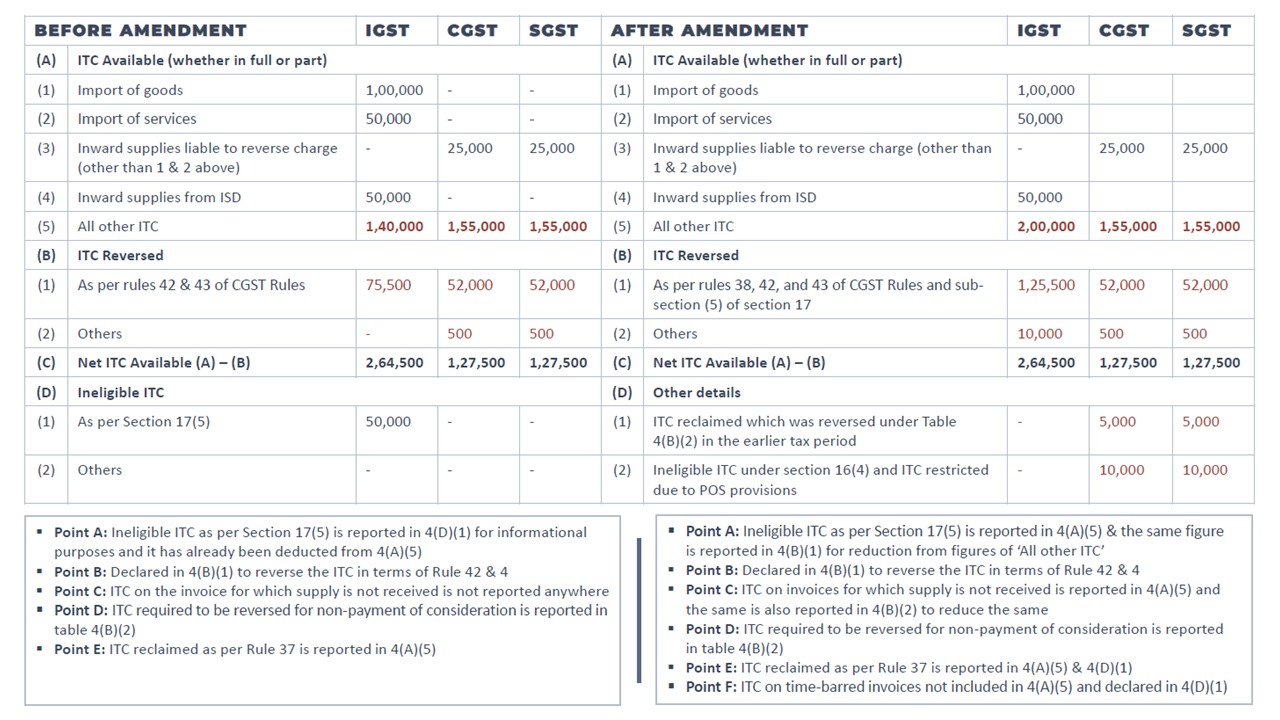

- Comparative illustration of reporting of ITC reversal before and after the amendment of GSTR – 3B is provided in next slide for better understanding

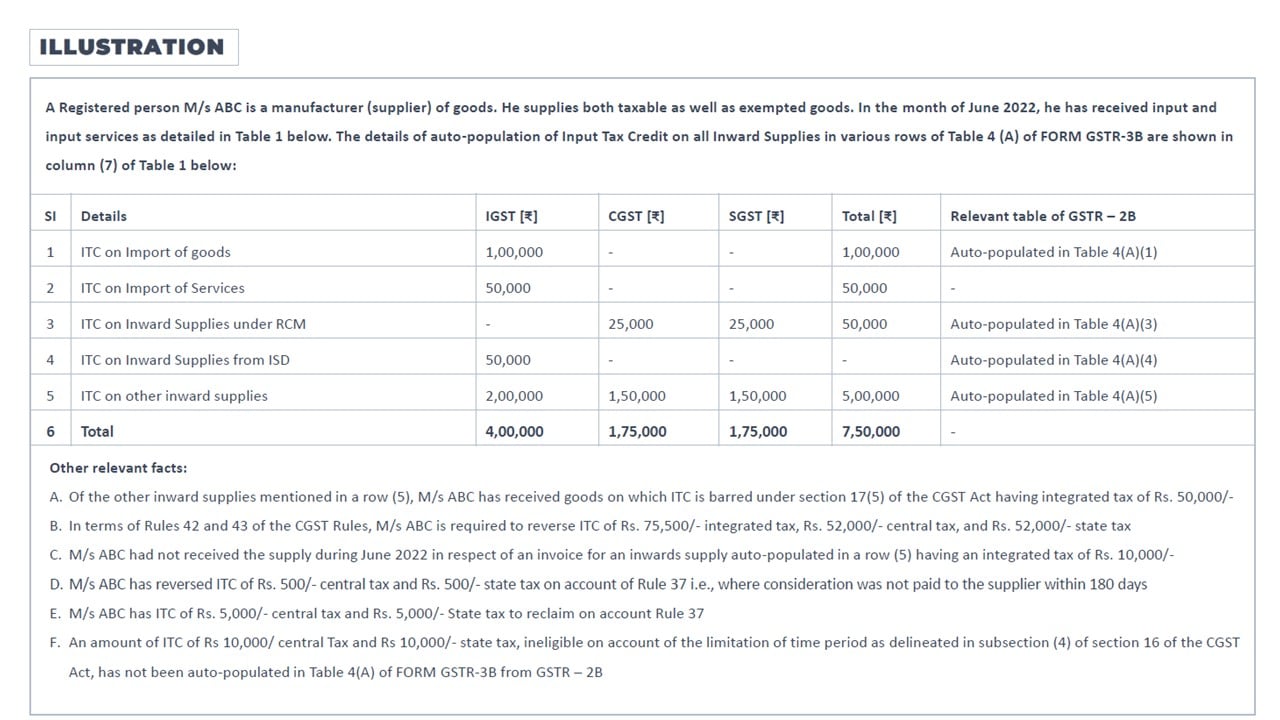

Illustration

Illustration

StudyCafe Membership

Join StudyCafe Membership. For More details about Membership Click Join Membership Button

Join MembershipIn case of any Doubt regarding Membership you can mail us at [email protected]

Join Studycafe's WhatsApp Group or Telegram Channel for Latest Updates on Government Job, Sarkari Naukri, Private Jobs, Income Tax, GST, Companies Act, Judgements and CA, CS, ICWA, and MUCH MORE!"