CA Pratibha Goyal | Jan 3, 2024 |

GSTR-1 New Changes: Table 14 and Table 15 Added in Form GSTR-1

GSTR-1 has been updated by Goods and Service Tax Network (GSTN) for reporting transactions by E-Commerce Operators whereby 2 new important tables have been added.

GSTN issued Advisory on functionalities available on GST portal for GTA Taxpayers

The tables that have been added in GST Return are; Table 14 for reporting Supplies made through E-Commerce Operators and Table 15 for reporting Supplies U/s 9(5).

Earlier, we had tables in Form GSTR-3B for reporting these transactions, but there were no specific tables in the GSTR-1 Form.

Table in GSTR-3B was Table 3.1.1 for reporting Details of supplies notified under section 9(5) of the CGST Act, 2017 and corresponding provision in IGST/UTGST/SGST Acts. Now when the tables have been added in GSTR-1, same will ensure that data is auto-populated in GSTR-3B from GSTR-1.

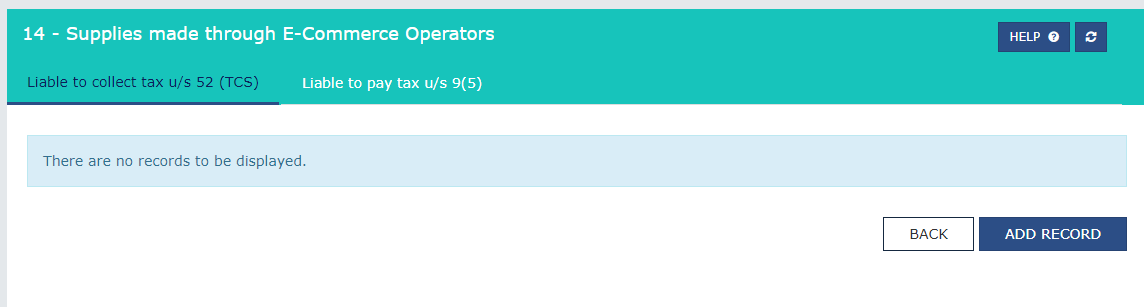

In this table, you can add details of taxable outward supplies made to e-commerce operator.

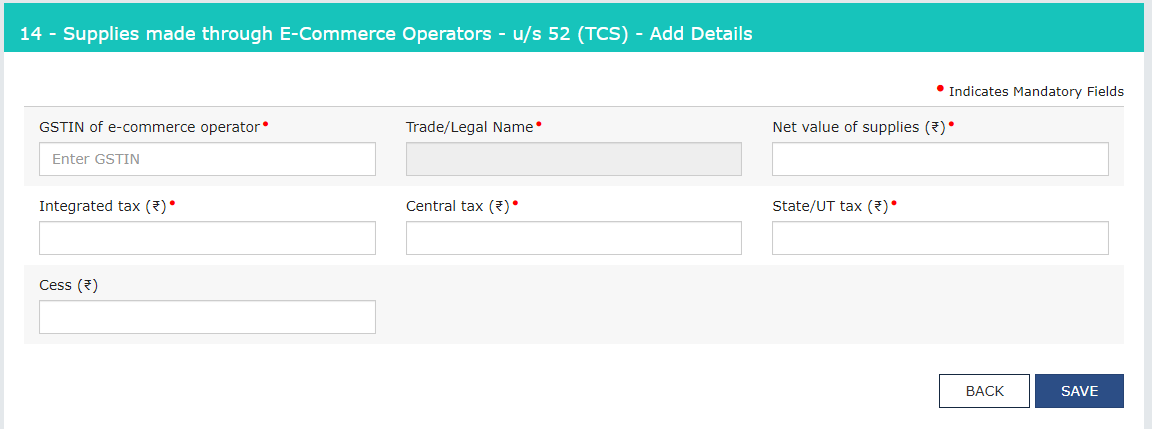

‘Liable to collect tax u/s 52 (TCS)’ – By default, this tab shall be displayed. Please report here the summary of the TCS supplies made u/s 52.

