CA Pratibha Goyal | Feb 28, 2024 |

GSTN issues Advisory on Delay in GST registration despite successful Aadhar Authentication

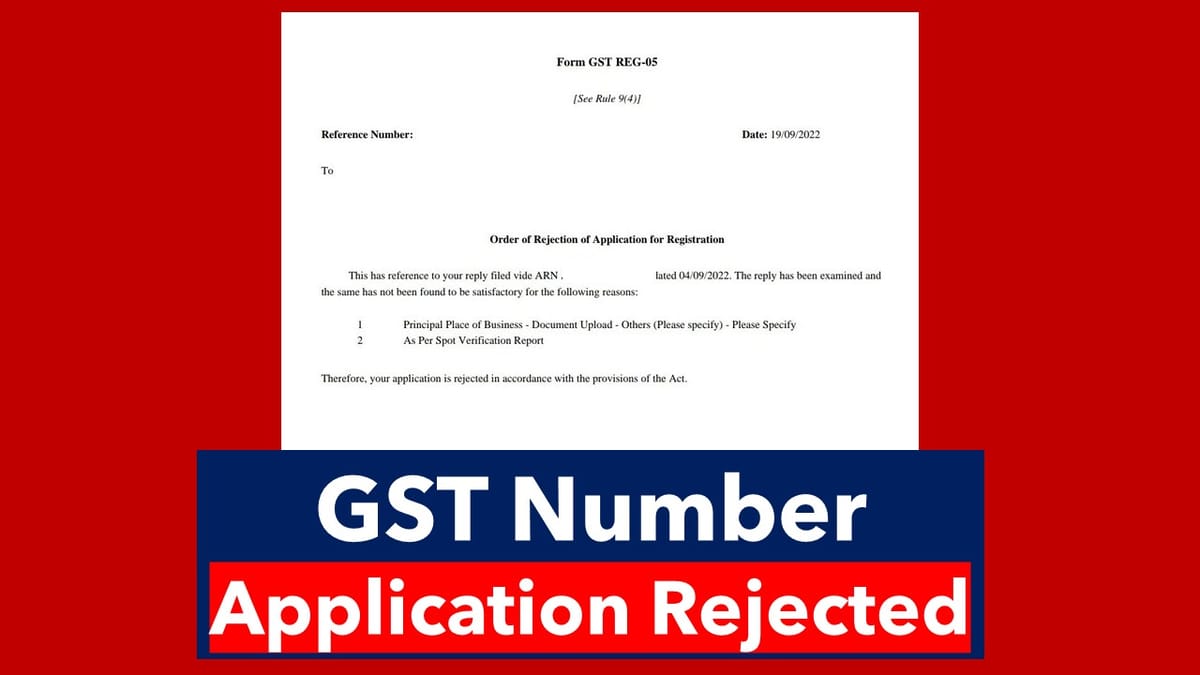

The Goods and Service Tax Network (GSTN) has issued an advisory on Delay in getting GST registration reported by some Taxpayers despite successful Aadhar Authentication as per Rule 8 and 9 of the CGST, Rules, 2017.

It was complaint of Taxpayers that despite of successful Aadhar Authentication their GST Number is not provided to them. Now the portal has said that if after the Aadhaar authentication the person is identified in terms of Rule 9(aa) by the common portal for detailed verification based on risk profile, the application for registration would be processed within thirty days of application submission.

The Advisory issued on GST Portal reads:

Rule 9. Verification of the application and approval

As per Rule 9(aa) where a person, who has undergone authentication of Aadhaar number as specified in sub-rule (4A) of rule 8, is identified on the common portal, based on data analysis and risk parameters, for carrying out physical verification of places of business the notice in FORM GST REG-03 may be issued not later than thirty days from the date of submission of the application.

In case of any Doubt regarding Membership you can mail us at [email protected]

Join Studycafe's WhatsApp Group or Telegram Channel for Latest Updates on Government Job, Sarkari Naukri, Private Jobs, Income Tax, GST, Companies Act, Judgements and CA, CS, ICWA, and MUCH MORE!"