Reetu | Jun 2, 2022 |

GSTN enabled option to add additional trade name(s) at the time of registration on GST Portal

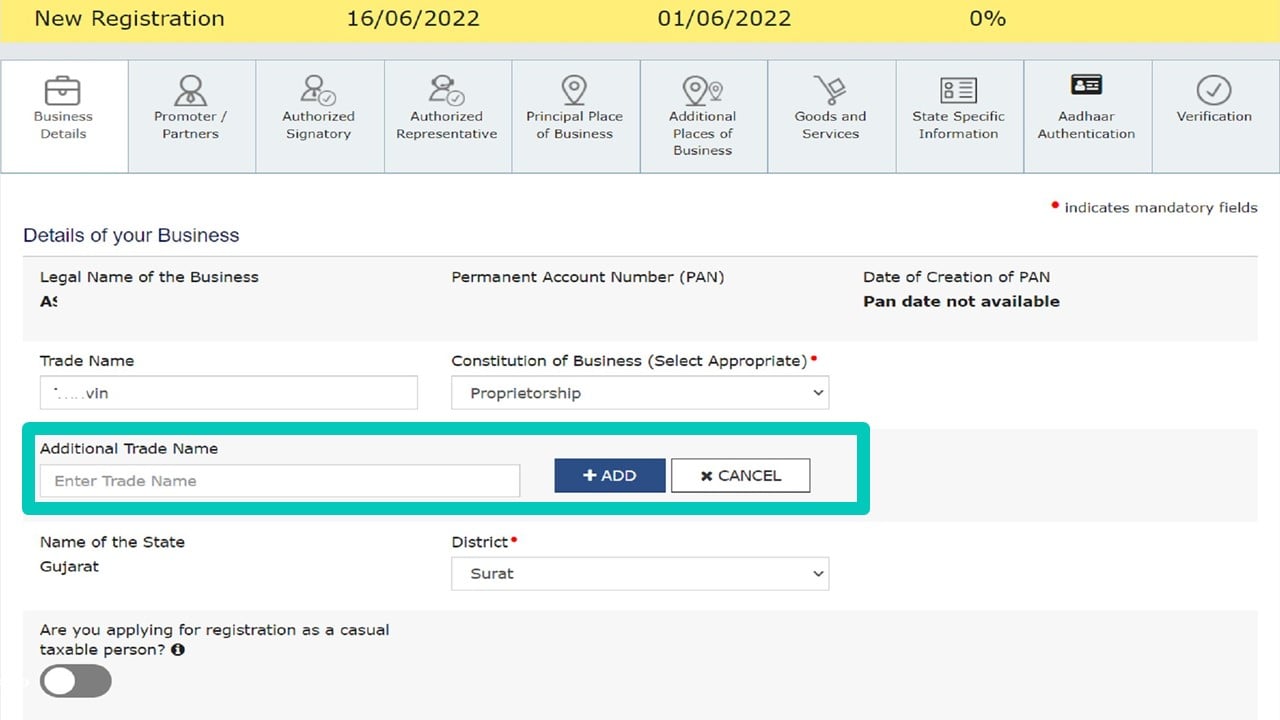

The Goods and Service Tax Network (GSTN) has enabled the new functionality to add additional trade name(s) at the time of registration for the businesses that would be operating in multiple domains under a single registration.

It’s possible that a company with the same GSTIN utilises various trade names for different firms. In the past, only one Trade name could be entered into the GST Portal. As a result, many registered taxpayers were forced to obtain two or more GSTINs in order to have an RC for each trade name. However, a taxable person can now use several trade names with a single GSTIN, and the trade name will be validated by the GST RC.

Now You can Add “Additional Trade Name” in GST, which was a long standing Demand by the businesses.

It is enabled based on trade requests, particularly for businesses that operate across multiple domains and have a strong brand recall for their trade name.

Please keep in mind that you are allowed to use multiple trade names. For example, suppose you own a company or firm that sells auto parts, and you want to start trading in the same company with a different trade tomorrow.

Another Eg., a sole proprietorship with a travel and tour business as well as a wholesale firm.

In case of any Doubt regarding Membership you can mail us at [email protected]

Join Studycafe's WhatsApp Group or Telegram Channel for Latest Updates on Government Job, Sarkari Naukri, Private Jobs, Income Tax, GST, Companies Act, Judgements and CA, CS, ICWA, and MUCH MORE!"