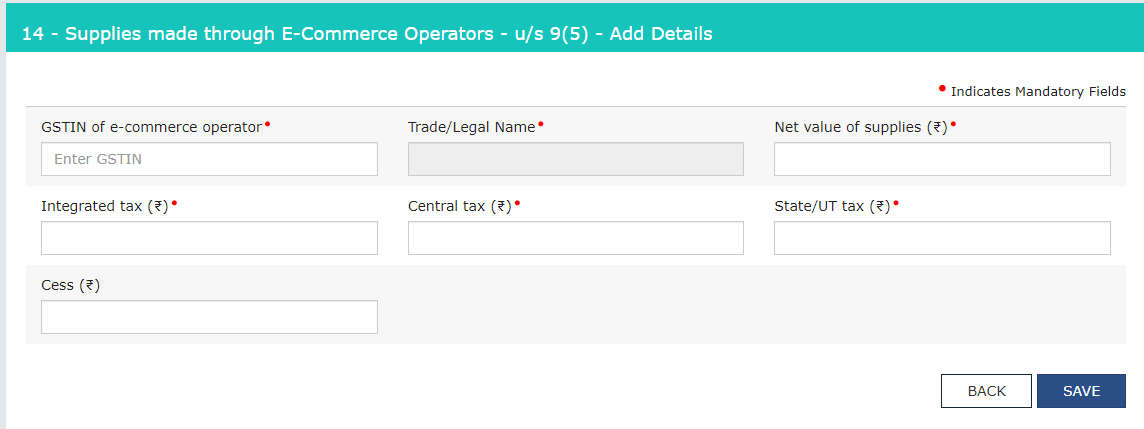

‘Liable to pay tax u/s 9(5)’ – This tab shall be display on table 14, you can add record by click on this tab. Please report here the summary of the supplies made through E-commerce operators covered under sec 9(5).

‘Liable to pay tax u/s 9(5)’ – This tab shall be display on table 14, you can add record by click on this tab. Please report here the summary of the supplies made through E-commerce operators covered under sec 9(5).

‘ADD RECORD’ – You can add details (E-COMMERCE wise) by using this tab.

‘ADD RECORD’ – You can add details (E-COMMERCE wise) by using this tab.

‘PROCESSED RECORDS’ – Successfully added details shall be available under processed records table.

‘PENDING/ERRORED RECORDS’ – This table displays details which were added by you but not processed successfully.

‘BACK’ – On click of this button, you can navigate back to GSTR-1 dashboard page.

Please note – Values/amounts can be positive or negative.

In this table, you can add details of taxable outward supplies on which e-commerce operator is liable to pay tax under section 9(5) of the Act.

In this table, you can add details of taxable outward supplies on which e-commerce operator is liable to pay tax under section 9(5) of the Act.

The e-commerce operator can report the supplies on which e-commerce operator is liable to pay tax under section 9(5) of the Act for the below types of suppliers and recipients:

1. REGISTERED TO REGISTERED (B2B)

2. REGISTERED TO UNREGISTERED (B2C)

3. UNREGISTERED TO REGISTERED (URP2B)

4. UNREGISTERED TO UNREGISTERED (URP2C)

‘REGISTERED TO REGISTERED’ – By default, this tab shall be displayed. Records added shall be displayed in Record Details table based on the recipient-wise and supplier-wise. This table shall provide the following details:

Supplier details – GSTIN of supplier

Supplier details – GSTIN of supplier

Trade/Legal name – Name of the supplier

Recipient details – GSTIN of recipient

Trade/Legal name – Name of the recipient

Processed Records – No. of records which are successfully processed. On click of the hyperlink, you can navigate to DOCUMENT WISE DETAILS tab.

Pending/Errored Records – No. of records which are not processed or pending. On click of the hyperlink, you can navigate to PENDING/ERRORED RECORDS tab.

Add Document – On click of the + symbol, add page shall be opened with supplier & recipient GSTIN and name pre-filled.

‘DOCUMENT WISE DETAILS’ – You can view all the processed records added in respect to a particular supplier/recipient GSTIN. You can edit document details or delete them, before submitting GSTR-1.

‘ACTION’ – Delete icon will delete the document details. Edit icon will open the document details for editing.

‘PENDING/ERRORED RECORDS’ – You can view all the pending/errored records added in respect to a particular supplier/recipient GSTIN.

‘ADD RECORD’ – You can add document details for taxable outward supplies on which e-commerce operator is liable to pay tax under section 9(5) of the Act related to registered supplier and registered recipient.

