Reetu | Jul 6, 2023 |

GSTN Update: GSTR-3B tab will not open before filing of GSTR-1

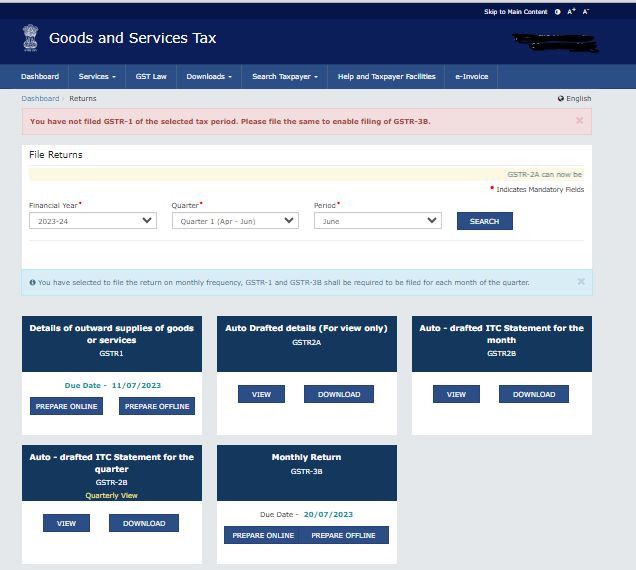

The Goods and Services Tax Portal has notified an important update regarding GSTR-3B and GSTR-1 form.

Now, GSTR-3B tab will not open before the filing of GSTR-1. It is now mandatory for taxpayers to file GSTR-1 first in order to file GSTR-3B. GSTN portal will not allow to file GSTR-3B before the filing GSTR-1.

Form GSTR-3B is a simplified summary return that allows taxpayers to disclose and discharge their summary of GST liabilities for a certain tax period. Every tax period, a regular taxpayer is obliged to file Form GSTR-3B returns.

Form GSTR-1 is a monthly/quarterly Statement of Outward Supplies that must be filed by all regular and casual registered taxpayers who make outward supplies of goods and services or both, and it provides information on such outward supplies.

In case of any Doubt regarding Membership you can mail us at [email protected]

Join Studycafe's WhatsApp Group or Telegram Channel for Latest Updates on Government Job, Sarkari Naukri, Private Jobs, Income Tax, GST, Companies Act, Judgements and CA, CS, ICWA, and MUCH MORE!"