Studycafe | Dec 12, 2019 |

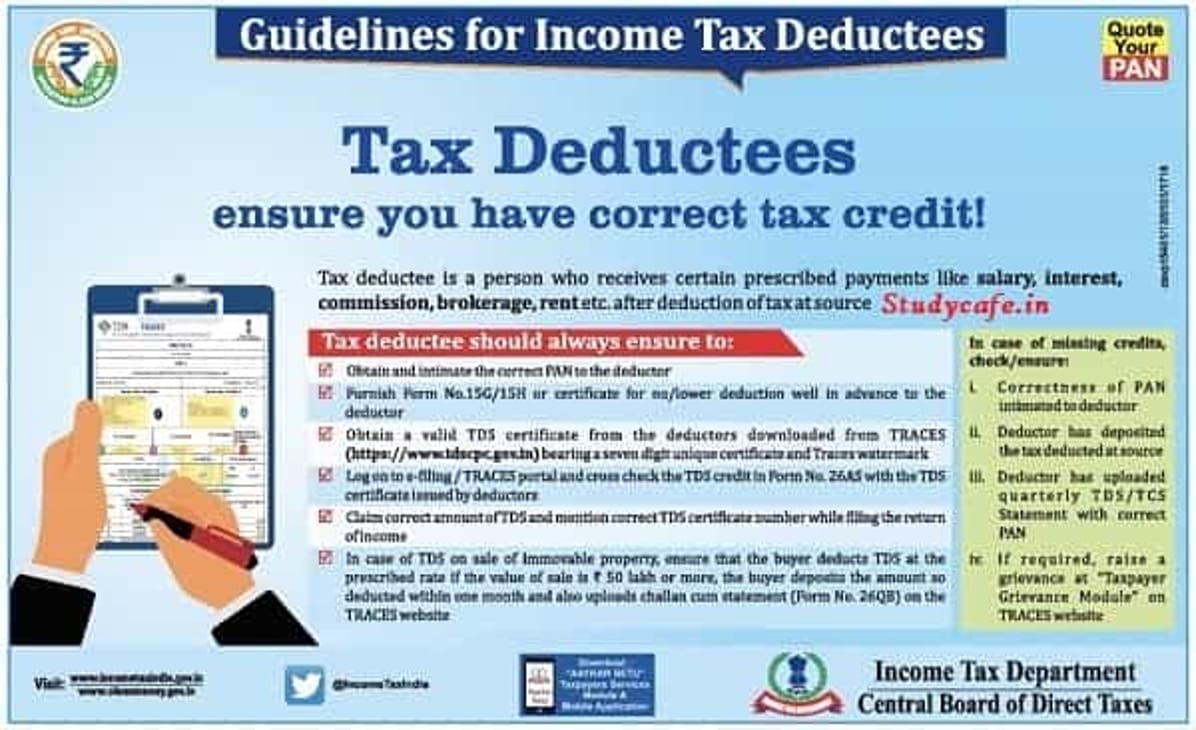

Guidelines for Income Tax Deductees : How to ensure you have correct tax credit

Tax deductee is a person who receives certain prescribed payments like salary, interest, commission, brokerage, rent etc. after deduction of tax at source. Recently Income Tax has issued guidelines for TDS Deductees or Tax deductee.

These are very useful to ensure correct tax credit!

Tax deductee should always ensure to:

In case of missing credits, check/ensure:

i. Correctness of PAN intimated to deductor

ii. Deductor has deposited the tax deducted at source

iii. Deductor has uploaded quarterly TDS/TCS Statement with correct PAN

iv. If required, raise a grievance at “Taxpayer Grievance Module” on TRACES website

For Regular Updates Join : https://t.me/Studycafe

Click Here to Buy CA INTER/IPCC Pendrive Classes at Discounted Rate

In case of any Doubt regarding Membership you can mail us at contact@studycafe.in

Join Studycafe's WhatsApp Group or Telegram Channel for Latest Updates on Government Job, Sarkari Naukri, Private Jobs, Income Tax, GST, Companies Act, Judgements and CA, CS, ICWA, and MUCH MORE!"