‘BACK’ – On click of this button, you can navigate back to GSTR-1 dashboard page.

‘REGISTERED TO UNREGISTERED’ – On click of this tab, you can add details of taxable outward supplies, on which e-commerce operator is liable to pay tax under section 9(5) of the Act, related to registered supplier and unregistered recipient.

‘ADD RECORD’ – You can add details (POS/SUPPLIER wise) by using this tab.

‘ADD RECORD’ – You can add details (POS/SUPPLIER wise) by using this tab.

‘PROCESSED RECORDS’ – Successfully added details shall be available under processed records table.

‘PENDING RECORDS’ – This table displays details which were added by you but not processed successfully.

‘BACK’ – On click of this button, you can navigate back to GSTR-1 dashboard page.

‘UNREGISTERED TO REGISTERED’ – On click of this tab, you can add details of taxable outward supplies, on which e-commerce operator is liable to pay tax under section 9(5) of the Act, related to unregistered supplier and registered recipient. Records added shall be displayed in Record Details table based on the recipient-wise. This table shall provide the following details:

Recipient details – GSTIN of recipient

Trade/Legal name – Name of the recipient

Processed Records – No. of records which are successfully processed. On click of the hyperlink, you can navigate to DOCUMENT WISE DETAILS tab.

Pending/Errored Records – No. of records which are not processed or pending. On click of the hyperlink, you can navigate to PENDING/ERRORED RECORDS tab.

Add Document – On click of the + symbol, add page shall be opened with recipient GSTIN and name pre-filled.

DOCUMENT WISE DETAILS’ – You can view all the processed records added in respect to a particular recipient GSTIN. You can edit document details or delete them, before submitting GSTR-1.

‘ACTION’ – Delete icon will delete the document details. Edit icon will open the document details for editing.

‘PENDING/ERRORED RECORDS’ – You can view all the pending/errored records added in respect to a particular recipient GSTIN.

‘ADD RECORD’ – You can add document details for taxable outward supplies on which e-commerce operator is liable to pay tax under section 9(5) of the Act related to unregistered supplier and registered recipient.

‘BACK’ – On click of this button, you can navigate back to GSTR-1 dashboard page.

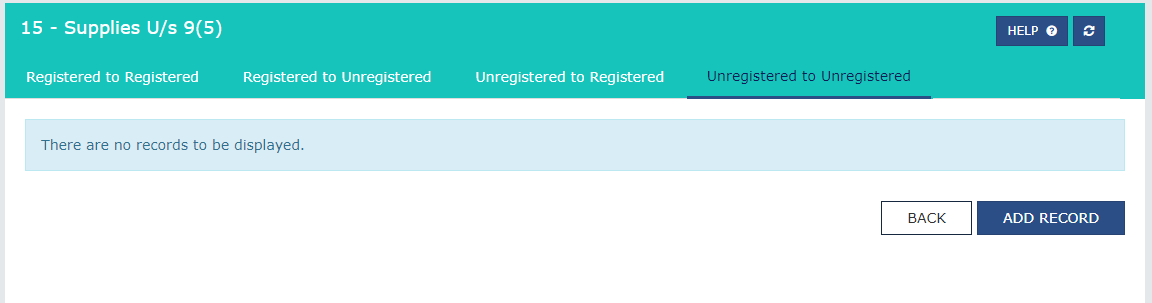

‘UNREGISTERED TO UNREGISTERED’ – On click of this tab, you can add details of taxable outward supplies, on which e-commerce operator is liable to pay tax under section 9(5) of the Act, related to unregistered supplier and unregistered recipient.

‘ADD RECORD’ – You can add details (POS wise) by using this tab.

‘ADD RECORD’ – You can add details (POS wise) by using this tab.

‘PROCESSED RECORDS’ – Successfully added details shall be available under processed records table.

‘PENDING RECORDS’ – This table displays details which were added by you but not processed successfully.

‘BACK’ – On click of this button, you can navigate back to GSTR-1 dashboard page.

In case of any Doubt regarding Membership you can mail us at [email protected]

Join Studycafe's WhatsApp Group or Telegram Channel for Latest Updates on Government Job, Sarkari Naukri, Private Jobs, Income Tax, GST, Companies Act, Judgements and CA, CS, ICWA, and MUCH MORE!"